Textile entrepreneurs came out with a huge investment amid the deadly coronavirus pandemic to boost production capacity and adopt new technology – all to meet the growing export demand of the country’s apparel sector.

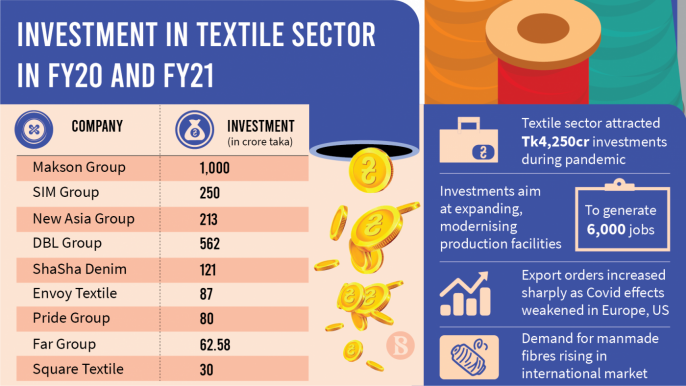

Investments worth about $500 million, or over Tk4,200 crore – highest in a decade – are in progress to expand and modernise production facilities to meet the growing demand mostly of manmade fibre in the international market, industry insiders say.

Because the pandemic has weakened in Europe and the United States – two major destinations of Bangladeshi apparels – thanks to widespread vaccination, the demand for readymade garments is returning to the pre-Covid level, industry people have said.

Many textile manufacturers are now overwhelmed with export orders, which they will not be able to complete in time by using their current capacity, they added.

Besides, trade tensions between the US and China have also encouraged local entrepreneurs to invest in some value-added yarn and fabrics.

They further added that as a backward linkage, the textile sector lags behind in the production of blended yarn and fabrics like polyester, synthetic, viscose and lycra (known as man-made fiber).

“As such, we still have to import these kinds of yarns and fabrics to meet the demand of buyers.”

Meanwhile, Bangladesh’s competitor countries have been upgrading their technology for producing these products. This also has made entrepreneurs in the local textile sector invest heavily in modernising factories and increasing production capacity.

The new investments are expected to generate employment opportunities for about 6,000 people, according to stakeholders.

Mohammad Ali Khokon, president of the Bangladesh Textile Mills Association (BTMA), told The Business Standard that almost every factory is now investing in BMRE – balancing, modernisation, rehabilitation and expansion.

Almost all, if not all, of the factories that did not invest in these areas in the last ten years are out of business now, he added.

Referring to the increased demand for textile products, including cotton and man-made fabrics, Mohammad Ali Khokon said, “Currently, my factory has daily export orders of 100 tonnes of fabrics while we have the capacity to produce only 60 tonnes.”

Apart from local entrepreneurs, foreign investors are also coming up with announcements of setting up factories in the country for the production of man-made fabric.

The renowned Korean industrial conglomerate Youngone – owner of the Korean Export Processing Zone – announced earlier this year that it would invest $200 million in producing man-made fabric.

According to the BTMA, more than 433 spinning mills were in operation in Bangladesh in 2020, which had a combined production capacity of 3,270 million kilograms of yarn per year.

Local spinners can supply nearly 85-90% of the required yarn and fabrics for knitwear.

In the case of woven fabrics, local weavers can supply below 40% of the requirement. Because of this the woven garment industry has remained dependent on foreign fabrics, according to BTMA data.

Of all garment items produced globally, 78% is made from manmade fibers while cotton fibre accounts for the rest, according to data from the International Textile Manufacturers Federation (ITMF) – a Switzerland-based platform for global textile makers.

But Bangladesh lags far behind its competitors in making man-made fibres, said BTMA President Mohammad Ali Khokon. “This is why we are dependent on imports of these products.”

Maksons Group, one of the top 10 spinning mills in the country, has announced that it is investing around Tk1,000 crore in three new spinning units in Mirsarai Economic Zone.

Metro Spinning Limited, a concern of the group, will invest Tk340 crore in a unit, while Maksons Spinning Mills will pour Tk254 crore and Tk348 crore into two other units, according to company insiders.

