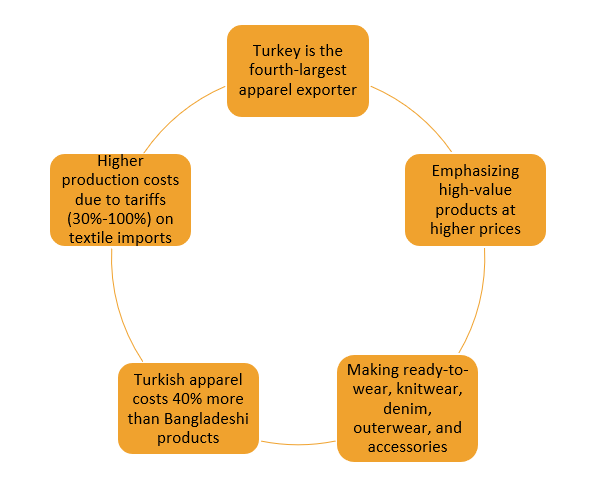

Turkish-made apparel now costs approximately 40% more than similar products from Bangladesh, a gap that was only 15-20% a few years ago. This is creating opportunities for Bangladeshi exporters to attract consumer’s attention

The global apparel market is a battleground where countries compete for market share and economic benefits. The two major players in the global apparel market are Bangladesh and Turkey. They are competing with each other. While Bangladesh, the second-largest apparel exporter, is increasing its market share by offering competitive prices without compromising on quality, Turkey, the fourth-largest apparel exporter, is primarily focused on high-value products with higher prices. Both major players in the global apparel industry are navigating a complex and competitive landscape.

Bangladesh’s garment exports reached a record $47.38 billion in 2023, marking a qualitative shift towards non-cotton products, outerwear, activewear, and suits. This diversification underscores Bangladesh’s evolving capabilities and its commitment to meeting the changing demands of global markets.

One of the key factors contributing to Bangladesh’s competitiveness is its lower production costs. The cost-effectiveness of Bangladeshi garments, combined with improving product quality, has made the country an attractive sourcing destination for major global brands such as H&M, Zara, and Primark. Additionally, the adoption of advanced technologies and innovations in manufacturing processes has further enhanced Bangladesh’s position in the global market.

Turkish apparel industry focuses on producing a wide range of clothing items, including ready-to-wear clothing, knitwear, denim, outerwear, and accessories. Turkey is also a major hub for textile production, with many apparel manufacturers sourcing their fabrics locally.

According to a recent report, Turkey’s apparel industry has been under pressure due to recent economic policies and global market shifts. The Turkish government has implemented tariffs ranging from 30% to 100% on textile imports to protect local yarn and fabric manufacturers from cheaper foreign competition. This move, however, has increased production costs for Turkish apparel manufacturers, making their products significantly more expensive. As a result, Turkish-made apparel now costs approximately 40% more than similar products from Bangladesh, a gap that was only 15-20% a few years ago.

It’s good news for Bangladeshi exporters that this gap will help them to catch more new buyers. Most of the cases, consumers want to pay competitive price for the items they buy. When they will find same quality product with two different prices, they mostly choose the more affordable option. This is because consumers often seek the best value for their money, prioritizing cost savings while still getting the quality they desire.

To counter these challenges, Turkey is focusing on its green transformation and the development of its ready-to-wear fashion brands. These strategic initiatives aim to differentiate Turkish products in the market by emphasizing sustainability and brand recognition. By investing in eco-friendly production processes and marketing its fashion brands more aggressively, Turkey hopes to appeal to the growing segment of environmentally conscious consumers and maintain its market position despite higher prices.

While Bangladesh has benefited from its cost advantage, there is a strong argument for re-evaluating its pricing strategy. Keeping prices low has undoubtedly helped Bangladesh capture a larger market share, but it may also limit the industry’s profitability and ability to invest in further improvements. Instead of competing solely on price, Bangladesh should consider increasing its prices modestly. This approach would align with the perceived value of its high-quality products and provide additional revenue to invest in technology, worker welfare, and sustainability initiatives.

Also, to sustain its growth trajectory, Bangladesh must continue to innovate and add value to its products. Embracing fashion tech trends, such as virtual sampling, data analytics, and e-textiles, can differentiate Bangladeshi products in the global market. Additionally, enhancing production capabilities through the integration of IoT and connected technologies can improve efficiency and reduce waste, further strengthening Bangladesh’s competitive position.

In fine, the competition between Bangladesh and Turkey in the apparel export market underscores the importance of strategic pricing, market diversification, and value addition. Bangladesh’s ability to offer high-quality products at competitive prices gives it a significant edge, but a strategic price increase could enhance its market positioning and sustainability. Turkey, facing higher costs, must leverage its strengths in sustainability and brand development to stay competitive. Both countries must navigate these dynamics carefully to sustain growth and employment in their respective apparel industries.