RMG export to almost all major destinations increased by 16.61% in July of FY22-23

Bangladesh has made a great start to this fiscal year in the export of ready-made garments to almost all export destinations with positive growth in July.

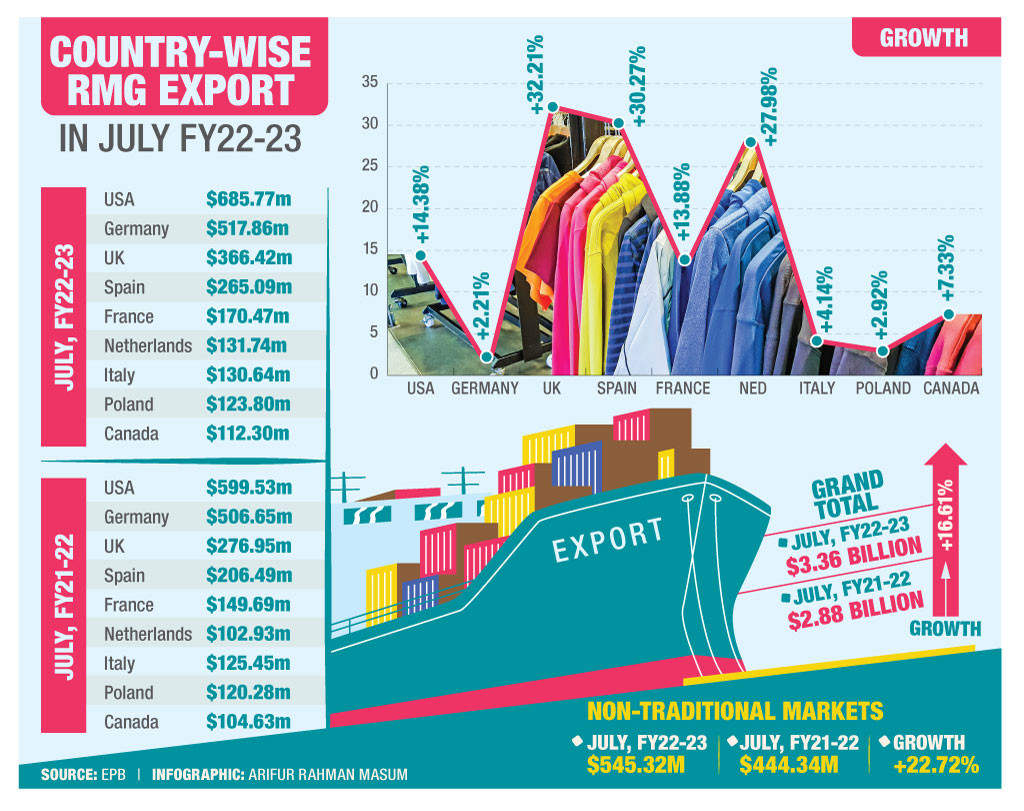

According to the recently published country-wise detailed apparel export data of the Export Promotion Bureau (EPB), in July of fiscal year 2022-23, Bangladesh exported apparel items of worth $685.77 million to the US, the largest single export destination for Bangladesh, fetching a year-on-year growth of 14.38%.

In the same month of the last FY (2021-22), Bangladesh exported apparel items of $599.53 million to the US, said EPB data.

Bangladesh exported garments worth $517 million to Germany, the second largest single export destination, registering a YoY growth of 2.21% from $506.65 million of July of FY 2021-22.

During the mentioned period, registering a 32.21% YoY growth, Bangladesh exported apparel goods worth $366.42 million to the UK, the third highest destination for the country’s RMG products, up from last year’s $276.95 million, EPB data said.

The apparel export to the other major destinations such as Spain, France, Netherland, Italy and Poland also registered positive growth by 30.27% to $265.09 million, by 13.88% to $170.47 million, by 27.98% to $131.74 million, by 4.14% to $130.64, and by 2.92% to $123.80 million respectively.

During the mentioned period, the apparel export to the overall EU market grew by 13.36% to $1.65 billion from $1.46 billion in the same period of last fiscal year.

During July of FY 2022-23, export Canada reached$ 366.42 million by fetching a YoY growth of 7.33% from $104.63 million in July of the last fiscal year, EPB data showed.

Newer markets or non-traditional markets, that are outside the US and major European countries, also played a key role in the growth for Bangladesh’s apparel exports in the first month of the current fiscal year.

In the context of Bangladesh’s key export destinations, Japan, Australia, Russia, India, China, South Korea, UAE, Malaysia, Brazil, Mexico and some other countries are known as non-traditional markets.

During the mentioned period, the apparel export to the non-traditional markets reached $545.32 million with 22.72% year-over-year growth, from $444.34 million of the last FY.

Among the major destinations of the non-traditional markets, exports to Japan reached $92.74 million, with a YoY growth of 4.26% from $88.96 million of the last fiscal year.

From India, Bangladesh earned $76.98 million in the first month of FY22-23, registering a growth of 71.74% from $44.82 million in July of the last fiscal year.

Among the major destinations of the non-traditional markets, export to Australia, South Korea, and Mexico increased by 18.53% to $65.32 million, by 22.27% to $37.96 million, and by 88.92% to $34.67 million, respectively, said the EPB data.

Talking to Dhaka Tribune, Mohiuddin Rubel, director of the Bangladesh Garment Manufacturers and Exporters Association (BGMEA), said that the RMG export to almost all major destinations increased by 16.61% in July of FY22-23.

“But these orders were placed in May when the global situation was not as volatile as it is now. This growth may just be a short-term phenomenon as per the impression from the global brands and buyers,” he added.

Revenge shopping (a type of splurge shopping that occurs after a frugal spending period), which rose up among customers, has already been declining, Rubel also said, adding that in the aftermath of the Covid-19 pandemic and geopolitical crisis, global trade and economy were going through dire conditions.

High fuel price and shortage of supply are portraying a negative impact on the global scenario and our industry has also been affected by this with a hike of 62% in yarn price, 500% in freight cost, and 60% in chemical cost, he also said.

Moreover, minimum wages increased by 7.5% at the beginning of the last year, he added, noting that average production cost has increased by 40%-45%.

“Moreover, productivity and efficiency are a major concern for us as average productivity in Bangladesh is around 45%. But in Vietnam and Turkey, it is 55% and 70% respectively,” the BGMEA official also said.

He also said that in this crisis situation, entrepreneurs are getting backup support from the governments which helps to stay afloat.

“We also want some kind of policy support from the government and we are also trying to overcome the vulnerabilities like product and market overconcentration, absence in the niche market, improvement of backward linkage industries,” he added.