Khokon, who is managing director of Maksons Group, said, “We are going for big investment to manufacture high-value diversified products so that we can stay competitive in the market.”

In the manner of Maksons Group, Envoy Group, New Asia Group, DBL Group, Pride Group, ShaSha Group have decided to make huge investments during the pandemic.

Speaking to The Business Standard, Envoy Textiles Chairman Kutubuddin Ahmed said the firm is making investments to build new capacity to produce blended yarn, which is expected to help to reduce over-rate cost.

“As an existing factory, it needed comparatively less investment than a new one,” he added.

He also mentioned that the company is adjusting its capacity preference, buoyed by the prediction that demands for fabrics will soon go beyond the pre-pandemic level riding on vaccination drives in the apparel sector’s two key export destinations – Europe and the USA.

Kutubuddin Ahmed, who is a former president of the Bangladesh Garment Manufacturers and Exporters Association (BGMEA), also said the firm produces high quality fabrics so that it need not do any marketing to sell those.

“The US-China trade tensions also have helped to expand capacity to produce blended yarn that used to be imported from China.

“Currently, the government has put some non-tariff hassles on Chinese-origin products as the supply chain is more traceable to identify the origin of a product.”

Another large exporter in the apparel sector, DBL Group, has decided to invest Tk562 crore in capacity expansion.

The conglomerate has plans to expand the dyeing and finishing capacity of its Hamza Textile Mill- unit 2. For this purpose, the International Finance Corporation has allocated Tk376 crore.

The industrial group has also set up a new unit at Matin Spinning Mills to produce specialised yarn, including man-made fibre. The new initiative requires about Tk186 crore.

Top officials of DBL expressed the hope that the new units will go into production by the end of this year, creating job opportunities for around 2,000 people.

The New Asia Group has announced an investment of Tk213 crore to expand its production capacity and modernise technology.

The group’s Managing Director, A Matin Chowdhury, told TBS, “There is a high demand among buyers for the yarn they produce, as we import cotton from America and make yarn by using modern technology.”

“In line with technological advancement worldwide, the quality of yarn has also changed. So we are investing heavily in producing better quality yarn,” he added.

Mentioning that the business currently is in a negative state due to the Covid-19 pandemic, he expressed the hope that the situation will not last long. “Business will not stop because of this. So, we are getting ready to meet the growing demand for cotton-based yarn.”

HR textile, a concern of Pride Group, has plans to invest Tk80 crore to expand its capacity.

The group’s Director Professor Mohammad Abdul Momen said, “We plan to expand our capacity in sustainable production, as global buyers are moving towards more environment-friendly products in terms of consumption of energy, water and chemicals.”

“Against this backdrop, we have a plan to convert the existing chemical effluent treatment plant (ETP) of our textile factory to a biological ETP to make it more environment-friendly,” he added.

The group also plans to install some latest technologies and machinery to make it a more efficient production centre, said Professor Abdul Momen, adding, “We are producing high-value products for summer and winter. That is why we have full orders all year round.”

The enhanced capacity will help the company offer some diversified products to existing buyers and boost its turnover, he further added.

Shasha Denim has already invested Tk50 crore in purchasing land for its expansion to produce sustainable products.

Its Managing Director Shams Mahmud said it is planning to produce more high value products by using existing capacity.

Besides, the company is also in the process of setting up a new plant for recycling yarn spinning and an eco-friendly washing plant.

The new project will involve an investment of about $50 million, he added.

Last year, the denim mill also procured a part of the Italian textile mill, EOS Textile Mills Ltd.

Export situation

In the one decade till the 2018-19 fiscal year, exports of readymade garments grew by 176% to $34.13 billion. During the period, exports of woven garments grew by 192% to $16.63 billion and that of knit garments grew by 165% to $16.5 billion.

In the first 11 months of the 2020-21 fiscal year, the country fetched $28.56 billion by exporting readymade garments. The amount was 11.1% higher than that earned in the same period a year ago but 10% lower compared to the corresponding period of the 2018-2019 fiscal year, according to Export Promotion Bureau (EPB) data.

Apparel exporters expect that apparel exports will exceed $34 billion this fiscal year.