Bangladesh’s apparel exports to non-traditional markets grew by 32.74% year-on-year to about $7.70 billion in the first 11 months of the current fiscal year, according to data from the Export Promotion Bureau (EPB).

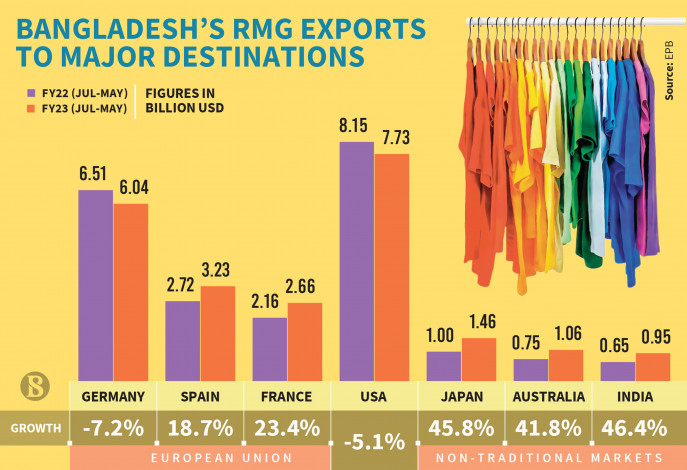

While apparel shipments to two major markets – the US and Germany – experienced a decline of 5.07% and 7.22%, respectively.

Exporters and economists have noted that Bangladesh’s apparel sector is performing well in non-traditional markets following the Covid recovery.  Infographic: TBS

Infographic: TBS

This is attributed to the relatively stronger economic performances of these markets compared to their Western counterparts, which are facing challenges due to the ongoing Russia-Ukraine war, they added.

The EPB data showed that apparel exports to Japan, Australia, India, Korea, and China have recorded 46% to 26% growth in the July-May period of the fiscal 2022-23.

Japan imported about $1.5 billion worth of apparel from Bangladesh, while shipments to Australia surpassed $1 billion, registering growth of 45.80% and 41.82%, respectively.

The export to the Indian market is also close to the $1 billion mark with 46.44% growth, compared to only $647.27 million in the same period of the previous fiscal year.

According to the EPB data, apparel exports to Korea and China also saw 28.85% and 26.25% growth to $501.01 million and $252.01 million, respectively, in July to May of FY23.

Mohammad Abdur Razzaque, chairman of the Research and Policy Integration for Development (RAPID), said the new markets are growing larger, which is a good indication for the apparel industry.

The growth in apparel exports to India, Japan, and Korea has contributed to an increase in market share, he told The Business Standard, saying that these economies are doing better despite the global economic slowdown.

The RAPID chairman said that high inflation in the US and an economic recession in Germany have had an impact on Bangladesh’s apparel exports to those markets.

He also feared that after Bangladesh’s LDC graduation in 2026, apparel exports may not get duty-free access to India and Japan.

Echoing Razzaque, Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA) Vice President Fazlee Shamim Ehsan said, “We may lose duty-free access to some markets after graduation, and the Canada market may not grow further as Vietnam has already signed an FTA with Canada.”

“After Covid, we got an opportunity to explore new markets, and, due to geopolitical reasons, buyers are moving from China, which helps us grow in new markets,” he added.

Ehsan also said that the share of non-traditional markets is over 18%, which is a positive sign for the industry. “If we can increase this share to 30%-35%, it will represent a well-balanced diversification of markets,” he added.

Shahidullah Azim, vice president at the Bangladesh Garment Manufacturers and Exporters Association (BGMEA), said apparel exports from Bangladesh may not continue to grow in the coming months as most factories are facing order shortages.

Most factories are currently operating at around 30% lower capacity, he said, highlighting that despite increases in utility prices, the shortage of gas and electricity supplies has also resulted in higher apparel production costs.

On the other hand, some buyers are also cancelling or imposing up to a 25% discount, which is making the situation tougher for apparel exporters, he added.

Bangladesh’s apparel exports amounted to $42.63 billion in the first 11 months of the fiscal 2022-23.