Bangladesh is known across the world by its readymade garments (RMG). It’s like Hollywood signifies global movie industry, Nepal symbolizes the Himalayas, Egypt connotes the pyramids. Though these locations do have other landmarks, the countries are still overwhelmingly identified with such major attractions.

Bangladesh and its RMG have now become synonymous. The country does have other products but nothing is comparable with garments. The RMG industry has drawn attention of the world to the unique capabilities of the country’s entrepreneurs and workforce. Bangladesh, which was almost synonymous with natural disasters and dependency on foreign assistance, is now the world’s second largest garments exporter and its economy has become much more self-sufficient than what many experts could not even imagine after its independence (reference: the infamous ‘bottomless basket’ comment of former US Secretary of State Henry Kissinger). Bangladesh becomes an “Economic and Social Miracle” of the world, considering its success in many areas while confronting challenges from a few areas.

Bangladesh has earned its political independence by sacrificing millions of lives and is now poised to earn its economic full independence by virtue of business development of the country, led by the garments sector.

A visionary bureaucrat-turned-businessman late Nurul Quader is credited for the birth of the RMG industry in Bangladesh. His Desh Garments, with the partnership of Daewoo, immensely contributed to the development of the early stage of the RMG industry. Prior to starting its operations, Desh Garments sent a 130-member team, including 18 women, to Korea in 1978 for developing the skills of the newly-recruited workforce for the industry. Desh Garments started its operation in 1979 and its first shipment was made in January, 1980. Those trained professionals were the first generation of Bangladeshi garment experts who later became the pioneers in developing the industry. Almost at the same time, in 1979, Kihak Sung, a business graduate from the prestigious Seoul National University, visited Bangladesh for the first time and decided to establish a garment facility at Agrabad, Chittagong with 250 workforces in 1980. Youngone is the first foreign direct investment (FDI) in Bangladesh’s apparel sector. These two industrial incidences have deep rooted impact on the growth of country’s RMG industry.

Strengths of Bangladesh’s RMG industry can be categorized as: (i) more than 35 years of garment manufacturing experience, (ii) globally appreciated competitive prices (iii) internationally-accepted standard of product quality, (iv) sincere and dedicated workforce (v) a large number of young population with English communication efficiency (vi) duty-free market access to most of the developed world including the European Union (EU), Canada, Australia, Japan, Korea and also to the developing economies like India, China and many other countries and (vii) government incentives and supporting measures to develop the RMG industry.

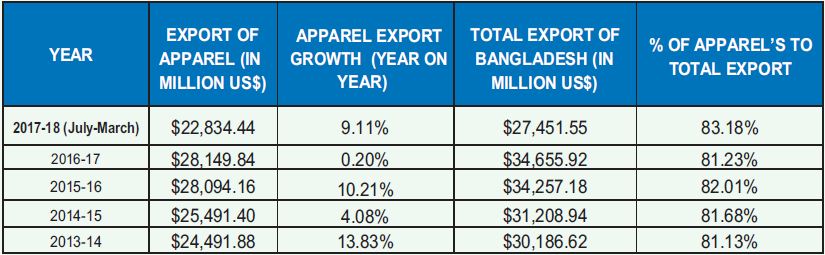

Around 4.4 million workers, mostly women, are now employed in the RMG industry. Almost 82% of the country’s export earnings depend on garment exports. The industry also has a huge spill-over impact on many sectors and industries of the country.

There is no denying of the fact that the industry has now become the main driving force for the country’s steady economic growth. What is more encouraging is that a bright future is waiting for Bangladesh’s garment industry provided it meets some challenging but of course not unattainable requirements for its sustainable growth.

