However, deposits in no-frill accounts increased by Tk607 crore

The savings of the extreme poor declined by 6.11% last year as they could not save money due to income loss brought on by the economic crisis and increased living costs.

The total deposit of the ultra-poor who have no-frill Tk10/50/100 accounts dropped to Tk215 crore at the end of December last year from Tk229 crore in the same period of the previous year, according to a Bangladesh Bank report.

No-frill accounts are savings accounts that do not require a minimum balance, and the account holder gets access to internet banking, a debit card, and ATMs across the country with a zero balance. These accounts do not have any unnecessary rules or “frills”.

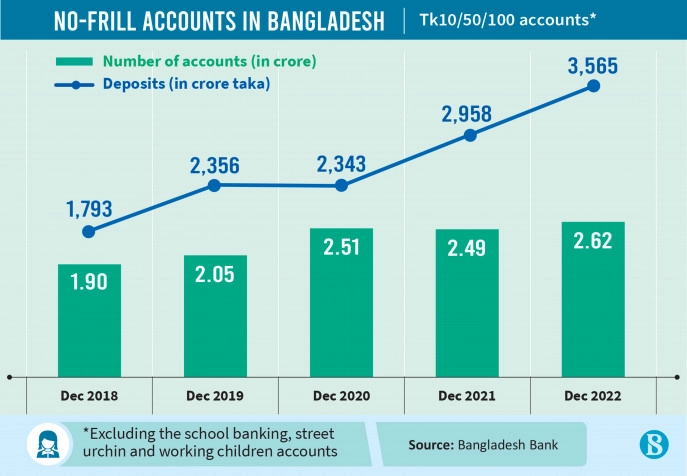

However, the total deposit in no-frill accounts increased by 20.52%, or Tk607 crore, last year, mostly due to contributions from freedom fighters, social safety net beneficiaries, and ready-made garment workers.

According to data from the central bank, apart from the ultra-poor, farmers, freedom fighters, apparel workers, and beneficiaries of social safety net programmes use no-frill bank accounts.

At the end of December 2022, deposits in these accounts stood at Tk3,565 crore, up from Tk2,958 crore at the same time the previous year. Besides, the number of no-frill accounts has increased by 13 lakh to 2.62 crore in the last year, it added.

Among them, deposits in about 1 crore farmer accounts increased by 10.18%, or Tk52 crore.

An analysis of data from the central bank shows that the total accounts of the extreme poor at the end of December 2022 stood at 35.38 lakh.

According to that, the number of accounts of these people, who are at the lower level of the financial hierarchy of society, has increased by about 53,000 or 1.47% last year. At the end of 2021, this group of people had 34.87 lakh accounts. If compared with 2020, it can be seen that these accounts have increased by about 7 lakh, or 23.75%, in two years.

However, even though the number of accounts are increasing fast, the deposits are not rising at the same pace. When deposits are increasing in the country’s banks, economists point to the decrease in deposits in the accounts of the ultra-poor, as this population is heading towards more poverty.

Deposits in school banking accounts rise Tk79 crore

The amount of deposits in school banking accounts has also increased by Tk79 crore last year.

In December last year, the total amount of deposits in 32.62 lakh accounts stood at Tk2,285 crore, compared to Tk2,206 crore in 28.67 lakh accounts during the same period of the previous year.

In the light of the existing school banking policies, banks can open student accounts with a minimum deposit of Tk100 and no service charges. Moreover, these accounts offer attractive interest rates, debit card facilities, and financial education programmes.

Out of 61 banks operating in Bangladesh, 57 have so far offered school banking.

According to a report by the Bangladesh Bank, five banks hold 55.17% of the total number of school banking accounts.

As of December 2022, 19 banks had opened 30,898 street urchin accounts through 53 non-governmental organisations, compared to 19,405 such accounts opened through 23 NGOs at the same time a year ago.

Overall, no-frill accounts contribute significantly to bringing the financially excluded under the umbrella of formal financial services.