China has gradually been shifting from labour-intensive to capital-intensive industries. With has started a drop in its relative share of global readymade garments (RMG) exports. This has created a golden opportunity for countries like Bangladesh. Increasing labour costs, resulting from rapid socio-economic progress and improvement of the people’s living standard, have prompted the global RMG giant to take its strategic policy of preferring capital-intensive industries. According to the China Labour Bulletin, published on December 14, 2016, the average monthly minimum wage in the Shanghai increased to 2190 Yuan (US$327) in 2016 from 1120 Yuan in 2010. And as of June 2016, except to very small and remote areas, most cities currently have a minimum wage of 1600 Yuan (US$ 239). Paradoxically, China has now started importing RMG from other countries, including Vietnam, Italy, Bangladesh, Turkey and Cambodia. According to International Trade Centre (ITC) trade-map, China’s total RMG import amounted to around US$ 6.0 billion in 2016. Bangladesh’s RMG exports to China increased to around US$0.47 billion in 2016 from US$ 0.15 billion in 2012 which indicates that China’s apparel market can be a lucrative destination for Bangladeshi RMG exports.

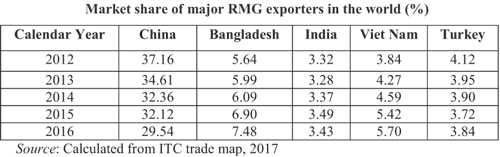

CURRENT SITUATION OF THE GLOBAL RMG MARKET: Contribution of the RMG sector to global export basket was US$ 434.98 billion in 2016, which was 3.0 per cent of the total outlay. At present, the major five importers – United States, Germany, Japan, United Kingdom and France – account for around 50 per cent of world’s RMG import whereas top five RMG exporters – China, Bangladesh, Vietnam, Turkey, and India – have 50 per cent share of the global RMG export market. However, China’s share in global RMG export market has gradually been declining, and it dropped to 29.54 per cent in 2016, from 37.16 per cent in 2012. On the other hand, Bangladesh still remains as the second largest RMG exporter in the world with its share rising from 5.64 per cent to 7.48 per cent. But Vietnam has made a stunning progress in the sector raising its share in global RMG exports to 5.70 per cent 2016 from only 3.84 per cent in 2012, making it the third-largest exporter. Though the country still lags behind Bangladesh by 1.78 per cent share in RMG exports, its growth rate is faster than that of Bangladesh. As for India, its market share remains static during the period between 2012 and 2016 but Turkey has experienced a slight fall in its market share in the same period except for the year of 2016 when it was been able to raise its share by 0.12 per cent. The above analysis shows that both Vietnam and Bangladesh are being benefited from China’s gradually withdrawal from RMG market.

Current Situation of Bangladesh RMG

RMG sector is one of the lifelines of the economy of Bangladesh. According to the Export Promotion Bureau (EPB), and the Bangladesh Bureau of Statistics (BBS) data, export earnings from this sector amounts to US$ 34.85 billion in the FY -2016-17, constituting around 81 per cent of the total export receipts of the country. The contribution of this sector to gross domestic product (GDP) of the country is 12.35 per cent. Of the RMG export earnings, the knitwear accounts for US$13.75 billion and the woven sector for US$14.39 billion. However, recently, the RMG sector of Bangladesh has been facing stiff competition from some neighbouring countries like Vietnam, India, Pakistan, Sri Lanka, Cambodia, and Myanmar as they have taken necessary initiatives to boost apparel production and exports to enhance their shares in the global apparel market. For example, India has already taken steps to inject huge investment into textile and RMG sector. On the other hand, due to increasing raw material costs and huge spending on some best business initiatives, such as ensuring social compliance issues and implementing eco-friendly production method like ‘going green’ approach, Bangladesh’s apparel sector is passing through a critical juncture. Though the production cost has increased due to these factors, from the buyers’ side the product prices remain static, causing slight erosion in the competitiveness of the sector. But hopefully, in the long run, the compliance-related initiatives will benefit the sector to a great extent in enhancing production efficiency, competitiveness and image-building.

WHAT DOES THE SECTOR NEED: The government should take some strategic steps to resolve the sector’s existing problems and put the sector on a sound footing globally. But as the government alone can not do everything to boost the sector, entrepreneurs will also have to take some measures along with the government.