McKinsey & Co. forecast that Bangladesh would be able to export apparels worth $45 billion by 2020. It opined that Bangladesh has the potentials to grow much more, if 5 Ps – people, power (utility), place (workplace), politics (stable political environment) and ports (infrastructure) can be properly developed and utilized for the industry. Goldman Sachs has included Bangladesh in ‘Next 11’ after the BRICS countries (Brazil, Russia, India, China and South Africa). JP Morgan ranks Bangladesh as a ‘Frontier Five’ country in the coming days. Bangladesh roughly exports 6.4% of the world’s apparel requirements and China, the number one, supplies around 36.4%.

Bangladesh now exports garments worth US$ 28 billion annually and plans to export apparels valued at US$50 billion in 2021 when Bangladesh will celebrate its golden jubilee of independence.

Bangladesh RMG Export’s Recent Data

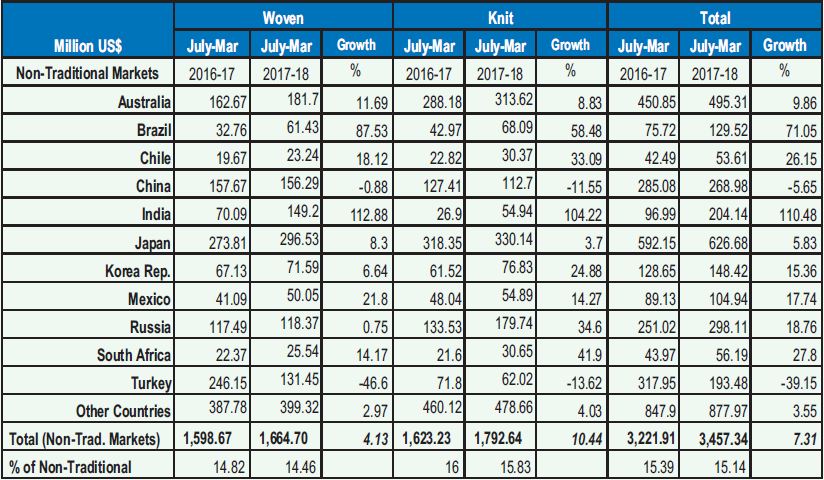

Due to its great economic development, China is now having double-edged constraints to the growth of its garment industry – (i) continuous rise of wages, losing its competitiveness and (ii) increased demand from domestic market, attracting many manufacturers to feed the local market, instead of export. Bangladesh has started exporting to China, which has been growing steadily. Japan, the traditional market for Chinese garments, has adopted ‘China plus one’ policy – has opened up a new door for the growth of Bangladesh’s garment industry.

Export earnings from the USA, one of Bangladesh’s key destinations, witnessed 1.62% growth in the first eight months (July-February) of the current fiscal year (FY18) compared to the corresponding period of the previous fiscal year (FY17) due to the good performance of the RMG sector. The major exports to the US market during the July-February period were woven garment ($2,566.91 million), knitwear ($913.05 million), home textiles ($114.35 million) and cap ($86.61 million). During the period, around 25.34 per cent of the country’s total woven garment exports entered the US market, followed by knitwear (9.02 per cent) and home textile (16.78 percent).

