With export orders secured three to six months ago, Bangladeshi apparel exporters now struggle to log even the break-even costs thanks to recent price hikes of cotton yarn – used for making T-shirts to jeans.

“While receiving the orders in July-August, it was beyond our wildest imagination that the yarn price would spiral this much” Shahidullah Azim, vice-president of Bangladesh Garment Manufacturers and Exporters Association (BGMEA), told The Business Standard Saturday.

He said pricier yarns would push many of the apparel-makers to losses as the export orders would eventually turn out to be bank liabilities.

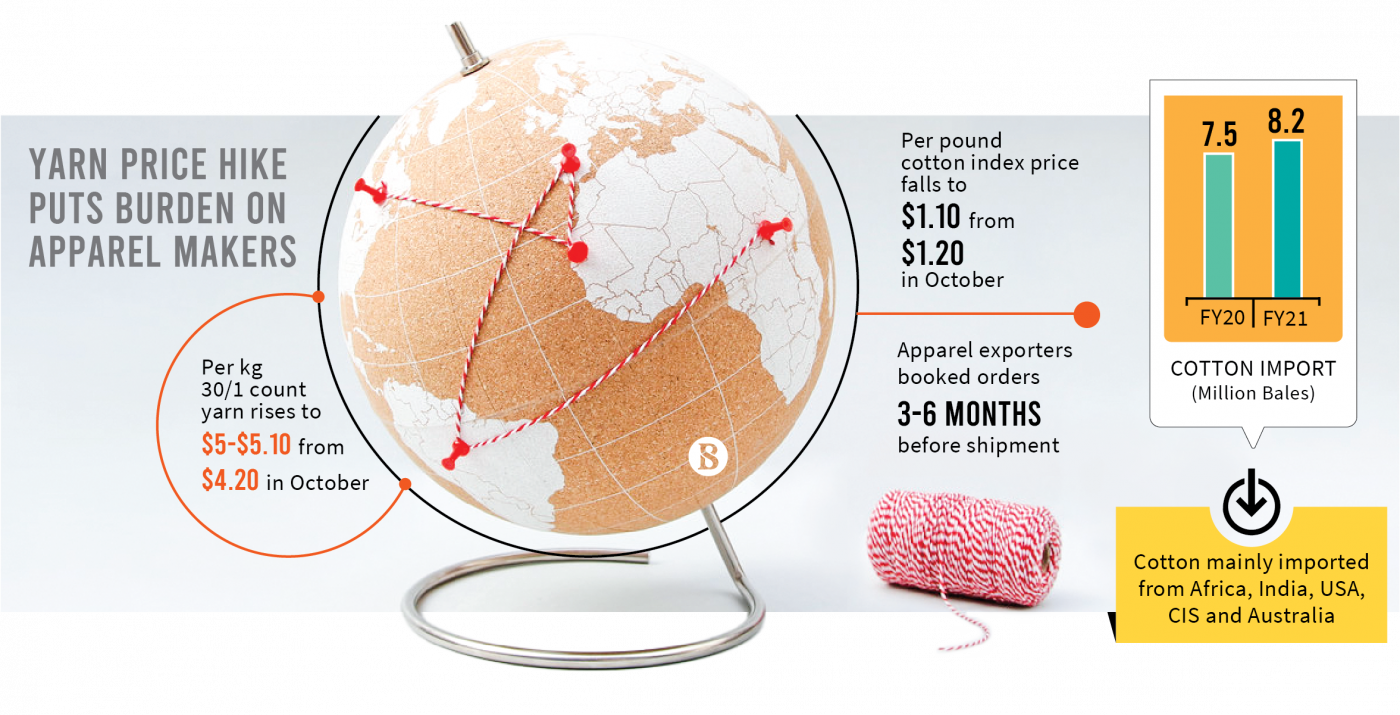

Bangladesh imports cotton mainly from Africa, India, the US, Australia, and Uzbekistan. With the raw material, local spinners produce yarns and sell the products to the local apparel makers and textile-makers.

