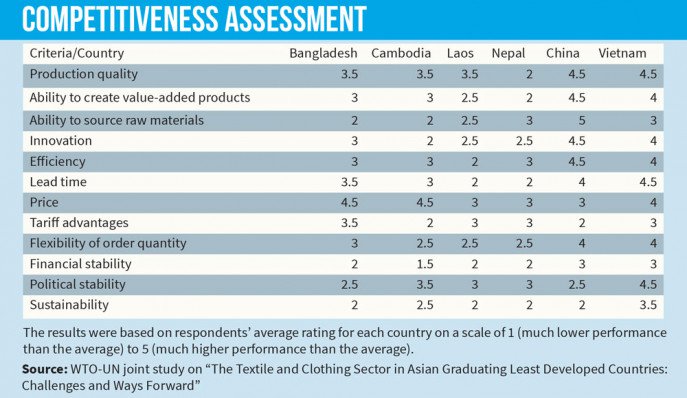

Vietnam’s fashion industry on the ten leading indices logs at least one score ahead of Bangladesh, while the gaps are 1.5 and 2 respectively on sustainability and political stability

In terms of product quality, lead time, and sustainability, Bangladesh’s clothing sector is not as good as its neck and neck market peer Vietnam, according to a recent World Trade Organisation (WTO) competitiveness report, as Dhaka scores remarkably low than Hanoi on ten indices out of a total of twelve.

A lead time of apparel exports is the period between the placement of an order and the delivery of the finished product. Vietnam is better able in sourcing raw materials, according to the report, and also can release the imported consignment at its ports within 24 hours.

In contrast, Bangladesh takes 48 hours to one month to release raw material imports for the apparel industry, said local garment factory owners. They said Vietnamese workers are 10%-15% more efficient in manufacturing, while the country can deliver the final product to European buyers 10-15 days earlier than Bangladesh.

“Transportations from and to Chattogram port eats up a major portion of our delivery deadline. Vietnam certainly is well ahead of us in overall logistic support,” Shovon Islam, managing director at Bangladeshi garment manufacturer Sparrow Group, told The Business Standard.

Then comes the shipment time. Vietnam directly sends the products to the buyers from its seaports, but Bangladesh cannot.

Due to the unavailability of a deep-sea port, feeder’s vessels have to take the products to countries such as Singapore and Sri Lanka, where the products are transferred to mother vessels for shipment to Europe and the USA.

“Lead time is very crucial in the current competitive market,” said Fazlul Hoque, a former president of the Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA), adding Bangladesh lags in port and customs management.

With around $29 billion in apparel export, Vietnam surpassed Bangladesh to become the second-largest readymade garment exporter after China in the global market in 2020. According to unofficial data, Bangladesh regained the second position by earning $1.94 billion more than Vietnam in the first seven months of 2021.

Other major gauges of the recent WTO report, titled, “Textiles and clothing in Asian graduating LDCs: Challenges and options” – prepared after surveying at least 150 exporters and 30 global brands and retailers – are the ability to create value-added products, innovation, efficiency, the flexibility of order quantity, financial stability, and political stability.

Vietnam’s fashion industry on the ten leading indices logs at least one score ahead of Bangladesh, while the gaps are 1.5 and 2 respectively on sustainability and political stability, shows the report. The report was prepared with data contributed by several UN agencies including the United Nations Conference on Trade and Development (UNCTAD).

Only on two indicators – price and tariff advantage, Bangladesh is ahead of Vietnam and China thanks to duty-free access to key global markets and local cheap labor. The country is a little ahead in some indicators than three other least developed countries in Asia including Cambodia, Laos, and Nepal.

Sparrow Group’s Shovon Islam said any hiccup in the supply chain would ultimately affect efficiency. “If a fabric does not arrive at the port on time, if there is a supply chain disruption, or if the workforce cannot be utilized properly, the efficiency would get hurt. This is happening to us,” he noted.

