Textile Today published a report in February this year showing that after losing the second position as apparel exporter in the global market to Vietnam in 2020, Bangladesh regained it in 2021. Analyzing the Export Promotion Bureau (EPB) data and the General Statistics Office (GSO) data Textile Today disclosed the report.

According to the EPB data Bangladesh earned $35.81 billion in 2021, while Vietnam earned $32.75 billion in the same period as per the data of GSO.

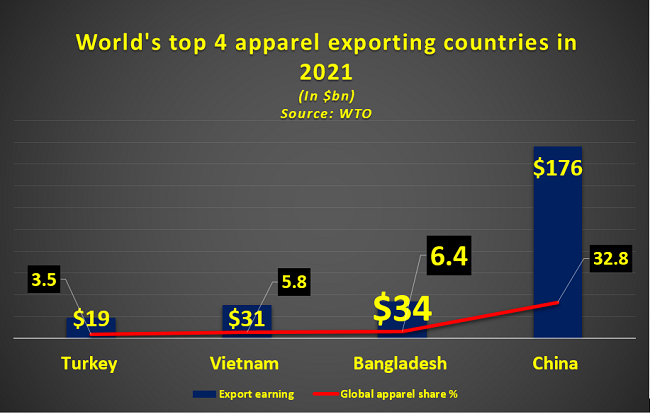

The latest World Trade Organization’s (WTO) ‘World Trade Statistical Review 2022 also showed that once again, Bangladesh’s readymade (RMG) export to the world has hold onto the second position after China. Also, Bangladesh’s apparel trade share increased by 2.23% to 6.50% in 2021.

This is clearly a positive note For Bangladesh’s textile and apparel industry. As the industry is bouncing back with high-hopes despite multifaceted global challenges. Apparel entrepreneurs have upgraded the technology and product quality as well as capacity. Thus, despite COVID-19 and Russia-Ukraine conflict the brands and buyers keep on placing more orders and the RMG industry gained from that.

Country’s leading association for RMG, The Bangladesh Garment Manufacturers and Exporters Association (BGMEA) recently revealed its ambitious plan to elevate Bangladesh’s share in the global apparel business to 10% by 2025 from the current 6.26%.

Bangladesh’s RMG is focusing in diversifying markets and apparel products to swell its growth. In July to November of FY 2022-23, Bangladesh’s apparel export to non-traditional markets grew by 24.17% of its total apparel export.

As per the WTO publication, Bangladesh remained the second-largest exporter of clothing after China – while Vietnam, and Turkey ranked third and fourth respectively. The report also highlighted that the country is gaining from its favorable sourcing destination with its high reputation in transparency and circularity i.e., most sustainable factories, comparatively low labor cost, smooth supply chain – while globally leading fashion retailers are trying to down their apparel sourcing from China.

The WTO statistics also disclosed a comeback in apparel consumption as the annual export value of the top 10 apparel exporting nations stood at $460 billion – which was $378 billion in 2020. While, the value was $411.0 billion in 2019.

As the global economy improved from COVID, the world apparel export resounded in 2021, while the world textile exports grew much sluggish due to a high trade volume the year before. Explicitly, thanks to consumers’ robust demand, world clothing exports in 2021 fully bounced back to the pre-COVID level and surpassed $548.8bn, a significant increase of 21.9% from 2020.

Despite that the WTO predicts that despite witnessing a growth – the world textiles and clothing trade could face strong headwinds down the road due to a slowing world economy and consumers’ weakened demand. Notably, amid hiking inflation, high energy costs, and retrenchment of global supply chains.

The World Trade Statistical Review 2022 data also revealed that in terms of global apparel share, China remained the top apparel exporting nation with 32.8% market share and exported apparel worth $176 billion.

While Vietnam became the third major RMG exporting nation with a 5.8% market share and exported apparel items worth $31 billion in 2021.

Followed by Turkey, with 3.5% global garment export share and exported apparel worth about $19 billion last year.

Alternative of China

Another significant sourcing trend, leading fashion brands and retailers have been trying to cut their apparel sourcing from China, driven by many economic and non-economic aspects, from cost considerations and trade tensions to geopolitics. Particularly, despite China’s strong performance in 2021, China accounted for only 23.1% of US apparel imports in 2022 (January to September), much lower than 36.2% in 2015. Similarly, China’s market shares in the EU, Japanese, and Canadian RMG import markets also fell over the same period, signifying this was a global phenomenon.