Investment in new technologies will diversify the sector’s export basket and speed up the factories’ overall production process

Bangladeshi apparel and textile makers are set to invest about $3.5 billion in new technologies within the next year to make the sector’s $100 billion export target a reality by 2030.

The new technologies – including state of the art machinery to produce manmade fibre and robotic technology – will diversify the sector’s export basket and speed up the factories’ overall production process.

The fresh investments are expected to generate employment for about 2.2 lakh people in about 230 apparel and textile units.

Of the new factories, 137 were registered with the Bangladesh Garment Manufacturers and Exporters Association (BGMEA), 60 with the Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA), and 27 with the Bangladesh Textile Mills Association (BTMA) in 2022, said sources.

There is no exact data on how much new investment the sector has received. The cost of setting up a readymade garment factory can often reach up to Tk100 crore, but the minimum setup cost for a 10-line factory in a rented building amounts to at least Tk5 crore, according to industry insiders.

If this calculation is taken into account, 197 new members of the BGMEA and the BKMEA invested approximately Tk6,000 crore or $600 million in constructing knit, woven and denim factories, according to senior officials of these organisations.

Moreover, around $3 billion investment comes in the form of the establishment of 15 new textile units and expansion of 12 others, mostly dedicated to producing man-made fibre.

BTMA President Mohammad Ali Khokon told TBS that the new textile manufacturers have already opened letters of credit to import capital machinery and are scheduled to launch operations by 2023.

BKMEA Executive President Mohammad Hatem told The Business Standard, “Each new garment factory will create around 300-1,000 employment opportunities.”

Among the new members of the BGMEA, five are foreign companies while three are joint ventures, said the organisation’s Vice President Shahiduallh Azim.

The BGMEA is focusing on non-traditional markets besides the European Union and the USA, he added.

Big names – such as Team Group, Urmi Group, Chattogram-based Pacific Jeans, and RDM Group – are setting up new facilities to boost their production capacity and have a bigger stake in the global RMG export market.

Kutubuddin Ahmed, chairman of Envoy Textiles Limited, told TBS that the company’s parent organisation Sheltech Group has started setting up denim garments and knit composite factories, which will start production by the end of 2023.

“Our eco-friendly denim factory will produce high quality apparel items. The knit composite factory will be set up in a joint venture with a renowned foreign apparel maker to produce high-value garment products. Both of these units will be equipped with the latest technologies for supplying products to high-end buyers,” said Kutubuddin Ahmed.

Urmi Group, another leading garment manufacturer, has invested Tk120 crore in setting up a new garment factory.

Urmi Group Managing Director Asif Ashraf said, “The new factory will have 40 production lines and create about 3,000 job opportunities.”

Eyes on increased market share

Dr Mohammad Abdur Razzaque, chairman of Research and Policy Integration for Development (RAPID) Bangladesh, said Bangladesh’s role as a global leader in apparel export will get further consolidated in the coming years.

In cotton apparel, Bangladesh with a global market share of 16% is likely to soon surpass China, which has a market share of 17%. However, Bangladesh’s share in man-made fibre-based apparel is less than 5%.

“A 20% share in cotton apparel and 12% share in man-made apparel will enable Bangladesh to earn $100 billion exports from the apparel sector,” said Dr Razzaque, who is also research director at the Policy Research Institute of Bangladesh (PRI).

China’s global market share is set to fall further. Therefore, tremendous opportunities exist for Bangladesh to expand exports fast, he added.

Sparrow Group Managing Director Shovon Islam said, “We are looking to increase our global market share through producing high value products, including manmade fibre.”

Investment in new tech to boost production

Garment, textile and related accessories manufacturers said most of the large and medium-sized factories in this sector have been replacing manual machines with automatic ones.

The Narayanganj-based Fatullah Apparels Limited has recently replaced manual thread cutters with automated trimmers, which ensure the optimum quality of the products.

The factory has also automated the system, which monitors and reports workers’ productivity to benefit efficient workers.

“Our LEED certified green factory has invested in new technologies to reduce production time and physical labour,” Fatullah Apparels CEO Fazlee Shamim Ehsan told TBS.

Urmi Group has introduced robotic goods transportations, auto pressing and automated finishing machines inside their premises.

Ananta Apparels and Fakir Group have introduced a hangar system to speed up their assembly line, said Fazlee Shamim Ehsan, who is also vice president of BKMEA.

Besides, over the past decade, apparel entrepreneurs have been keen to set up their own design centres, which will enable them to fetch 5-20% or more in earnings for their products.

Garment industry owners’ organisations do not have information on how many factories in the country have world-class design studios. Industry insiders said currently, over 100 local apparel exporters have their own design and innovation centres, 25 of which are world-class.

The use of advanced machinery and robotic technology has also been gaining importance in recent years. At least 30 garment factories have already started using such technology, said BGMEA Vice President Shahidullah Azim.

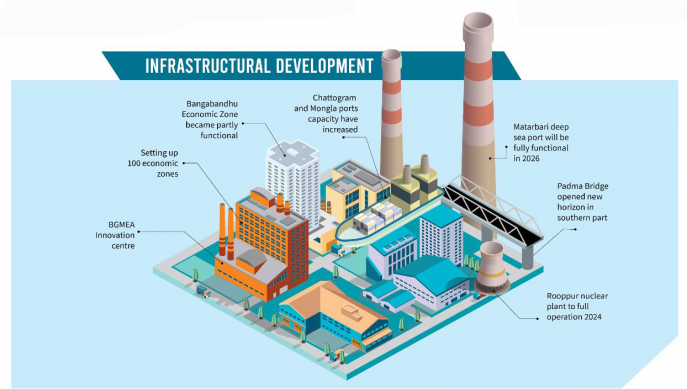

BGMEA President Faruque Hassan said they have invested in the Centre of Innovation, efficiency and OSH, to develop a futuristic apparel industry. The centre – scheduled to launch during the Made in Bangladesh Week – will include facilities like innovation lab, distance learning system, display, library, museum and day care centre.

The centre will also offer lessons on upgradation of technology, fourth industrial revolution, improved industrial relations and workers’ empowerment, basics of business and digital marketing.

Dr Mohammad Abdur Razzaque, research director at the Policy Research Institute of Bangladesh, said environmental, social and governance investment is necessary to increase workers’ productivity and to face challenges following the country’s graduation from least developed country status to middle-income nation.