Bangladesh has secured its leading position as one of the leading global suppliers in the textile and garments sector. It is a challenge to maintain the country’s position despite the ongoing Covid-19 pandemic epidemic. Sustainable growth and value addition can be achieved, if the sector expands towards the production of Technical Textiles (TT) and Personal Protective Equipment (PPE).

German-based Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) – with support of BGMEA – conducted a study titled ‘Feasibility study on scaling up the production of Technical Textile (TT) including Personal Protective Equipment (PPE) in Bangladesh’ concluded that Bangladesh, still in the primary phase of technical textiles, and has a vast perspective to grab the big technical textile markets of EU and USA.

According to BGMEA, 155 members export masks and PPEs. Masks have been exported to 19 countries and PPE to six countries. The complexity of raw material sourcing and testing or certification standards is one of the reasons for Bangladesh’s backwardness in technical textile exports. The current size of the global technical textile market is about $180 billion and projected to grow to $224 billion and $93 billion respectively by 2025, according to the findings of the feasibility study.

The results of the study were unveiled to the public through an online platform at the BGMEA head office yesterday. President of BGMEA, Faruque Hassan, and German Ambassador to Bangladesh Achim Tröster were the spoke persons at the event. Country Director of GIZ Bangladesh Angelika Fleddermann, Textile Cluster Coordinator Werner Lange and Business Scout Thomas Hübner, and BGMEA Director Abdullah Hil Rakib and Managing Director of TEAM Group were also present. Charles Dagher, Consultant, GFA, and one of the authors of the feasibility study supported by his study team colleague presented a list of the most important critical gaps that currently limit the potential growth of the sub-sector and new development strategies.

The study called for Bangladesh to capitalize on the country reputation as a consistent and certified trading partner in the EU and the United States market. Once, Bangladesh has built its confidence and reliability TT and PPE’s product sector, advanced technology can be introduced. These will help to diversify and refine the product portfolio, providing more profit. While a limited number of products adhere to high-quality standards, a host will open the door for niche sections and products. Encouraged by the success of start-up manufacturers, more companies will jump and the sub-sector will grow. Still, some big obstacles remain to be overcome. Charles Dagher presented a list of the most important critical gaps that currently limit the potential growth of the sub-sector in his study.

| Table: Identification of critical gaps: | |

|---|---|

| Critical Gaps | Degree of impact |

| Lack of collaboration within the industry | High |

| Low international recognition as suitable TT/PPE sub-sector supplier | High |

| Lack of marketing intelligence and branding | High |

| Little awareness amongst key players in traditional T&A sector | High |

| Lack of certification for raw and processed materials | High |

| Uncontrolled unit costs and lead time negatively impacting sector competitiveness | High |

| Inadequate capacity to master new technologies | Medium |

| Limited training for technical or management human resources | Medium |

| Slow customs clearance and other procedures | Low |

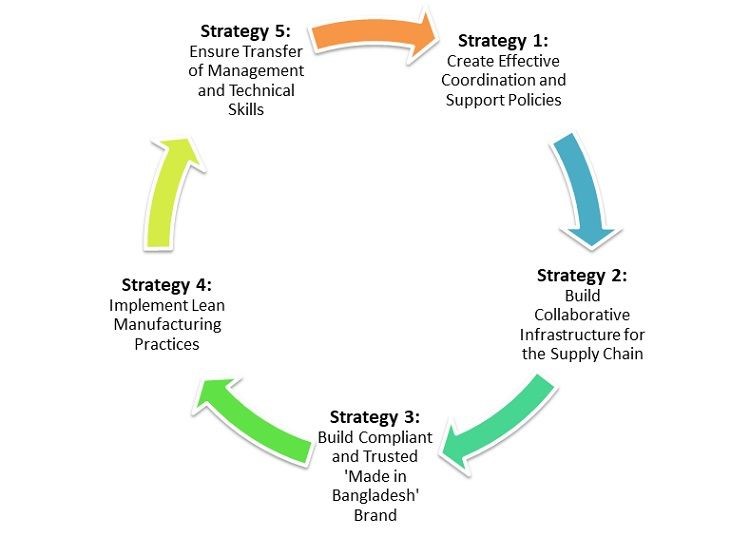

German development cooperation, GIZ textile cluster, is enabling local stakeholders to address some of these challenges. German Ambassador Achim Tröster assured the continuation of support, outlining the successes of GIZ interventions in the textile and garment sector during the event. GIZ developed 5 Strategies and 22 Sub-strategies with 94 Key actions and 142 outcomes. Achim Tröster said, “GIZ is highly encouraged to collaborate with Bangladesh in the textile sector and to provide the strategic impetus for further development of the technical textile sub-sector through this research.”

The application of each strategy has different numbers of results, including two stages.

Stage 1 – Short- and Mid-Term TT/PPE Sub-sector:

Promotion of Bangladesh TT/PPE supply chain (Limited number of products).

- Reliable, compliant, and trusted label product Made in BD’

Stage 2 – Long-Term T&A Sector:

Increase Product Diversification and Sales.

- Innovative ideas – product development and diversification.

Germany is the third-largest exporter of technical textiles in the world with a 9% share. Thomas Hübner said, “If Bangladesh can overcome the critical gaps shown in the study, then the Bangladesh textile industry can export technical textiles like RMG products.”

The study suggested establishing reliable material supply channels, ensuring accurate quality products, and focusing on a limited number of products to achieve the required product certification. The study identified 18 products, of which 16 were classified as medical and two as non-medical. These products belong to more or less the same product family, which allows traditional textile and apparel (T&A) manufacturers to adapt their existing activities to new product lines with minimal technical training.

Charles Daghe said, “Only the most affordable and efficient companies can thrive in the competitive and complex TT / PPE sub-sector”.

Bangladesh should not be marketed primarily as a low-cost and low-wage supplier. Rather, the country should be branded as a reliable supplier of complete package services and competitively priced products – in terms of quality, safety, and testing standards – to markets like EU and US,” he added.

Once a successful manufacturing system is achieved, the sub-sector will be able to further promote the ‘Made in Bangladesh’ PPE label in the international market, start relationships with major PPE sourcing agencies and attract more foreign and national investors for further development. Sector, it has recommended.

However, manufacturers are already having small doubts about the growing demand of medical PPE market. The world is moving towards vaccination. The covid-19 situation is already declining in several exportable countries. Director of BGMEA, Tariqul Islam and Assistant Director of Snowtex said, “Manufactures should think twice because it is becoming more of a seasonal requirement than a necessity.”

At first, the textile industry in Bangladesh did not have testing facilities for the production of technical textiles. When making medical PPE, manufacturers may be faced with having to follow international standards for making medical PPE. But Bangladesh has overcome the difficulty of starting production of international standard medical PPE.

Abdullah Hill Rakib said, “With the initiative of GIZ and proper testing facilities, Bangladesh can make potential improvements in capturing the technical textile market.”

Faruque Hassan, President of BGMEA said, “At the moment we need investment and technical knowledge from the developed part of the world.”

Bangladesh textile industry is ready to face the growing market of the textile industry TT and PPE. Bangladesh has joined hands with brands, testing service companies, and technology providers to help make the country’s potential a reality.

Faruque Hassan said, “Bangladesh Textile Sector will implement GIZ Feasibility Project in seven days with proper support of joint ventures.”