CPD study finds

Local garment shipments have continued to attain an impressive recovery, largely driven by volume, as the price hike rate has been very low with normalcy restoration in the global supply chain from the pandemic’s severe fallout.

The volume-driven export growth had important consequences for bottom tier entrepreneurs and their falling profit margins, said a study of the Centre for Policy Dialogue (CPD) made public at its office in Dhaka yesterday.

This is also likely to have implications for workers who are possibly having to meet higher production targets, it said.

The rise in productivity is not being realised through higher prices, although it is helping Bangladesh’s apparels remain competitive. This also has important implications for wages, the CPD said in its Independent Review of Bangladesh’s Development (IRBD).

Bangladesh has two main export destinations for locally made garment items — the US, which accounts for 24 per cent of the shipments, and the European Union (EU), which accounts for 64 per cent.

The CPD study found that garment export from Bangladesh to both markets increased between July and October of the current fiscal year compared to the corresponding period of last fiscal year.

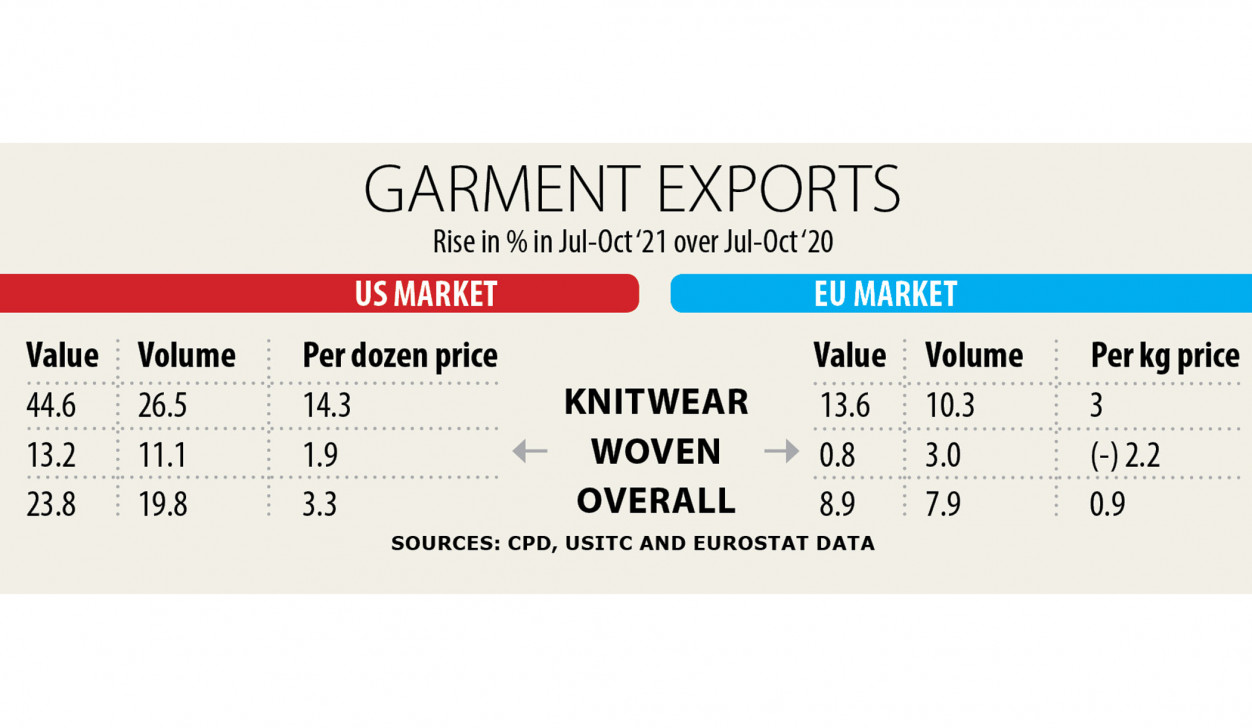

In the US market, the 23.8 per cent growth in export earnings was mostly driven by volume, which rose by 19.8 per cent, whereas in contrast the rise in price per dozen was a mere 3.3 per cent.

The CPD study also found that in case of woven garments, which is predominantly exported to the US market, average prices rose by only 1.9 per cent.

The rise in export value of 13.2 per cent was mostly driven by growth in volume of 11.1 per cent of the woven garment to the US markets.

In case of knit garments, the situation was somewhat different – export earnings rose by 44.6 per cent, with average prices increasing by 14.3 per cent while the export volume rose by 26.5 per cent of the knitwear items to the American markets.

Similarly, in the EU markets the recovery in garment shipment has been taking place but mostly in volume as the prices per kilogramme of the apparel items increased minimally.

For instance, export earnings rose by 8.9 per cent against the backdrop of a rise in volume of 7.9 per cent as against the rise in price of an insignificant 0.9 per cent to the EU in July and October of the current fiscal year compared with the corresponding period of the last fiscal year, the CPD study also said.

The study said in case of EU markets, the value per kg of knitwear items increased by 13.6 per cent and volume increased by 10.3 per cent but the price increased only by 3 per cent in July and October of the current fiscal year compared with the same period of the last fiscal year.

In case of woven garment items in the same markets in the same period, the value increased 0.8 per cent and volume increased by 3 per cent and the price of per kg woven garment items in fact declined by 2.2 per cent, the study also said.

The trend of volume-driven growth is more prominent for woven compared to knit, the CPD said, adding that it would be appropriate to say that where domestic value addition was higher, competitive strength and bargaining power of exporters are, to that extent, stronger.

The study indicates that brands and buyers had only marginally absorbed the rise in the costs of apparel production.

The export earnings have registered an impressive growth of 24.3 per cent during the first five months of FY22 while the base effect of low growth in FY20 is an issue.

The export performance is no doubt encouraging as growth of export earnings during July to November of FY22 surpassed the strategic annual target of 12.2 per cent set out for FY22, the study said.

For most part, this growth has been anchored in the high growth of export earnings from the readymade garments at 23 per cent. The growth of non-readymade garment export earnings was also an impressive 30 per cent during this period

More than three-fourths of the incremental export earnings was generated on account of the readymade garment sector, signalling the continuation of predominance of the item in the country’s export basket and the rising export concentration in recent years.