The growth of garment shipment to the US and the European Union declined in July-December as consumers in the two largest export destinations of Bangladesh have remained concerned about the persisting economic uncertainty for the raging Russia-Ukraine war.

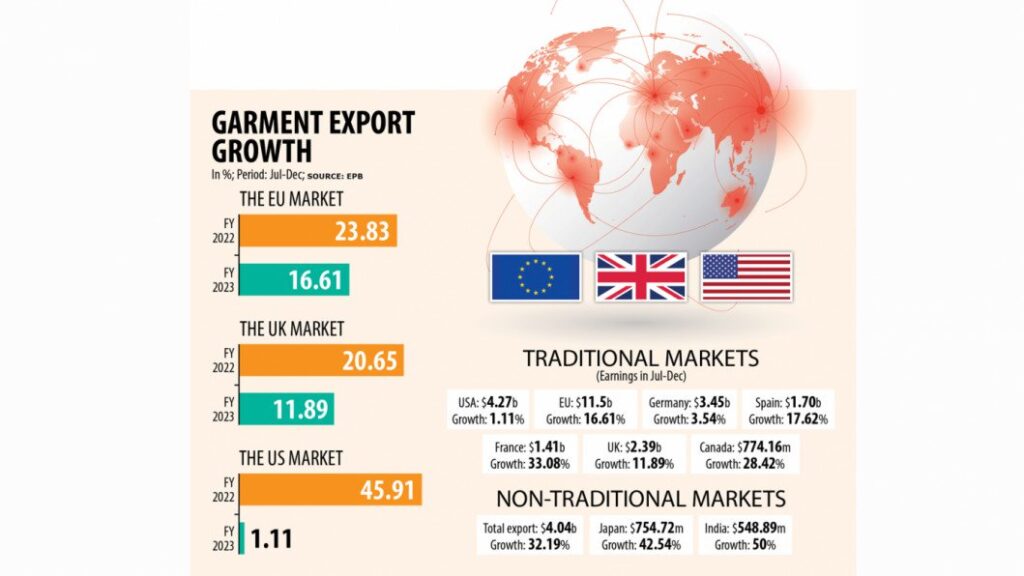

The earnings from the garment export to the US, Bangladesh’s single largest market, was $4.27 billion in the first six months of the current financial year, registering a growth of 1.11 per cent year-on-year, according to data from the Export Promotion Bureau (EPB).

The receipts were $4.23 billion but the growth was 45.91 per cent during the same half a year earlier.

In July-December, the earnings from the EU market were $11.50 billion, clocking a 16.61 per cent growth. The receipts don’t include the $2.39 billion Bangladesh received from the UK as the later left the bloc.

The takings stood at $12 billion during the identical half a year ago and the shipment growth was 23.83 per cent. The receipts, however, included the $2.14 billion that came from the UK.

This means the export earnings from the apparel shipment rose slightly despite the higher inflation stemming from the severe fallout of the ongoing war. But the growth slowed from a year ago.

Bangladesh witnessed significant growth in exports after the global supply chain began rebounding in the middle of 2021, overcoming the massive fallout from the pandemic, on the back of the government’s bold decision of reopening the economy despite the threat of the deadly virus.

But the same pace could not be maintained in 2022 after the war hit the global supply chain hard in February last year.

“The garment export may not continue the commendable growth in the next three months as international retailers and brands have placed fewer orders for the higher inflation in the western economies,” said Faruque Hassan, president of the Bangladesh Garment Manufacturers and Exporters Association (BGMEA).

The EU and the US make up more than 80 per cent of Bangladesh’s apparel shipment.

Euro area annual inflation was expected to be 9.2 per cent in December 2022, down from 10.1 per cent in November, according to an initial estimate from Eurostat, the statistical office of the EU.

In Europe, most people are concerned about rising prices, followed by the invasion of Ukraine, extreme weather events, unemployment, and political uncertainty as important concerns.

Consumer pessimism has inched higher, with 43 per cent expressing doubt about economic recovery—up from 36 per cent in June, according to a report of McKinsey & Company.

In the US, the consumer price index, however, declined for a sixth consecutive month, registering an annual increase of 6.5 per cent.

Still, US consumer confidence fell in November as inflation and economic uncertainty continued to loom large and potentially dampen holiday shopping plans, reported CNN earlier.

Among European destinations, the shipment to Germany rose 3.54 per cent year-on-year to $3.45 billion in July-December. Germany is Bangladesh’s single largest garment export destination in the bloc.

The sales to Spain and France grew 17.62 per cent and 33.08 per cent to $1.7 billion and $1.41 billion, respectively. The export to Poland declined by 18.43 per cent.

The UK imported $2.39 billion worth of garment items from Bangladesh. Canada bought $774.16 million worth of apparel items. The growth in the two countries stood at 11.89 per cent and 28.42 per cent, respectively.

Although the export growth of garment items to the major traditional markets, namely the US, the EU and Canada, has been falling, the trend is the opposite to the emerging destinations.

The export to non-traditional markets surged 32.19 per cent to $4.04 billion between July and December. It was $3.05 billion in the corresponding period of 2021-22.

In Asia, the export to Japan reached $754.72 million, clocking a growth of 42.54 per cent, while it rose 50 per cent to $548.89 million to India, EPB data showed.

“Amid the current global slowdown, Asian markets might appear as a saviour,” Hassan added.

“The garment export to South Korea, Japan and India has kept growing and the momentum will continue in the near future.”

Hassan, however, warned that the price of garment items per unit might not increase like last year.

Buyers raised the unit price of apparel items in 2022 following the price hike of raw materials like cotton and chemical and freight charges.

“The prices of raw materials are stabilising and the freight charge is also declining so buyers may not hike the prices of per unit garment items,” said the BGMEA chief.

He could not predict how the current financial year would turn out for the apparel sector finally as everything would depend on the direction of the war.

The apparel sector accounts for about 85 per cent of the national exports.