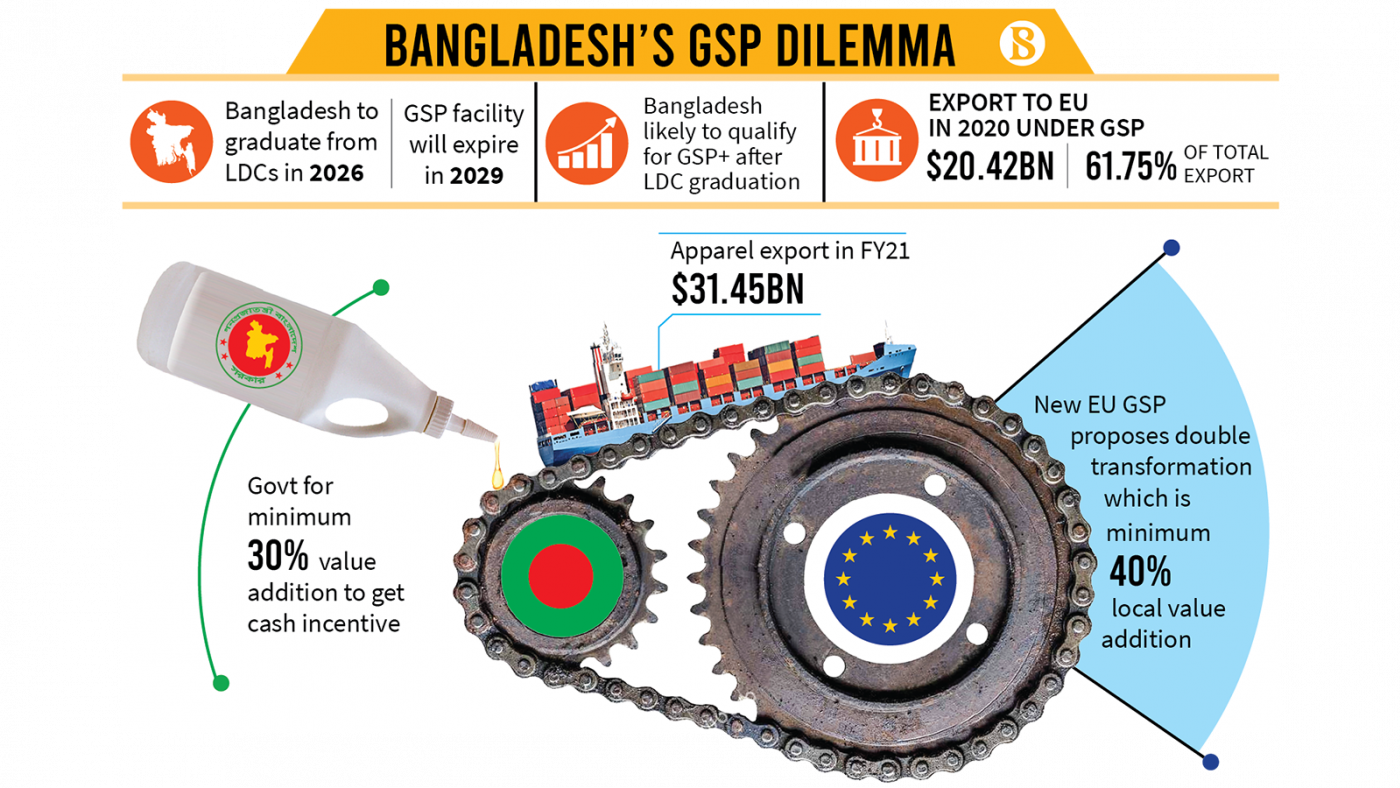

Apparel makers are pleading for lowering the threshold for local value addition set for the government’s cash incentives at a time when they are required to add more local value to get duty-free access to the European Union (EU) after three years.

To be eligible for the EU’s proposed new GSP (generalized scheme of preferences) framework, Bangladeshi garment makers will need a “double transformation”, which, as industry leaders assess, will amount to 40% local value addition – a level achieved by knit garment makers.

With a much lower local value addition, woven dressmakers will find it harder to get duty-free access to the EU market after Bangladesh graduates from the least developed country status by 2026, trade economists and industry insiders warn.

Lowering the threshold further to 20%, as demanded by the Bangladesh Garment Manufacturers and Exporters Association (BGMEA), will discourage local industrialization and efforts to add more local value to export apparel, they think.

The government provides cash incentives and export subsidies to encourage manufacturers to add more local content to their export products. The threshold now is 30%.

