Japan, Australia, Russia, India, China, South Korea, UAE, Malaysia, Brazil, Mexico, and other countries are part of those markets

Newer markets, that are outside the US and major European countries, played a key role in the robust growth of Bangladesh’s apparel exports in the fiscal year 2021-22.

In the context of Bangladesh’s key export destinations, the United States, Canada, the United Kingdom, and the European Union (EU) countries are generally known as the traditional markets.

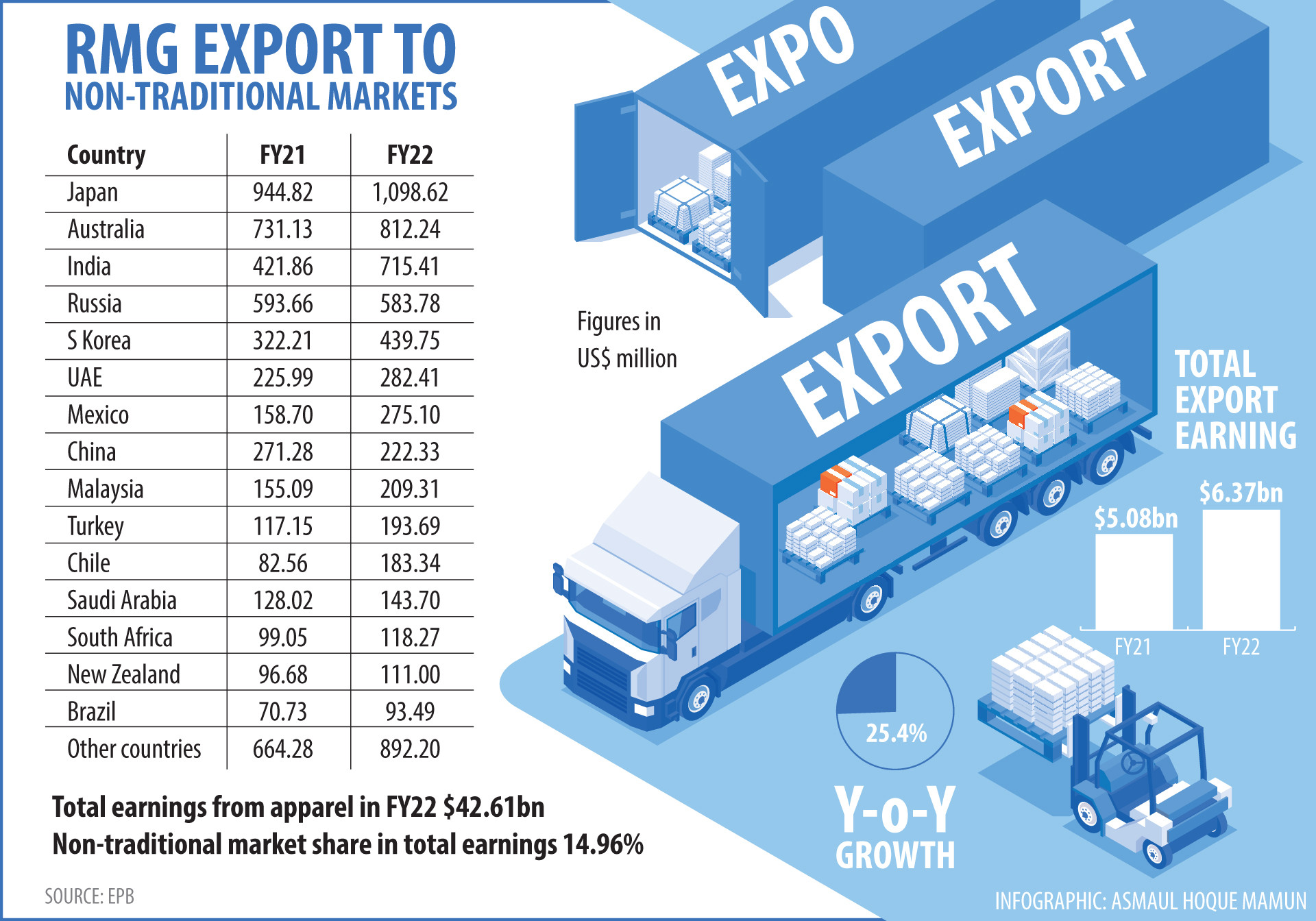

According to the latest figures of the Export Promotion Bureau (EPB), Bangladesh exported apparel items worth $6.37 billion to the non-traditional markets in FY22, a year-on-year growth of 25.4% from FY21.

Among the apparel items, Bangladesh exported woven items worth $2.85 billion and knitwear items worth $4.78 billion, EPB data stated.

The data also said that the country exported 14.96% of its total apparel item export to more than 15 destinations labeled as non-traditional markets.

In FY21, Bangladesh exported apparel items worth $5.08 billion to those destinations.

The rest of the markets are considered non-traditional markets where Japan, Australia, Russia, India, China, South Korea, UAE, Malaysia, Brazil, Mexico and many other countries are major destinations.

According to the EPB data, among non-traditional markets, Japan had pole position where Bangladesh exported apparel items worth $1.09 billion, a growth of 16.28% from $944 million in FY21.

Bangladesh also earned $812.24 million from Australia, $715.41 million from India, $583.78 million from Russia, $439.75 million from South Korea, $282.41 million from UAE, $275.10 million from Mexico, and $222.33 million from China by exporting apparel goods in FY22, said the EPB data.

The local apparel sector enjoys a 4% cash incentive from export to the non-traditional market.

How the growth occurred

Industry insiders said that Bangladesh was still on the right track in exporting apparel items to numerous global destinations amid global crises induced by war, inflation and disruptions in the supply chain.

They also said that entrepreneurs took initiatives to explore new markets which led to this sharp and continued rise in export earnings from the new destinations.

Talking to Dhaka Tribune, Faruque Hassan, president of the Bangladesh Garment Manufacturers and Exporters Association (BGMEA), said: “Our plan is to make the Asian market like that of the EU. Already our exports to Japan, India and Korea have gradually increased.”

He also said that although Russia was an emerging market, they missed to increase exports there due to the war.

The Middle-Eastern market is also their priority market now, he added.

RMG insiders also said that Bangladesh’s export earnings from new markets were increasing rapidly due to market diversification initiatives from the government and apparel manufacturers.

They also said that the BGMEA, in collaboration with the government, created opportunities for the manufacturers to participate in the global expos to connect new buyers, which contributed a lot to enhanced exports to new markets.

Moreover, safety improvement in the apparel sector expedited the export growth as it boosted investors’ confidence, leading to more work orders, said the sector people.

Prof Mustafizur Rahman, distinguished fellow of the Centre for Policy Dialogue (CPD), said that Bangladesh should focus on market diversification to maintain this trend of export, particularly the East Asian and Indian markets.

He also said that the authority should emphasize productivity, skill-driven competitiveness, signing preferential trade agreements, and export basket diversification.

According to the EPB data, Bangladesh bagged $52.08 billion through exports in FY22, registering a 34.38% year-on-year growth from $38.75 billion from export earnings in FY21 where the country’s export earnings crossed the milestone of $50 billion for the first time in history.

Among the export earnings, apparel sector, the highest earners of the export receipts, earned $42.6 billion in the FY22, fetching a Y-o-Y growth of 35.47%, which was $31.45 billion in the last fiscal.

Among apparel products, knitwear registered a growth of 36.88% to $23.2 billion, while woven garments saw a growth of 33.82% to $19.4 billion, the EPB data also stated.