Investment in spinning sector slowed down

The investment in the spinning sector has slowed down because of gas shortage and for volatile dollar markets over the last two years.

Last year, no new spinning unit was established in the primary textile sector of Bangladesh although the demand for local fabrics of both knit and woven has been increasing to shorten the lead time on export of garment items.

The garment exporters started preferring the locally spun knit and woven fabrics to imported fabrics as the use of local fabrics can reduce the lead time significantly.

For instance, if the fabrics is imported from China to be used for garment making in Bangladesh it takes nearly 40 days which is too long time considering the stiff competition by the suppliers worldwide.

But if the local fabrics and materials are used it takes only a few days or one or two days for processing as the local spinners supply easily from his or her factory.

The international clothing retailers and brands do not want to spare more lead time as they also have to compete with their peers in their respective countries.

However, the investment in such a vital sector has slowed down because of gas crisis and for volatile dollar exchange over the last two years mainly stemmed from covid 19 and Russia Ukraine war fallouts.

Current status of the spinning sector

Currently there are 550 big spinning mills in the country with an investment of nearly $15billion. The total investment in the country’s primary textile sector (PTS) that includes, spinning, weaving, dyeing, washing, finishing and printing, is nearly $25 billion. Of them, only 200 are export-oriented.

The installed spinning capacity is 4,500 million kilogrammes, but they are manufacturing 2,400 million kgs of yarn currently as their full capacity can’t be utilized because of the gas and power shortage. The local spinners have been expanding their capacity to a bit for meeting the demand.

More than 60 weaving mills produce fabrics for the export-oriented garment sector. Local denim millers produce more than 700 million yards of fabrics per year, according to data from the Bangladesh Textile Mills Association (BTMA).

Setting up a new factory is time-consuming and it takes at least three years and costs Tk 700 crore to set up a medium-sized factory.

Most of the spinning mills are producing the cotton yarn and for knitwear sector where the local spinners can supply nearly 90 percent raw materials as more investment took place in the knit spinning sector.

From the very beginning the local spinners have mainly invested money in the cotton spinning sector as it was easy for them due to lack of knowhow in non-cotton yarn. As a result, of the total exported garment items from the country, some 71 percent is cotton made yarn and 29 percent is non-cotton yarn.

However, recently, the spinners have been investing money on non-cotton units aiming to grab more market of value-added garment items as the prices of non-cotton fabre made garment items are better than cotton made fibre garment.

The spinners can supply nearly 90 percent raw materials to knitwear sector and 45 percent to the woven sector while the remaining demand is met through import mainly from India, China and Pakistan.

Impact of slow investment in spinning sector

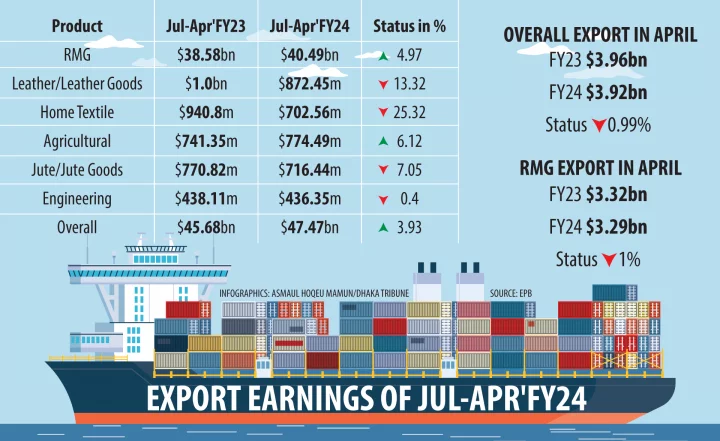

The impact of the slowdown in investment in spinning sector is dangerous. Because, the country’s $46.99 billion worth of garment items is largely dependent on the PTS integration.

The local garment exporters will have to import the yarn and fabrics with spending billions of dollars from other countries like from India, Pakistan and China.

For instance, in the fiscal 2022-23, Bangladesh imported woven fabrics worth Tk36,527crore to meet the demand of the local garment exporters, the BTMA data also said.

This is a segment of the total import of raw materials. If the amount of other sectors like yarn, knit fabrics and yarn are also added, the amount will be even higher.

Slowdown in investment will also impact on the technology knowhow and the garment sector will be dependent on the imported fabrics and yarn which will also impact the lead time.

As a result, the international retailers and brands may not choose Bangladesh as a preferred destination for souring the garment items.

Moreover, the local markets which is also billions of dollar worth will face a lot of smuggled in from other countries which might be a threat for the country’s industry.

Reasons for slow investment

Mainly for three reasons the investment in the spinning sector declined in the country over the last two years including gas crisis, volatile dollar exchange rate and for lower demand from the garment exporters.

For instance, many of the spinning mills have been running their production at 50 percent capacity because of the gas crisis in the industrial sector. As a result, the cost of production has gone high and the production has lowered for which the industry owners cannot make profit from the sales of the yarn.

Although the production fell in the spinning sector, but the government doubled the gas price in February in 2023 to Tk30 per unit from Tk16 per unit. But the gas supply situation did not improve to the expected level.

The volatile dollar exchange rate has also a negative role in inflow of investment in the spinning mills.

Many entrepreneurs have opened Letters of Credit (LCs) for importing the machinery when the dollar rate was lower and hovering around Tk86 and Tk87 per US dollar before the outbreak of the Russia Ukraine in February in 2022.

However, the war impacted the dollar exchange rate severely and the rate reached to Tk111 and Tk112 per dollar in officials which made the import expensive for the entrepreneurs.

Moreover, the dollar is not even available at the official rate for which the entrepreneurs have to buy the dollar at Tk123 from the unofficial channels and even from the banks to import capital machinery.

The western clothing retailers and brands experienced a dull sale seasons because of historic inflationary pressure stemmed from the severe fallouts from the Covid-19 pandemic and Russia Ukraine war.

As a result, the inventory of unsold stock of garment items was high in the stores of them for which the export of garment items was also low from Bangladesh.

As a result, the garment makers bought lower quantity of fabrics and yarn from the PTS in Bangladesh which also badly impacted in investment in the spinning sector.

Views of industry insiders

Khorshed Alam, chairman of Little Star Spinning Mills Ltd, also said the volatile dollar exchange rate, gas shortage and stockpiling of old unsold garment items in the stores in the western countries impacted badly in the inflow of investment in the spinning sector.

Moreover, the higher increase of gas price impacted badly in the investment as the profit declined. The spinning sector needs uninterrupted supply of gas for making profit and to run in full capacity, Alam said.

Monsoor Ahmed, chief executive officer of BTMA also echoed with the views of Alam. Even in the time of Covid-19 time few spinning mills were established but in 2023 no new unit was set up mainly because of gas shortage and volatile dollar exchange rate.

Available huge fund from the banking sector for establishing a spinning unit is also a challenge because setting up of even a small spinning mill requires more than Tk500crore which is difficult to available now at lower interest rate from the banking sector, he added.

In fine, spinning is the backbone for the local textile and garment industries and it needs good care of the sector. The uninterrupted gas supply to the spinning mills is very important for using its full capacity and for more investment.

The spinners are losing money as they have been running at 50 percent capacity due to gas shortage. The government should manage gas for the spinning sector at affordable prices so that they can make profit and expand their capacity and can go for new investment.