In a recent letter to Commerce Minister Tipu Munshi, BGMEA President Faruque Hasan proposed cutting the value addition rate to 20% for the eligibility for cash incentive as well as all subsidies.

The issue is still pending.

Industry people and analysts say cash incentives should not be an across-the-board offer; it will be rational to strip the firms of the incentives if they fail to add enough local value to their products.

Seeking anonymity, an apparel sector leader said the government may offer cash support only for new products with a 20% value addition, which will be helpful to diversify apparel items.

Explaining further, he said 20% value addition should be allowed for new manmade fabric-based items except for five major ones, which account for about 70% of Bangladesh apparel export earnings.

“The new items could be sportswear, wedding wear, and tech-wears; those may require imported fabrics and accessories. Once we can start producing those items, local industry will gradually develop based on them,” the apparel exporter said.

Dr. Mohammad Abdur Razzaque, chairman of the Research and Policy Integration for Development (RAPID) Society, told The Business Standard, “The 20% value addition will not be logical as the country is going to graduate from LDC status, while the new GSP proposal suggested a double transformation.”

The industry is facing a reality as every raw material price is going high, but prices of final products are not increasing like that, which is a major challenge to maintaining the value addition ratio, he also said.

Yet, the industry should focus on value addition despite all constraints, otherwise, apparel exporters will not be able to negotiate with brands and buyers for better prices, he added.

The buyers are well aware of all fiscal policies and incentives, that is why they offer prices calculating those incentives, and, ultimately, exporters are not getting those benefits.

If apparel makers want to export products with only a 20% value addition, that will be a very tough job to meet the new GSP double transformation condition for exports to European countries.

Of Bangladesh’s total $20.42 billion worth of exports to the EU in Calendar Year 2020, knitwear items account for $9.91 billion and woven products $7.15 billion.

After LDC graduation, Bangladesh will lose the opportunity to export to the EU market under the Everything but Arms (EBA) facility, while exports to India under South Asian Free Trade Area (Safta) and even to China will require 40% value addition.

If the value addition criteria are not fulfilled by apparel makers, they might export goods under standard GSP paying taxes. For a long time, Vietnam had exported to EU markets with a low-value addition under Standard GSP.

Vietnam eventually signed an FTA with the EU and now enjoys duty-free market access.

Faruque Hassan, president of the BGMEA, said, “We have sought a cut in the value addition requirement to 20% for only woven apparel as raw materials prices have increased. For this reason, 30% value addition is very tough for exporters.”

The government may relax the value addition condition for apparel exporters for a certain period, he said, adding that for example, it can be given for two years.

Local value addition happens at different rates – 40% in some products, but in the case of high-end and fancy products, it is very difficult to maintain a 30% value addition ratio as costs of fabrics meant for making such items are very high, which need to be imported as well.

Those products also require very expensive accessories, he added.

“We are demanding the facility to continue the growth of woven items,” the BGMEA president said, hoping that Bangladesh will be able to add more value to products before the LDC graduation.

Several companies are investing in high-value yarns and accessories, and the government also provides policy support for that.

To encourage local value addition in high-value products, the government should give at least a 10% cash incentive on manmade fiber-based new products.

Current status of value addition

The Bangladesh Bank calculates gross value addition from the apparel industry. But its last three quarterly reviews on RMG do not mention the recent value addition status.

According to the report of the Bangladesh Bank Quarterly Review on RMG, the apparel sector’s value addition reached 64.98% during the first quarter (July-September) of the last fiscal year.

Analyzing those data, TBS found that the value addition has remained almost static between 60% and 64% for almost a decade.

Exporters want more hike in wastage rate

In January this year, the BGMEA and the Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA) sent a proposal to the commerce ministry to increase the maximum wastage rate to 40%.

BKMEA vice-president Fazlee Shamim Ehsan said the wastage rate is equal in every country across the globe as everyone is using the same technology and machinery.

Later, the Export Promotion Bureau sent a letter to 20 companies, asking them to find out the actual wastage rate. Only two companies responded to the bureau’s inquiry, saying their wastage rate was more than 40%.

After that, the commerce ministry formed a committee to verify the actual wastage rates in garment factories. After inspecting six factories producing basic knitwear, specialized items, and sweaters and socks, the committee recommended setting the maximum wastage rate by averaging the amount of wastage of similar factories.

They proposed a 25% wastage rate for basic knitwear including T-shirts, polo shirts, trousers, shorts, skirts, pajamas; 28% for specialized items like rompers, tank tops, dresses, gowns, hoodies, and lingerie items; and 3% for items like jumpers, pullovers, cardigans, vests, and socks.