Export of apparel items to key destinations such as the US, Germany, and the overall EU faced persistent challenges during the first half (July-December) of FY23-24.

These hurdles were attributed to ongoing economic headwinds in international markets and domestic issues. Additionally, exports to other major destinations also experienced either minimal or negative growth in the same period.

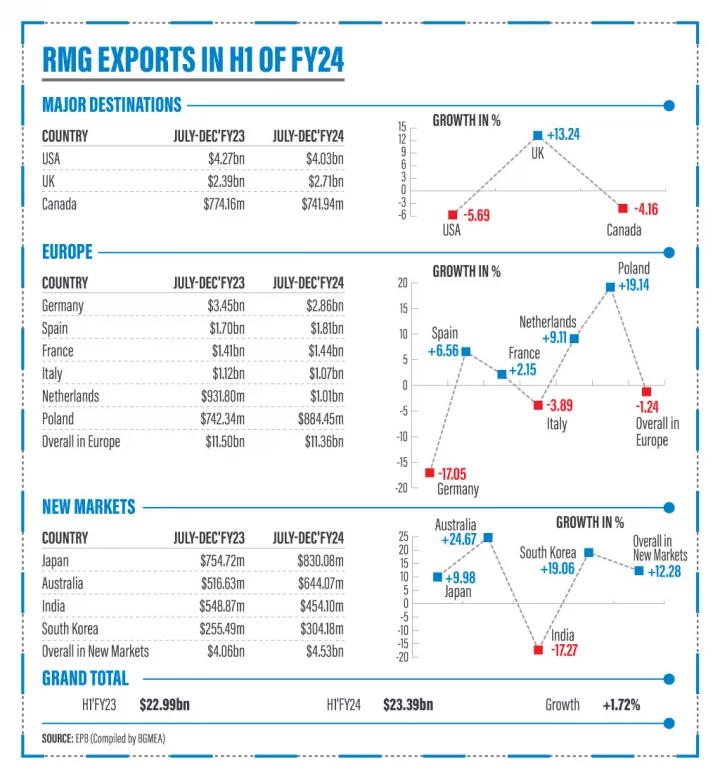

Based on the detailed apparel export data compiled by the Bangladesh Garment Manufacturers and Exporters Association (BGMEA) from the Export Promotion Bureau (EPB), Bangladesh managed to export apparel items worth $23.39 billion in July-December of FY24.

However, the growth was marginal, standing at 1.72%, with the total barely surpassing the $23 billion mark recorded in the corresponding period of FY23.

Like several past months, the RMG exports to the United States, the largest single export destination for Bangladesh, fetched a negative YoY growth of 5.69% to $4.03 billion, lower from $4.27 billion of the same period in FY23.

Moreover, exports to Germany, the second largest destination for RMG manufacturers, continued to experience a negative trend as the country was fighting against recession-like economic turbulence and inflation.

Bangladesh shipped apparel worth $2.86 billion to Germany, reflecting a decline of 17.05% from the $3.45 billion recorded in H1 of FY23.

In the H1 of FY24, with a moderate YoY growth of 13.24%, Bangladesh exported apparel goods worth $2.71 billion to the UK, the third highest destination for the country’s RMG products, up from last year’s $2.39 billion, EPB data stated.

Other destinations

Last month, exports to the overall EU markets again witnessed a fall in July-December period of FY24.

The apparel export to the overall EU market experienced a negative growth of 1.24% to $11.36 billion, down from $11.5 billion in the same period of last fiscal.

Apparel export to some major destinations such as Spain, France, Netherlands, and Poland registered moderate positive growth by 6.56% to $1.81 billion, by 2.15% to $1.44 billion, by 9.11% to $1.01 billion, and by 19.14% to $884.45 million respectively in H1 of FY24.

However, exports to Italy declined by 3.89% to $1.07 billion million in the mentioned period.

During July-December of FY2023-24, exports to Canada also fell by 4.16% to $741.94 million, EPB data stated.

In the context of Bangladesh’s key export destinations, Japan, Australia, Russia, India, China, South Korea, UAE, Malaysia, Brazil, Mexico and some other countries are known as non-traditional markets.

In H1 of FY24, the apparel export to the non-traditional markets reached $4.53 billion with 12.28% year-over-year growth, from $4.04 billion in the H1 of FY23.

Among the major destinations of the non-traditional markets, exports to Japan reached $830.08 million, with a Y-o-Y growth of 9.98% from $754.72 million in the last fiscal year.

Although India emerged as a potential non-traditional market, export earnings from India witnessed a downward trend since the first month of FY24 and still continue.

From India, Bangladesh bagged $454.10 million in the July-December period of FY24, registering a negative growth of 17.27% from $548.87 million in the last fiscal.

Among the major destinations of the non-traditional markets, exports to Australia and South Korea increased by 24.67% to $644.07 million and by 19.06% to $304.18 million respectively, said the EPB data.

What exporters say

Industry insiders said that Bangladesh performed better as nearly all competitors experienced sluggish exports due to the ongoing global economic turmoil.

Moreover, internal issues like energy and power shortages, political upheaval, and labor unrest also contributed to the export’s downfall.

However, they remain optimistic that exports will recover as buyers and brands are free to unload their Christmas stock and major destinations, particularly the US and the EU, are gradually controlling inflation.

BGMEA President Faruque Hassan said that almost all of their export destinations faced severe inflation due to the ongoing global economic crisis, and they hiked interest rates to tackle the situation.

The economies of the major destinations have improved recently, and rate reductions are probably on the horizon.

“I am optimistic that the final quarter of this fiscal year will bring in a sizable number of orders,” he added.

Mohiuddin Rubel, director of BGMEA, said that exports to non-traditional markets, especially Australia and Japan, were growing and providing support given the current situation.

Manufacturers are focusing on new markets as this destination is showing hope and backing the sector despite the global economic turmoil.

“We are producing diversified products for this market which help us to maintain consistency despite the current global situation,” he added, noting that the exports to India decreased, which is another concern for them.

However, negative growth in Germany as well as the overall Europe and the USA is a concern for them as the traditional markets are unable to make a comeback from the global economic turmoil and geopolitical concerns which impacted export, he observed.

“We have to work to increase the orders. Still, there is stagnation in the market with low demand. If the global situation changes, then the market will turn around, and we will be better than everyone because we are ahead in all aspects of safety, infrastructure and buyers have confidence in us,” Rubel added.