Different studies suggest that remittances sent through informal channels in developing countries account for roughly 35-75% of the official remittances; Bangladesh is no exception

Inward remittances have a significant impact on improving the microeconomic conditions of a country and it also greatly contributes to macroeconomic stability.

Bangladesh over the years has been a key remittance recipient country in the world. For more than a decade, remittance inflows in Bangladesh have been more than three times the volume of the Official Development Assistance (ODA).

However, a key concern in this issue is the diversion of remittances from formal to informal channels.

Different studies suggest that remittances sent through informal channels in developing countries account for roughly 35-75% of official remittances; Bangladesh is no exception.

For example, migrant household survey data in the country shows a huge discrepancy between the formally accounted remittances and the amount the migrant households actually receive from their counterparts living in the destination countries.

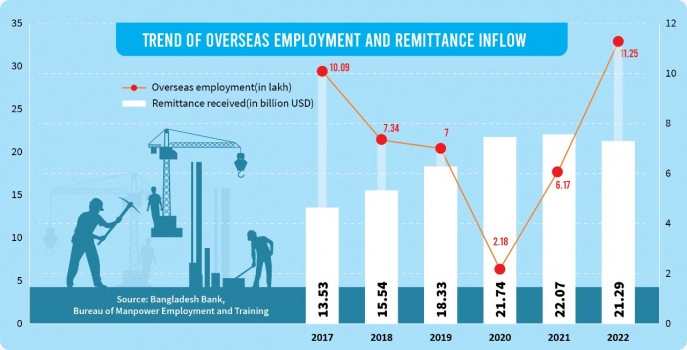

According to the Bureau of Manpower Employment and Training (BMET), overseas employment reached a record high in 2022, with 1.13 million foreign jobs. The normalisation of the pandemic situation, creation of new job markets, and soaring demand in major destination countries have mostly contributed to this increased foreign employment.

However, inward remittances declined to $21.29 billion in 2022 from $22.07 billion in 2021, depicting a 3.7% drop. This indicates a possible diversion of remittances from formal to informal channels.

And this is especially a matter of huge concern amid the widening Balance of Payments (BoP) deficit. Remittances are an integral part of a BoP account, which records the transactions between residents of a country and residents of other countries.

So, what is the reason behind this diversion?

Studies on labour migration suggest that the wide gap between the interbank and kerb market exchange rate, high remittance transfer costs, lack of financial market infrastructure, and migrants’ characteristics are some of the plausible causes of this diversion.

The informal channel provides higher incentives than the formal channel due to the significant gap between the official and kerb market exchange rate. Migrants also face higher remittance transfer costs in case of remitting money through formal channels.

A study by ILO on labour migration shows that migrants sending $200 through formal channels pay 6.5% in fees while through informal channels, the fee is only 2%.

There also exists inadequate financial market infrastructure in the country and furthermore, the existing infrastructure is less developed. Due to this, remittance service providers (RSPs) face higher competition from unregulated informal money transfer providers.

Migrant characteristics also contribute to the diversion of inward remittances from formal to informal channels. A high portion of migrant workers in the country are low-skilled and hence earn lower wages.

According to the BMET data, less and semi-skilled migrants accounted for more than 60% of the total overseas employment between 1976 and 2019. These migrant workers mostly send money to their households in small portions, and are reluctant to comply with the necessary documents required by the formal channels.

Lack of language proficiency and lower literacy rate is also common among these workers. In addition, they don’t want to bear high transaction fees existing in the formal channels. Thus, they prefer to send money through informal channels.

Now, the question arises on the possible solutions or initiatives to redirect the inward remittances. GoB has taken some appropriate measures to boost remittance inflows.

For instance, the government introduced a 2% cash incentive in July 2019 and further increased the incentive to 2.5% in January last year. Furthermore, some modifications have been made to ease the documentary regulations.

However, the efficacy of these initiatives need to be studied rigorously. Developing the financial market infrastructure should be emphasised properly.

The central bank, state-owned financial institutions, public sector programs, and postal networks are examples of existing public sector infrastructure that also needs to be used more effectively to redirect remittances to the formal channels.

The gap between the official and kerb market exchange rate needs to be reduced and continuously monitored. In addition, high remittance transfer fees existing in the formal channel are required to be lowered.

As mentioned earlier, Bangladeshi migrant workers are mostly unskilled; hence it is high time to upskill the migrant workers and conduct research on how this can be done effectively based on best practices exercised worldwide.

Diaspora bonds, a government debt security, may be useful in attracting inward remittances through formal channels. India introduced such bonds in the 1990s to support its BoP needs and was successful in raising nearly $40 billion in remittances. The feasibility of issuing such diaspora bonds needs to be investigated in the Bangladeshi context.

Muhammad Nafis Shahriar Farabi.

Muhammad Nafis Shahriar Farabi.

Muhammad Nafis Shahriar Farabi is a Research Associate at the Bangladesh Institute of Governance and Management (BIGM). He can be reached at nafis.shahriar@bigm.edu.bd