The sudden cancellation of shipment of 400,000 bales of cotton by Indian traders will negatively affect yarn production of Bangladeshi firms which could deal a blow to apparel exports, industry insiders said“It is a sad incident,” said Abdul Hai Sarker, chairman of Purbani Group, which imports 30,000 bales of cotton a year, 15 percent of which from the neighbouring country.Bangladesh imports 46 percent of its annual requirement for the natural fibre from India.Indian cotton traders have cancelled contracts involving 400,000 bales of the natural fibre after a rally in domestic prices and the rising rupee made overseas sales unattractive, Atul Ganatra, president of the Cotton Association of India, told Reuters last week.Prices surged more than 15 percent in the past six weeks after pest infestations squeezed supplies in India, the world’s biggest producer of the fibre.The local spinners have already increased the prices of yarn after the latest move by the Indian traders, said Mohammad Hatem, former vice-president of the Bangladesh Knitwear Manufacturers and Exporters Association.

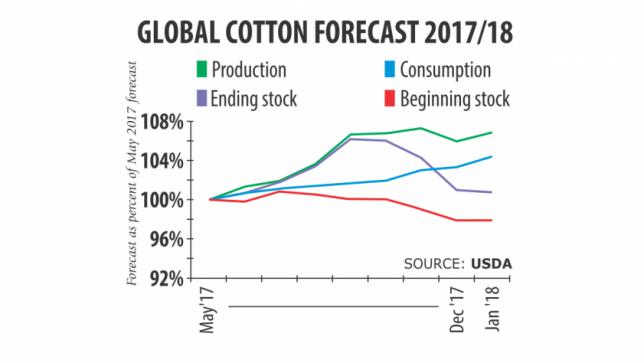

At present, the widely consumed 30-count yarn is selling at $3.30 a kilogram in the local market, up from $2.90 to $2.95 in the first week of the year, he said.Hatem said garment exporters had negotiated their work orders based on the previous rates of yarn, so the sudden spike in the rate will throw off their calculations and even their profit margins. Mehdi Ali, president of the Bangladesh Cotton Association, however, said the Indian cotton traders’ about-turn is unlikely to cause much damage as the quantity of the cancelled shipment is too little.“There is nothing to be panicked about. We have lots of other sources of cotton,” he said, citing the US, Australia, Brazil and some African countries as alternatives.Cotton is an agricultural product, so it is vulnerable to the vagaries of nature like droughts and floods, pest attack and so on.“So, we need to find a very strong alternative to India in order to ensure that our supply does not disrupt in case of any problem in a particular market,” Ali added.After hurricanes raised doubts about the supplies from the US, a top exporter, late last year, Indian traders signed a flurry of contracts. Now, they are reneging on them.Indian traders have so far shipped 1.5 million bales of the 2.5 million bales contracted since October 1, when the current year began, dealers said.Global cotton production is up nearly 7 percent to just over 120 million bales since May, according to the latest report of the United States Department of Agriculture.In fiscal 2016-17, Bangladesh imported 6.5 million bales of cotton, up from 5.5 million bales a year earlier.At the end of the current fiscal year, Bangladesh may import 7.1 million bales of cotton, according to Ali.Bangladesh spends about $3 billion a year for importing the fibre for local consumption.