However, Fazlee Shamim Ehsan, vice-president at the BKMEA, said he does not agree with all the indicators showing Bangladesh apparel behind Vietnam.

“None is supposed to be ahead of us in terms of flexibility of order quantity. We accept orders so flexibly that buyers can take several thousand pieces to only a few hundred pieces from us,” he claimed.

The BKMEA vice-president also defended the quality of made-in-Bangladesh products by saying, “We manufacture products as buyers want. Since Bangladesh is capable of satisfying the brands with the quality, the country is getting increasing work orders.”

Fazeley Shamim Ehsan, however, agreed that Bangladesh has a lot to improve in terms of higher value addition.

Like the BKMEA vice-president, Faruque Hassan, president at the Bangladesh Garment Manufacturers and Exporters Association (BGMEA), too said the report in some cases surprisingly underrated the progress made by the Bangladesh garment industry over the past decade.

“The report mentions environmental compliance-related risks as a downside for sourcing from Bangladesh, while the industry has made a huge stride to transform workplace safety, workers’ wellbeing, and environmental sustainability. The rating seems to be inappropriate,” he noted.

Vietnam’s FDI and FTA upper-hand

Noted economist Dr. Abdur Razzaque, who wrote the report, said Vietnam and Cambodia have a strong presence of foreign direct investment (FDI) in their apparel sectors that help them establish improved standards and bargaining power.

“More importantly, while Bangladesh is likely to lose preferential treatment in the EU apparel market, already developing Vietnam will be able to secure duty-free access in that market because of an FTA [free trade agreement],” Dr. Razzaque told The Business Standard.

Bangladesh will no longer be entitled to duty-free market access after 2029, as the country will graduate from the least developed country club in 2026 and its export will enjoy facility extension for another three years until 2029. For uninterrupted market access, Dhaka then would be requiring preferential trade agreements and free trade agreements (FTA) with countries and trade blocs.

But Bangladesh so far has the lone bi-lateral preferential trade agreement with neighboring Bhutan.

Dr. Razzaque said, “Many buyers consider duty-free status as a critical determinant of sourcing decisions. Although entire sourcing will certainly not be concentrated in Vietnam, with the loss of tariff advantages, Bangladesh will come under intense competitive pressure from such market peers such as India, Indonesia, and Sri Lanka.”

According to the report, Bangladesh may concede a loss of $5.37 billion due to the impact of LDC graduation on export.

Still, there will be orders

The WTO report says fashion brands and retailers adopt diverse sourcing considerations, including cost, speed to market, flexibility, agility, and compliance risks.

With China and Vietnam as critical sourcing bases, fashion brands mostly see the least developed countries Bangladesh, Cambodia, Laos, and Nepal as part of their diverse sourcing locations.

According to the report, Turkey is another major sourcing destination for European Union-based fashion companies, while EU-based buyers source fewer complex products (such as dresses and outerwear) from Bangladesh, Cambodia, Laos, and Nepal due to their limited production capacities.

The report mentions, fashion brands, and retailers may still find it attractive to source from Bangladesh, Cambodia, Laos, and Nepal after their LDC graduation. Major brands and retailers believe LDC graduation may only modestly affect their sourcing.

It also said that in the next three to five years, they will increase their sourcing from Bangladesh and Cambodia.

BGMEA President Faruque Hassan said Bangladesh’s graduation to a developing country will definitely cause some significant changes that need collaborative and joint effort to overcome.

Md Fazlul Hoque, former BKMEA president, said, “Bangladesh is working on the issues mentioned in the report, but it needs to be speeded up. We need to focus on FTAs and PTAs.”

“Despite not being covered by the GSP [Generalised System of Preferences] facility, we are still ahead of China and Vietnam in terms of export growths in the US market,” he added.

Commerce Minister Tipu Munshi told The Business Standard that Bangladesh will try to avail the duty-free export facility until 2031 – five years after the LDC graduation.

“Besides, we are looking for PTA and FTA agreements with several countries this year,” the minister commented.