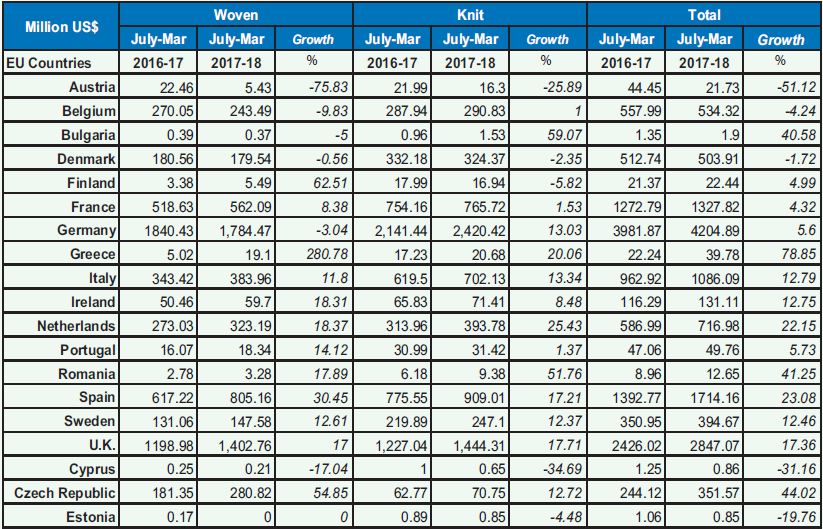

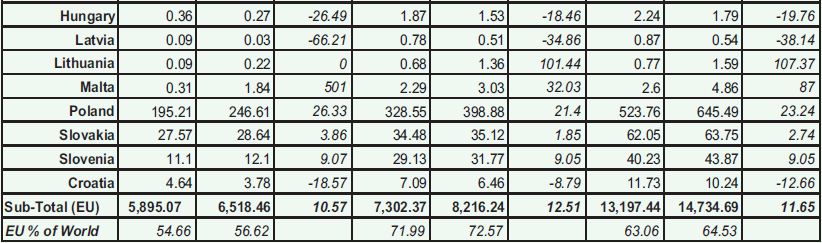

Bangladesh RMG Export Data for EU Countries: (July-March FY 2016-17 & 2017-18)

Bangladesh RMG Export Data for EU Countries: (July-March FY 2016-17 & 2017-18)

Bangladesh’s strategic location in between two leading world economies -China and India – also shows the enormous potentials for the growth of RMG industry. Both India and China have around 40 per cent of global population altogether.

India has become an export destination for “Made in Bangladesh” garments despite the fact that it is competing with the country to grab global apparel export business. Garment exports to India soared to 66.41 percent in the first six months of the current fiscal year on the back of demand from Western brands operating in the neighboring country and closure of some small- and medium-scale factories. According to data from Export Promotion Bureau, between July and December last year, garment shipments to India fetched $111.33 million. The data also showed between July 17 to March 18, Bangladesh has exported garments worth $ 268.98 million.

27 countries’ trade block, European Union (EU) is the largest Bangladesh RMG products export destination. Germany, the leading EU country has become the single largest apparel market for Bangladesh, emerged as Bangladesh’s largest export market overtaking the United States in July-February of the current fiscal year 2017-18 due to slow growth in readymade garments export to US market. Export earnings from Germany in the July-February period of FY18 stood at US$3.92 billion which is US$23.22 million higher than earnings from the USA — US$3.90 billion — during the period.

USA, European Union and Canada have been treated as the traditional export market for “Made in Bangladesh” garments. It used to be more than 95 percent of the total garment export volume in decade back but the scenario has changed. New export markets have emerged which are known as Non-Traditional Markets. It constitutes more than 15 percent of the export these

RMG Export Data for Non-Traditional Markets (July-March FY 2016-17 & 2017-18)

RMG Export Data for Non-Traditional Markets (July-March FY 2016-17 & 2017-18)

days, thanks to new market expansion strategy of the entrepreneurs which are being supported by the government with special incentives.

At present, the volume of the world garment trade is estimated at around US$ 450 billion. It is predicted that the global apparel market would be $650 billion by 2020. It means that a fresh demand for $200 billion worth of garments will be created within the next few years. Thanks to its vast experience and business exposures to the global markets, it is expected that Bangladesh would gain a reasonable chunk from this new demand, provided the country’s RMG industry successfully overcomes the existing challenges.

The challenges for the Bangladesh garment industry’s expected growth are coming mostly from within the industry. After tragic incidents of Rana Plaza building collapse and Tazreen Fashions inferno, the importance of workplace safety came to the fore. Two international buyers’ platforms, namely, Accord and Alliance, and the National Tripartite Action Plan were formed to inspect all the garment factories in Bangladesh. So far more than 2,100 factories have been inspected by all the three platforms. Among the inspected garment facilities, less than 2 per cent has been found risky. The inspected factories are also undertaking corrective action plans, as suggested by the inspectors. This is a positive development but in no way the industry should be complacent. Instead of criticizing global initiatives to improve the country’s workplace safety, both the government and the business should develop their own uncompromising mechanisms which would ensure safety and security of the workers.