Steps to be taken by the government:

- After its graduation to the middle-income country status, Bangladesh will not be able to enjoy duty-free and quota-free access (DFQF). Currently, the country is getting these facilities due to its Least Developed Country (LDC) status. Hence, there is the urgency of signing preferential trade agreements (PTAs) and free trade agreements (FTAs) with major apparel importers like European Union (EU)-27, United Kingdom, Canada, Japan, Australia, Republic of Korea, and Chile. Efforts should be made to explore non-traditional but potential RMG markets like Russia, Belarus, South Africa, Mexico, and the Middle East. Bangladesh’s nearest competitor, Vietnam has signed trade agreements with South Korea and the Eurasian Customs Union led by Russia. It also completed an FTA negotiation with the EU last year which will be operational after the Council of Ministers’ ratification.

- Commercial wings should be opened at the Bangladesh missions in the countries which are major apparel importers. These wings will help boost RMG exports in those markets through promoting the country’s echo-friendly products and opening new outlets.

- To ensure smooth supply of cotton, government should facilitate signing of long-term agreements with major cotton exporting countries like Brazil, Burkina Faso, and the Commonwealth of Independent States (CIS) which includes Azerbaijan, Armenia, Belarus, Kazakhstan, Kyrgyzstan, Moldova, Russia,Tajikistan, Turkmenistan, Uzbekistan and Ukraine. Besides, immediate measures should be taken to boost domestic cotton production, and to produce man-made fibre like viscose using jute.

- Duty-free import facilities should be provided to RMG exporters for procuring eco-friendly and cost-effective machinery and equipment.

- Undisrupted supply of power and energy at stable prices should be ensured to RMG factories.

- To cater to the demands of the RMG industry, specialised vocational training institutes should be set up for ensuring smooth supply of skilled manpower and to reduce its dependency on foreign workers. According to a World Bank report (Stitches to Riches, 2016), RMG sector of Bangladesh has lower productivity standard compared to other Asian countries.

- Provision of special fund should be kept for RMG sector for both product diversification and market diversification through establishing design centres and conducting research & development (R&D) activities.

- Availability of bank loans at the lowest possible rate should be ensured by the government to bring new entrepreneurs into this sector.

- Provision of special incentive packages should be kept for exporters based on their monetary value of export.

- Efficient port management should be ensured to maintain lead time.

- ‘One Stop Service Bill 2017’ prescribed by BEZA should be made should be made effective immediately to attract more foreign direct investment (FDI) and to create new domestic entrepreneurs.

- Implementation of National single window system should be introduced to facilitate the RMG manufacturers and exporters to obtain the necessary papers, permits, and clearances to complete their import or export processes at one go.

- Special economic zones exclusively for Bangladeshi RMG firms (separately for knit and woven) like proposed “knit polli” in Narayanganj should be set up to suitably relocate the existing RMG factories and also to attract new entrepreneurs to this sector. This initiative will help increase RMG production, ensure competitiveness, and environmental compliance of the factories through allowing those to share a central ETP system.

Entrepreneurs should take the following steps:

- They should use upgraded machinery to remain cost-competitive through resource utilisation and waste minimisation.

- Regular training and skill development programmes should be organised for workers and mid-level management.

- New designs should be created for their products in line with global fashion trends. Attention should be given on producing high-end products.

- National and international apparel fairs and exhibitions should be organised to meet potential buyers to expand exports in both new and potential markets. It will also help green and complaint RMG factory owners to reach out to the buyers who are concerned about environment and human rights issue.

- Factories should concentrate on creating own ‘brands’ to be competitive in grabbing new and potential markets and to get optimal prices of products.

POTENTIAL AND CHALLENGES: Bangladesh RMG sector has huge potential not only to increase its global market share but also to meet the growing global demand for apparel. The country’s RMG sector has some core strengths: availability of young and dynamic workforce, 100 per cent local ownership, highly experienced RMG producers, over 200 composite factories, quality products at competitive prices, adoption of “going green” approach in keeping pace with the global sustainable apparel production, implementation of social compliance issues, and most importantly, a supportive government. On the other hand, some challenges are also there: high lead time, lack of market and product diversification, shortage of power and energy, dependence on imported cotton, etc. When some mega infrastructure projects, including the Dhaka-Chittagong 4-lane Highway, Deep seaport at Payra and Rooppur Nuclear Power Plant are implemented, hydrocarbon exploration in the Bay of Bengal is completed, and the move to produce cotton in the ‘Barind’ areas of Rajshahi becomes successful, the RMG sector will hopefully overcome many of its existing challenges.