For Bangladesh’s export earnings, the apparel sector matters a lot as it contributed 84.58 percent or $46.999 billion to the national exports of $55.56 billion in FY-23. Similarly, knitwear products dominate RMG export earnings with 55 percent share in the clothing items export. As per the Export Promotion Bureau (EPB) data, in the fiscal year 2022-23 Bangladesh’s apparel sector earned $46.99 billion posting a 10.27 percent growth compared to $42.61 billion in the previous year.

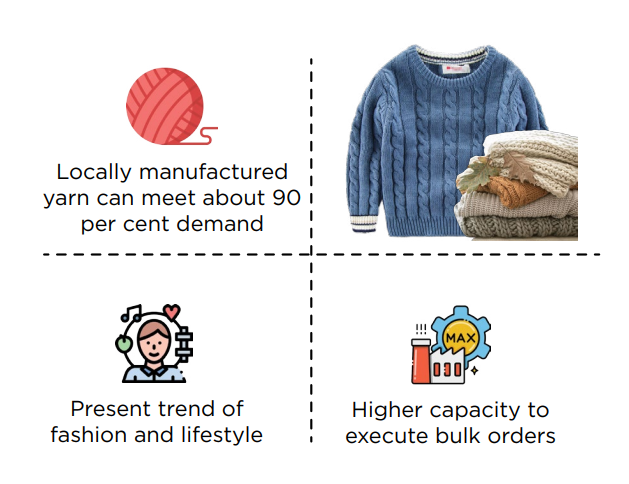

Of the total apparel export earnings, $25.73 billion or 54.77 percent came from knitwear products. Knitwear products export posted a 10.87 percent growth in FY23. Meanwhile, woven products recorded 9.56 percent growth to $21.25 billion. It is mention worthy here that changes in fashion and style and a strong backward linkage are highly credited for the dominance of knitwear products. “If look at the present trend of fashion and lifestyle, you will find consumers feel more comfort in casual wear. Even on different occasions, consumers also feel free to wear knitted items,” Dr Khondaker Golam Moazzem, Research Director at Centre for Policy Dialogue (CPD) said.

This has increased the demands of knitwear products and Bangladesh has taken the opportunity because of its higher capacity to execute bulk orders, said the economist. Meanwhile, a strong backward linkage is the prime reason for the outperformance of the knitwear sector.

“At a time when woven products manufacturers are highly dependent on imports for fabrics, locally manufactured yarn can meet about 90 percent demand. That is why our knitwear exporters are doing better than woven goods, said Mohammad Hatem, Executive President of the Bangladesh Knitwear Manufacturers and Exporters Association. Here, the actor is in the backward linkage industry, said the business leader. As per the data of the Bangladesh Textile Mills Association (BTMA) about 90-95% yarn demand for knit RMG and 40-45% yarn demand for woven RMG are met by the country’s Primary Textile Sector (PTS). On top of that, competitive prices and timely delivery are other factors for the success of Bangladesh knitwear sector, said Hatem.

“From the very beginning, we were highly dependent on imports as the backward industry for the apparel sector was absent. But in course of time, our textile investors have been able to establish an industry to supply raw materials from local sources,” said Mohammad Ali Khokon, President of Bangladesh Textile Mills Association (BTMA).

However, the present situation is not in favor of the industry as the electricity and gas crisis as well as increased prices is hitting the industry hard, said Khokon.

To retain the growth and dominance of the knitwear sector, the government should provide policy support to make the local supplier vibrant.

By providing yarn from local manufacturing, we are saving a huge amount of currency as well as generating employment for thousands, said the business leader.