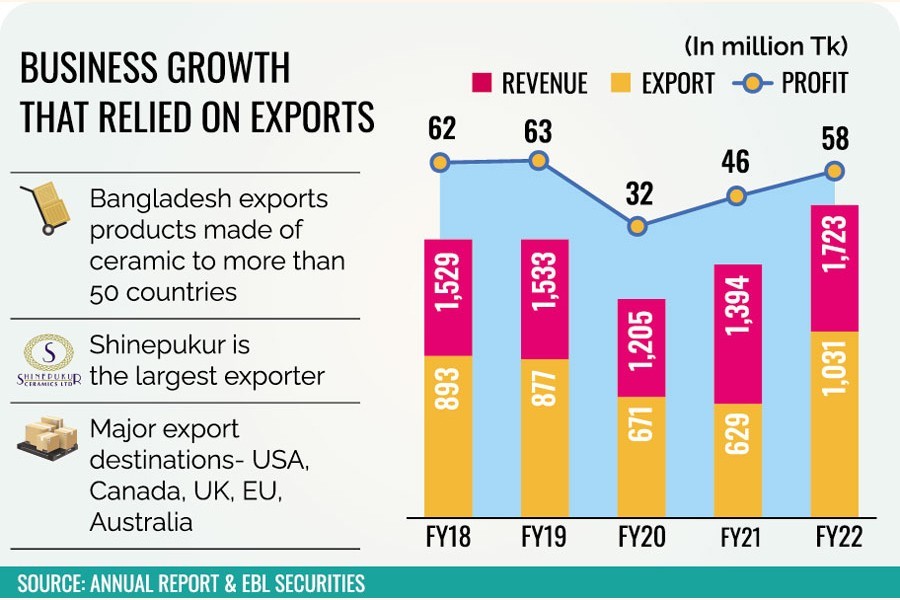

Shinepukur Ceramics has sustained its profit growth, focusing on exports at a time when the domestic demand slumped.

Its export jumped 64 percent in the FY22, making the tableware maker the largest exporter in the sector when the company’s domestic sales dropped 10.50 per cent to Tk 692 million.

So, it is overseas sales that helped Shinepukur’s revenue grow at 24 per cent and profit at 26 per cent year-on-year in the FY22. The year proved tougher for other ceramic manufacturers who struggled to make profit amid stubborn economic adversities.

The first quarter of the FY23 was also remarkable for Shinepukur. It reported a stunning 400 per cent spike in profit to Tk 14.78 million during the period through September last year, compared to the same quarter a year ago.

The achievement was possible because the company improved its product quality through cross-quality checks at every production stage and developed designs and packaging in line with international standards, said company Secretary Mohammad Asad Ullah.

“The most challenging part was to gain buyers’ confidence and to establish Shinepukur as the most compliant supplier,” he added.

The company’s export income is the highest among its peers.

Cash incentives, income tax exemptions, and import tariff waivers against the export volume helped the company cut down its overall expenses.

As a result, its profitability rose. About 23 per cent of the company’s overall gross profit came from cash subsidies against exports in the FY22.

Shinepukur Ceramics, a concern of Beximco Group, manufactures high-quality porcelain and bone china tableware for local and global markets.

Occupying an 18 per cent market share, it dominates the tableware segment in the domestic market.

But sales in the domestic market plummeted as new manufacturers stepped into the business raising competitiveness, said the company secretary. Moreover, local sales of products of porcelain declined.

That drove Shinepukur’s focus towards exports.

Though the demand for such products was lower in advanced nations against the backdrop of economic slowdowns, the company’s export exceeded the pre-pandemic level.

It has faced fierce competition in the global markets as well.

Overcoming the challenges, ASF Rahman, chairman of Shinepukur Ceramics, in the latest annual report, said, “We could retain our existing customers and also added a few new customers.”

Future prospects

The ceramic sector is a booming manufacturing industry in Bangladesh, which started its journey in 1958 with the establishment of a small manufacturing plant for porcelain tableware, built by Tajma Ceramic Industries in Bagura.

Industry insiders say the export of ceramic products is expected to increase significantly in the years to come as Bangladesh enjoys duty and quota-free access to developed nations.

Bangladeshi ceramic products are exported to more than 50 countries including the UK, the USA, Italy, Spain, Norway, France, the Netherlands, and Australia.

Ceramic exports stood at $41.31 million in the FY22.

“Top brands from different parts of the world are importing ceramic products from Bangladesh,” said EBL Securities in a report.

The local demand has also seen a boost over the years.

“Rapid urbanization, booming real estate and a rise in people’s disposable income are the key drivers of the local ceramic industry,” said EBL Securities.

According to the Bangladesh Ceramic Manufacturers & Exporters Association (BCMEA), the local demand for ceramic products shot up 22 per cent in the last five years.

The business potential has lured many new investors in the sector.

New companies, including manufacturing giants Meghna Group and PRAN-RFL Group, are going to invest around $1 billion in the ceramic industry considering local business prospects, EBL Securities said.

Foreign investments, mainly from China and the Middle East, have also been directed to Bangladesh through several joint venture partnerships including Fu-Wang Ceramics, BHL Ceramic, Star Porcelain, South East Union Ceramic and Sun Power Ceramics.

Bangladesh has emerged as a lucrative destination for investors because of the availability of skilled manpower and relatively low labour cost.

The latest increase in energy prices will, however, have a significant impact on ceramic manufacturers like other sectors as the production cost will go up forcing them to hike prices. That may reduce their price competitiveness, said EBL Securities.