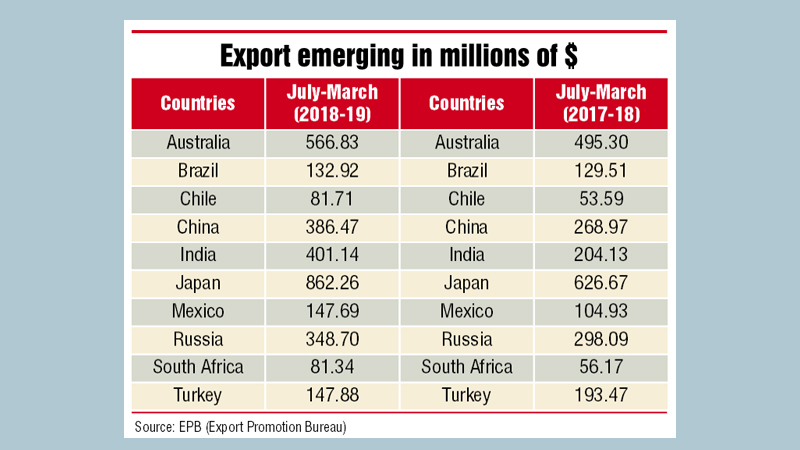

Garments shipments to non-traditional, mostly major markets grew by 29.62 per cent year-on-year to USD 3.15 billion in the first nine months (July–march) of FY2018-19 compared to USD 2.43 billion during the same period last year. This growth has been possible because of an incentive package and access to duty-free markets.Markets, other than the traditional markets, such as the USA, Canada, and Europe, are considered non-traditional. Among them are Chile, China, Japan, India, Australia, Brazil, Mexico, Turkey, South Africa, and Russia. These are the markets where Bangladeshi apparel exports are growing significantly.Siddiqur Rahman, former president of the Bangladesh Garment Manufacturers’ and Exporters’ Association (BGMEA), told The Independent that the government had announced a cash incentive of 5 per cent in 2010 for exports to non-traditional markets.Explaining the reason for the export growth, Rahman said that apparel-makers earlier were reluctant to reach out to those markets because entering a new market was difficult and time-consuming. Moreover, when a manufacturer enters a new market, the product price has to be reduced to below the average. These two reasons acted as a deterrent for garment manufacturers to explore new markets.But the cash incentive provided by the government over a considerable period of time has encouraged them to explore new countries and markets, said Rahman. “These two prime reasons (cash incentive and the long period) spurred exporters to explore new markets that grew dramatically over the past four to five years,” he added.Another reason is that most of the non-traditional markets have offered duty-free access to Bangladeshi apparel exporters, said Rahman.He also said that the cash incentive is 4 per cent, set around this time last year. “At present, non-traditional markets are contributing 15–16 per cent of the total export earnings,” he added.

In the July–March period of FY2018–19, Bangladesh earned USD 386.47 million from China, showing a growth of 43.68 per cent, up from USD 268.97 million in the same period of FY2017–18, according to the Export Promotion Bureau (EPB).China, the world’s largest apparel supplier, has started importing products from Bangladesh after the Chinese government allowed duty-free access to over 5,000 Bangladeshi products.Around 80 green garment factories are currently in operation. They are LEED-certified and 300 more are in the process of getting the certification. Of the top 10 green garment factories in the world, first seven are located in Bangladesh. In the July–March period of FY2018–19, Bangladesh earned USD 401.14 million from India, registering a growth of 96.51 per cent, up from USD 204.13 million in the same period of FY2017–18.Former senior vice-president of the Bangladesh Garment Manufacturers’ and Exporters’ Association (BGMEA), Faruque Hassan, cited a couple of reasons for this growth. “Famous international retail brands, such as Zara and H&M, have established their businesses in India and we are their biggest supplier,” he said.“Another reason is that the Indian domestic market has grown and the number of fashion conscious consumers has increased. We import RMG raw materials, such as cotton and machinery, from India. So, their exports, too, are increasing. It is a win-win situation from both the countries” he added.