Introduction

Product diversification is a most wanted demand in today’s business in underdeveloped and developing countries. This issue becomes more desirable after the COVID-19 situation. In Bangladesh, the Readymade Garments (RMG) industry–the main export earner—needs to go for product diversification to strengthen the business’s existence nationally and internationally.

Diversification is essential for knitting, dyeing, RMG, and backward linkage industries in Bangladesh. In this article, I have concentrated on the spinning sector. Product diversification is a strategy followed by a company to increase profitability.

They show how well a company utilizes its existing assets to generate profit and achieve higher sales volume from new products. Diversification can occur at the business level or the corporate level.

Business-level product diversification: Expanding into a new segment of an industry that the company is already operating in.

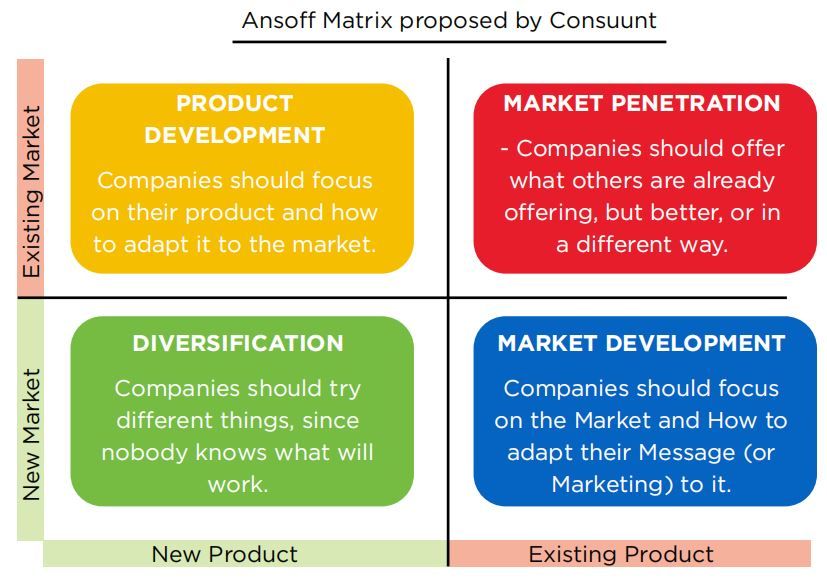

Corporate-level product diversification: Expanding into a new industry that is beyond the scope of the company’s current business unit. Diversification is one of the four main growth strategies illustrated by Igor Ansoff’s Product/Market Matrix:

Diversification strategies

- Concentric diversification: Concentric diversification involves adding similar products or services to the existing business. For example, when a spinning industry primarily produces 100% cotton yarn and starts manufacturing synthetic yarn (Polyester, nylon or fancy yarn, etc.) it means that the spinning industry needs to go for a concentric diversification strategy.

- Horizontal diversification: Horizontal diversification involves providing new and unrelated products or services to existing consumers.

- Conglomerate diversification: Conglomerate diversification involves adding new products or services that are significantly unrelated and with no technological or commercial similarities.

Benefits of product

diversification:

- To align with the latest global business trend. After the pandemic situation, the demand for synthetic yarn increased dramatically compared to the yarn produced naturally.

- To increase profit or sales revenue of the business.

- To contribute to the country’s economy.

- To sustain business growth and position nationally and internationally.

- To attain a competitive business advantage.

- To gain better protection from competitors’ threat of both local and intentional.

- Man-made fiber is recyclable and cost-effective compared to cotton fiber.

Main obstacles for product diversification in the spinning sector:

- Huge investment cost in setting up the spinning industry.

- Lack of knowledge of the international business trend and strategy.

- Lack of government initiative.

- Lack of trained and skilled manpower in man-made fiber spinning technologies.

- Indifferent attitude of some entrepreneurs towards setting up a new spinning industry due to fear of less profit with higher investment cost.

Discussion points:

- The spinning industry of Bangladesh is contributing to less than 30% for the man-made based RMG sector whereas the global market share is 63%.

- To survive the overall business trend of ready-made garment sectors, some entrepreneurs started to invest in man-made spinning sectors.

- Presently 430 spinning mills are operating. Out of 430, only 27 factories are producing man-made fiber (MMF) but these are for particular polyester yarn.

- Import of manmade fibers grew by 45.72% reached to 99,597 tons in the first five months (January to May) of this year. Of them, around 61,693 tons were polyester staple fiber, 32,454 tones viscose staple fiber, and around 5,450 tons of Tencel and flax fiber compared to 68,348 tons during the corresponding period in 2020, according to BTMA source.

The below are the factories that invested/investing in synthetic yarn projects:

o DBL GROUP.

o SQUARE TEXTILES.

o ENVOY GROUP.

o METRO SPINNING MILLS.

o MAKSONS SPINNING MILLS.

o MOZAFFAR HOSSAIN

SPINNING MILLS.

- The only 20% demand of our country is meeting by 27 industry those are producing man-made fibers.

- The Korean company has invested $65 million in 3 factories and they declared to set up another 2 factories in Korean EPZ by investing $120 million.

Some recommendations for implementation of product diversification:

- Policy support from the government is required.

- Reduction of VAT on man-made fiber (MMF). VAT on MMF 6 taka but the same on cotton yarn is 3 taka.

- Govt may take initiative to set up an Industrial park for man-made fiber (MMF) spinning industry.

- Foreign direct investment can be encouraged for the setup of man-made fiber (MMF) spinning industry.

- A foreign joint venture man-made fiber spinning project can be set up.

- Hiring technical expertise to set up industry locally.

Conclusion

For the survival of the fittest, we need to understand the global business situation. We did not achieve the 50 billion RMG export target in this current year 2021. We can’t be hopeless. We can do better in the coming year of 2022. To make the dream into reality, we need to make short-term and long-term strategic planning.

Besides these, competitors’ threats should be analyzed on regular basis. However, we need a better Bangladesh, a better world.