Bangladesh’s RMG industry should now focus mid and higher-end apparel markets instead of lower-end products mostly; in fact, it’s an embarrassment for the industry since even after 35 years of its inception, Bangladesh RMG industry relies mostly on the basic garments business. It is obvious that to uplift its market segment, the industry should address strictly safety, compliance and environmental issues as well as incorporate modern technology and machinery advancement.

Shortage of electricity and gas has been strangling the RMG sector. While new enterprises, in many cases, cannot emerge due to lack of gas connections, production in the running factories is hampered due to low pressure of gas and load-shedding. Over the last few years, utility and service charges have increased manifold and the indication is very clear that upon start of using costlier LNG, utility cost would be increased further. Therefore, increased cost of production is and will be a big challenge for the industry. After Rana Plaza building collapse in 2013, national Labour Law was amended and minimum wages were revised. Recently, Bangladesh government has formed a new wage board for the RMG sector to formulate a new wage structure for apparel workers. It would increase the cost of production in a new height as all indications are there for further increase of wages.

Unfortunately, keeping pace with the increased cost of production, productivity and efficiency of country’s RMG factories have not improved. The bank interest rate in Bangladesh is higher than those competing countries, another bottleneck for the growth of the industry.

The garment industry now needs skilled human resources in terms of both skilled workers and mid-level management. A large number of expatriates are still working in the mid-management and higher positions in our garment industry. We do not have any confirmed report in hand but it is said that in between $2 billion to $5 billion are being remitted by foreign professionals who are employed in the country.

It is sad that Bangladesh’s RMG industry is yet to be successful to attract a large number of brilliant youth who are entering the job market. Very few business graduates from the country’s best institutions are interested to work in the garment industry. Young new blood and ideas should be welcome in the industry. Development of Human Resources should get necessary priority and therefore professional as well as technical trainings are imperative for the industry.

Political stability is a pre-requisite for growth of any industry. But the garment industry has become the worst sufferer in political unrest in Bangladesh as time, being lost in such turmoil, is a determining factor in the international apparel market as timely shipment should be the topmost priority. Labour management is another challenge that RMG industry needs to address. While it has to show total respect and commitment to uphold labour rights, stakeholders have to be farsighted as well as courageous enough not to kneel down to any undue and illogical pressure from outsiders. The government officials, the entrepreneurs and the labour leaders should have a consensus on the rights of workers as well as the rights of protecting businesses.

Despite all the limitations and sometimes rowing against the tide, the RMG industry of Bangladesh has been maintaining a steady growth because of its resilient entrepreneurs, vibrant workforce and policy supports from the successive governments. The industry has eliminated successfully child labour in 1995 and efficiently phased out the quota regime of the MFA in 2004. Now concerted efforts are required to ensure workplace safety of international standard, workers’ rights and overcome all other challenges that hinder the growth of the RMG industry. The industry that lays golden eggs in the Bangladesh economy has to be protected and allowed to grow as per its potentials.

The history of Bangladesh’s garment industry would be incomplete without acknowledging the contributions of the manufacturers as well as workers’ committed contributions for the development of the industry. Nevertheless, it would not be possible if the consecutive governments did not ensure favorable fiscal and non fiscal policies for the industry. The growth potentials of country’s RMG sector are visible even though challenges to confront the

growth scope also exist. Since Bangladesh RMG sector is one of the lifeline of country’s economy, all stakeholders of the industry should have a concerted effort to ensure further growth of Bangladesh RMG industry.

Mehdi Mahbub MBA

President, Bangladesh RMG Centre (www.rmgcentre.com)

Founder & CEO, Best Sourcing (www.bestsourcing.biz)

Presenter, RMG & Bangladesh, RMG Talk, RMG past present future TV Programs