Bangladesh is poised to become the source of most of the European Union’s (EU) apparel as China, the largest apparel supplier worldwide, is witnessing a decrease in its share of trade with the bloc.

The penetration of Bangladeshi garment items has been growing with rising demand for basic and value-added garments.

China continues to hold the title of being the largest apparel supplier to the EU.

It accounts for a 29.39 per cent share of the total import of apparel by the bloc’s 27 countries, according to Eurostat, the EU’s statistical office.

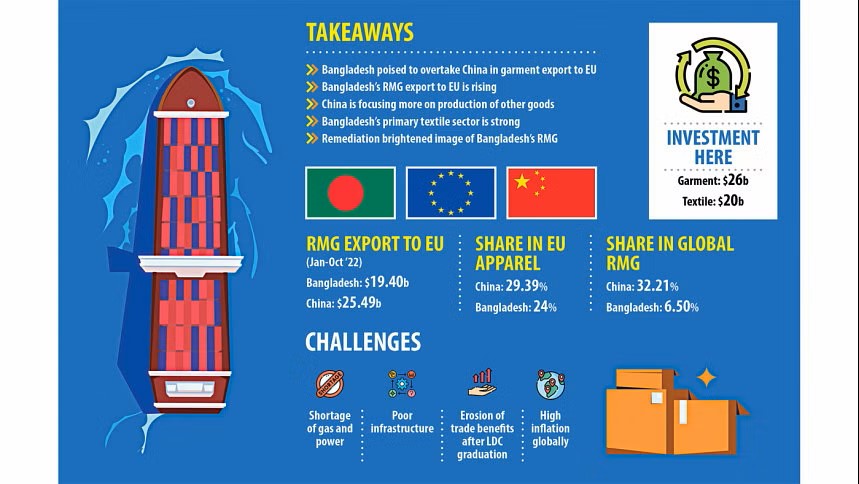

In the first 10 months of 2022, the EU’s imports from China reached $25.49 billion with a 22.43 per cent year-on-year growth.

Apparel shipments to the EU from Bangladesh grew by 41.76 per cent in the January-October period of last year to $19.40 billion, helping to retain its position as the second largest garment exporter to the world’s largest trade bloc after China.

Apparel shipments to the EU from Bangladesh grew by 41.76 per cent in the January-October period of last year to $19.40 billion, helping to retain its position as the second largest garment exporter to the world’s largest trade bloc after China.

During the period, the EU imported $86.74 billion worth of apparel from the world, which was a year-on-year growth of 24.41 per cent.

China has been losing its global apparel market share over the last couple of years mainly because of a shortage of skilled workforce, withdrawal of foreign investments and an increase in production costs.

The Chinese industrial production base is shifting from manufacturing to heavy and sophisticated technological gadgets involving mobiles and home appliances.

This is resulting in work orders being shifted from China to other Asian countries like Bangladesh, Vietnam, Thailand, Cambodia, India and Pakistan.

With workers quitting garment factories for higher salaries in the production of sophisticated items, Chinese garment manufacturers are experiencing a shortage in their skilled workforce.

Moreover, garment manufacturers are unable to pay higher salaries as international clothing retailers and brands are unwilling to pay more for garment items.

For instance, even in 2015, the global market share of China in apparel trade stood at 39.3 per cent and now it has reduced to 32.21 per cent, according to World Trade Organization (WTO).

In 2015, Bangladesh’s share in the global apparel market was 5.9 per cent and based on the country’s garment export data of 2021, the percentage has gone up to 6.5 per cent.

Region-wise analysis also shows a decline in garment shipments from China.

For instance, in 2015, the market share of China in the EU apparel segment was 37 per cent and in 2022, the percentage declined to 28.4 per cent, according to a study by Sheng Lu, an associate professor of apparel and textiles at the University of Delaware.

Meanwhile, Bangladesh’s market share in the EU increased to 24 per cent in 2022 from 18.5 per cent in 2017, according to the Bangladesh Garment Manufacturers and Exporters Association (BGMEA).

As per local exporters, another reason for work orders being diverted from China to Bangladesh is the recent tariff war between the US and China as international retailers and brands want a sustainable sourcing destination.

Moreover, the remediation of garment factories with recommendations of the Accord and Alliance, two international inspection agencies, also fortified workplace safety measures in Bangladesh.

This ultimately brightened the image of the country and the sector itself for which international retailers and brands are coming up with increasing volumes of work orders.

Bangladesh is also shifting to its production base to high-end value-added garment items from basic items.

The local manufacturers are grabbing a bigger market share of garment items mnade from man-made fibres to obtain better prices and more work orders from international retailers and brands.

Over the last four and a half decades, the capacity of Bangladesh’s garment industry has also grown a lot, enabling it to cater to any quantity of work orders.

Starting off with a few million US dollars in 1976, the country’s garment industry has so far invested more than $26 billion.

Not only this, the country’s primary textile sector, which includes spinning, dyeing, finishing, knitting, weaving and sizing, has witnessed investments worth over $20 billion.

The primary textile sector is acting as the garment industry’s main supplier of raw materials locally.

Moreover, work orders have also been recently shifting from other countries like India, Pakistan, South Korea, Vietnam, Sri Lanka, Myanmar, Ethiopia and Cambodia as they are incapable of catering to order for large volumes at competitive prices.

Bangladesh is already overtaking China in terms of exporting denim to the EU, said Faruque Hassan, president of the BGMEA.

“I am hopeful that we will overtake China in other product categories as well in the near future,” he told The Daily Star over the phone.

Bangladesh has a lot of prospects but local exporters have to face challenges of energy, United Nations country status graduation, higher cost of funding and poor infrastructures such as that of ports, roads and highways, he added.

Ahsan H Mansur, executive director of the Policy Research Institute, said it may be possible to overtake China with regard to exports to the EU in the near future for two reasons.

Primarily it will be for the shortage of skilled labour and secondly for Bangladesh producing high-end value-added garment items, Mansur said.