Cotton rates were on the rise worldwide since the beginning of this year, leading to a surge in yarn and fabric prices. Apart from the price spikes in the international market, the country’s dressmakers have been accusing local spinning mills of overcharging them than the global cotton price spirals.

In the face of a growing row between the two parties, there had been a “good faith” agreement in November that spinners would not charge apparel-makers more than $4.20 per kg for the yarn if the international cotton price index remained below the $1.20 per pound mark.

According to the latest US Commodity index per pound, cotton prices were at $1.10 on 3 December – down from $1.20 on 9 November.

However, Sheikh HM Mustafiz, managing director of Cute Dress Industry Ltd, said that they have been buying yarns at $5-$5.10 per kg for the last couple of weeks.

Mustafiz, whose knitwear units make high-end export items, also noted that they were now paying more for other garment raw materials such as dyes, chemicals, and apparel accessories.

According to the BGMEA, some of their member manufacturers have put a hold on yarn purchases thanks to the turbulent market.

BGMEA Vice-President Shahidullah Azim claimed some of the spinners now have stopped issuing proforma invoice (PI) – a preliminary bill or estimated invoice which is used to request payment from the committed buyer for goods.

Sandwiched between pricier yarns and overcharging by local spinners, the association has asked its members not to accept any order without calculating the profit margin.

Rashedul Hasan Rintu, director of Bangladesh Textile Mills Association (BTMA), believes many of the apparel-makers are in trouble with the recent yarn price hikes as they received the orders at older rates.

Rintu said the yarn price is now about $4.80-$4.90 due to the recent cotton price hike. Cotton surged to a record at $1.30 per pound even a few days ago.

He, however, hoped cotton prices would go down in the international market in the coming days as the index hints at a downtrend.

Brushing aside the overcharging allegations, BTMA President Mohammad Ali Khokon said yarn prices in Bangladesh are almost at the same as the international market.

Referring to the current yarn market in neighboring India, he said per kilogram of 30-single count yarn in India now costs $4.70-$4.80, which is $4.80-$4.90 in Bangladesh.

He also dismissed the accusation of stopping the issuance of the proforma invoice.

All fingers pointed at surged demand, chained supply

Khokon said his company Maksons Group usually needs around 1,814 tonnes of cotton every month as they maintain a 4,000-tonne inventory.

But propelled by a demand surge, he said the company has opened a letter of credits (LCs) for 9,000 tonnes of the raw material and most of the shipments are now stuck at various ports.

“Generally, cotton comes to Bangladesh from the US through Shanghai port. But due to a shortage of Bangladesh-bound shipping lines, the cotton shipment went to Malaysian port Klang. We do not know when the consignments will arrive at Chittagong port,” he explained.

However, a representative of leading international shipping lines said Bangladesh-bound ships usually face 7-14 days in a port logjam at the Malaysian port.

In FY21, Bangladesh, the second-largest exporter, earned around $39 billion in merchandise exports, of which apparel items accounted for over $31 billion. The country also stands at the second position in cotton imports as in the last fiscal year, it imported over 8 million bales of cotton, mainly from African countries.

Md Ruhul Amin Sikder, secretary-general of Bangladesh Inland Container Depot Association (Bicda), said container shortage due to the pandemic-led supply chain disruption has eased up.

“About 50% of the crisis gradually decreased in the last two to three months,” he added.

Shafiqul Alam Jewel, director of the Bangladesh Shipping Agents Association, also echoed the same.

He said, “If the virus situation does not deteriorate further, container shortage will completely go away in the next couple of months.”

Though reports on US port congestions are still not encouraging, people involved in logistics services here are hopeful of good days ahead.

A Bloomberg report, however, said yesterday the US supply chain bottleneck is still months away from being clear as the busiest port complex of Los Angeles and Long Beach have kept nearly 100 container carriers waiting outside the official area. The average wait for a ship rose by a week to 20.8 days on Friday from a month ago.