The fabric enterprise in Bangladesh has been under pressure in the back of its financial growth, and inside this area, domestic textiles have emerged as a promising niche. With its professional workforce, aggressive pricing, and robust production base, Bangladesh can come to be a first-rate international participant in the domestic fabric market.

Bangladesh started its journey as a home textile manufacturer in the 1980s and managed to get $150 million in its early journey (FY 2004-05) as an exporter. In recent years the market has reached a new peak with $1 billion and has emerged as a new pathway to achieve $100 billion export target set by the government.

Figure 1: Home textiles encompass an extensive variety of products, inclusive of bedding, towels, curtains, rugs, and fabric fabrics, which might be critical in the worldwide indoor decor market.

Home textile’s market share

In recent years, Bangladesh’s domestic fabric enterprise has skilled speedy growth, pushed with the aid of growing worldwide calls for first-rate and less costly fabric products. Home textiles encompass an extensive variety of products, inclusive of bedding, towels, curtains, rugs, and fabric fabrics, which might be critical in the worldwide indoor decor market.

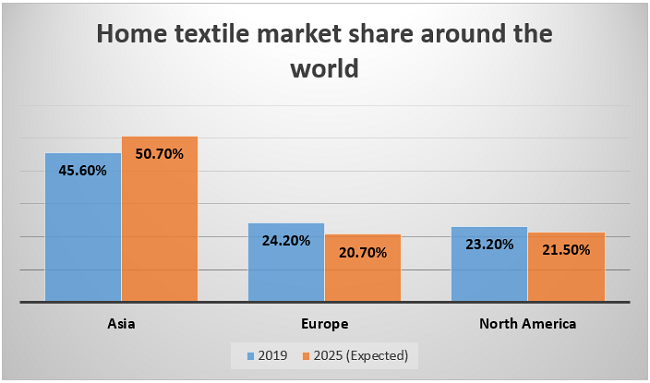

The market shares are changing and the prediction says the market will be of $133.6 billion approximately. The region that would hold the most share is Asia. Here is a chart of the global share of the home textile market in 2019 and 2025 (Expected).

At present time, in the market of home textiles, Bangladesh has competitors like China, Pakistan, and India. After the Corona pandemic struck, the RMG sector was looking for a value-added product to boost export and raise income. Home textiles sure gave way to that thought. It also was expanded because China and India lost market demand in the home textile sector.

Figure 2: Market share of home textile worldwide.

Home textile as a new pathway

Bangladesh has been struggling with the export rate in this sector because it is assumed that the 40-60% market price was uncontrollable because of the raw material import. As Bangladesh has to import 98 percent raw cotton to fulfill its demand.

In recent year’s Corona Pandemic, the unstable situation in the Russia – Ukraine war have impacted the whole export sector. The inadequacy of gas and electricity is also creating some unavoidable harm to the whole textile and apparel sector.

There is some aspect why the home textile could be a way to fulfill $100 billion export. Firstly, Bangladesh has been producing man-made textile fibers which is a good raw material for home textiles that includes bed linen, towel linen, and others. This can overcome the inadequacy of raw materials both in terms of cost and quality.

Secondly, home cloth has huge potential in Bangladesh. However, if cumulative artwork is accomplished in this area and research fields are created, there is no question that this sector will bring manifold growth. Textile factories are working to offer the right high-exceptional products through sustainable practices, which might be desired through a manner of approach to overseas buyers.

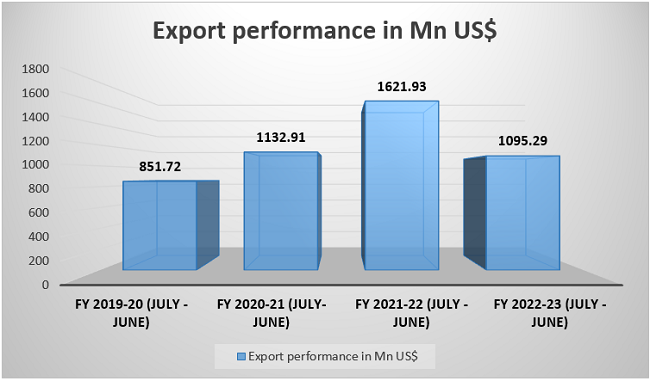

Bangladesh’s home textile market is expected to CAGR of 7% from 2023 to 2028. At present this sector is expanding with the raising consumer and rising real estate business. The export is also growing but the statistics show that the home textile export isn’t being able to meet the expected target rather its export is lagging. We have seen from the report of Fiscal Year 2022-23 (July – June) that the percentage fall and the difference is 32.47%. The targeted export was 1980 million USD whereas the actual export performance was 1095.29 million USD.

Figure 3: Export performance of Bangladesh.

If we see the export reports, we would see the sudden fall very clearly. The report is shown below.

The sudden fall has indicated ongoing problems regarding the inefficiency of raw materials in the production process. The inadequacy of electricity and gas also impacted the market. The local business holders and the government have taken steps to pull this sector up and let it be our country’s second-largest export income earner.

The Bangladesh authorities acknowledge the ability of the house fabric zone and have applied numerous projects to help its increase. These consist of coverage reforms, infrastructure development, and economic incentives for fabric producers and exporters. The authorities’ dedication to enhancing the benefit of doing enterprise and fostering good funding weather similarly strengthens the zone’s increased prospects.

Challenges and way forward

Despite its mammoth potential, home textiles in Bangladesh facing several challenges that should be addressed for sustained growth:

- Infrastructure development: Continued funding in infrastructure, inclusive of dependable electricity supply, green transportation networks, and stepped-forward logistics, is critical to fulfill developing export needs and compete efficiently on the worldwide

- Technology and innovation: Encouraging the adoption of superior technologies, including automation, virtual printing, and layout software, will beautify productivity, product quality, and layout capabilities, allowing Bangladesh to provide a much wider variety of modern domestic fabric products.

- Market Diversification: While Bangladesh already has a significant presence in traditional export markets, diversifying into emerging markets, such as South America, Africa, and the Middle East, can provide new growth opportunities and reduce dependency on a few key markets.

The home textile area holds remarkable capability for Bangladesh’s export increase and monetary development. With its value competitiveness, professional workforce, and favorable authorities support, Bangladesh is well-located to grow its marketplace percentage in the worldwide home textile industry. By addressing challenges, embracing innovation, and pursuing marketplace diversification, Bangladesh can paintings toward accomplishing its formidable aim of reaching USD hundred billion in domestic fabric exports.