Since the 1990s, Cambodia’s exports from the apparel, footwear and travel goods sector have grown significantly. The growth of this labor-extensive sector has been encouraged by low labor cost, intensive industry, the signing of international trade agreements and the presence of favorable investment condition.

According to a recent report by the Ministry of Labor and Vocational Training, seventy-nine garment companies are part of 1,188 new enterprises that opened in Cambodia in the first eight months of this year, creating nearly 60,000 jobs.

World’s top exporter

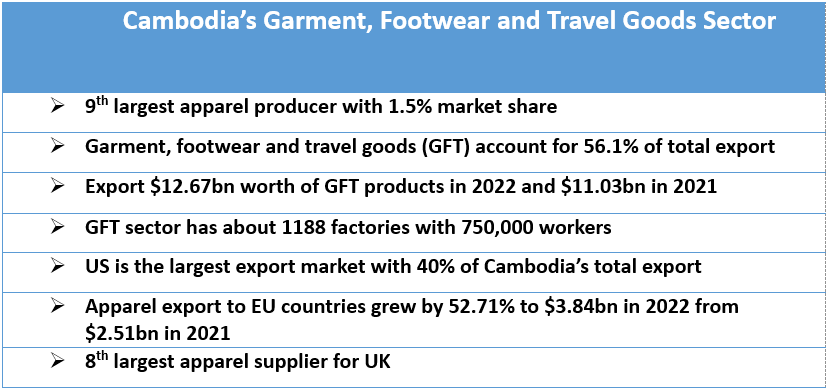

In 2017, Cambodia became the world’s 9th largest apparel producer, accounting for 1.5% of the world’s export value. In 2022, the garment, footwear and travel goods products accounted for 56.1 percent of the Cambodia’s total export of $22.48 billion.

According to a report from the General Department of Customs and Excise, Cambodia exported garment, footwear and travel goods products worth $12.67 billion in 2022, up 14.9 percent from $11.03 billion in 2021.

The garment, footwear and travel products industry is the largest foreign exchange earners for Cambodia. The sector has about 1,188 factories and branches, employing about 750,000 workers, most of whom are women.

The United States is Cambodia’s largest export market and one of Cambodia’s largest overall trading partners. About 40 percent of Cambodia’s total exports went to the United States in 2022—primarily garments, textiles, footwear and travel goods. Cambodia’s apparel export to the US was near $5 billion in 2022 which was 28.46% higher than the previous year.

Cambodia and the United States signed the US-Cambodia Trade and Investment Framework Agreement (TIFA) in 2006, which facilitates and promotes greater trade and investment between the two countries and provides a forum for resolving bilateral trade and investment issues.

Apparel export by Cambodia to the EU countries grew by 52.71 per cent to $3.84 billion in 2022 compared with that of $2.51 billion in 2021.

Cambodia is 8th largest apparel supplier for UK with 4.18% market share of the UK’s total apparel imports of $8.356 billion.

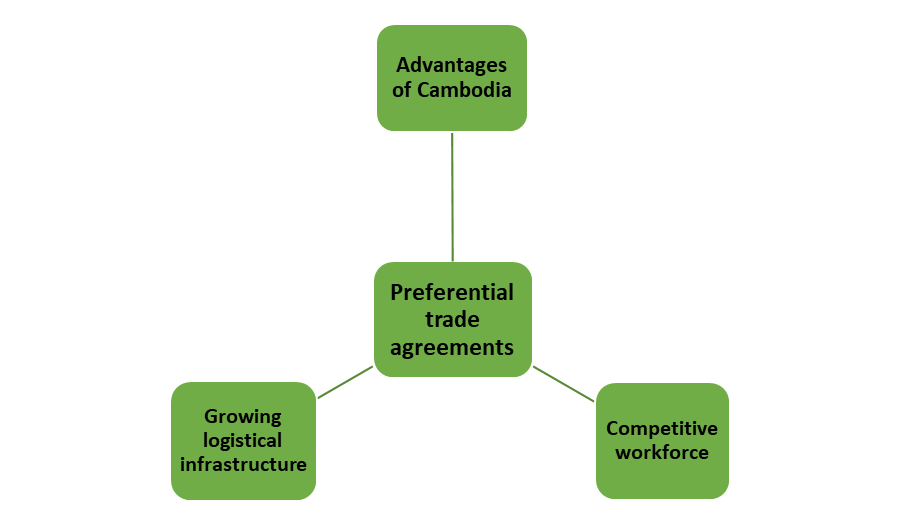

Preferential trade agreements

Cambodia has successfully established trade agreements or preferential schemes with importing countries such as the EU, US, China, Japan and ASEAN. Cambodia is a member of ASEAN and is part of intra-ASEAN’s Free Trade Agreement (FTA) as well as ASEAN’s FTA with China, Japan, Korea, India, Australia & New Zealand respectively. In addition, Cambodia is also a signatory of the Regional Comprehensive Economic Partnership (RCEP), the world’s largest trade deal connecting approximately 30% of the world’s population and output. It enables the export of goods to partner countries at very low rates or with quota-free and duty-free access.

Growing logistical infrastructure

Cambodia is the linchpin of the Southern Economic Corridor (SEC) development project linking Myanmar, Thailand and Vietnam. Phnom Penh is the center of the route connecting Bangkok and Ho Chi Minh City.

Cambodia has a total of 17 airports, with 3 international airports connecting to key markets around the world. The Sihanoukville Special Economic Zone (SSEZ) on the coast of Cambodia is connected to major international trade centers by road, rail, sea and air. Additionally, a $1.9 billion investment is underway for the Phnom Penh-Sihanoukville Expressway, which connects the capital to the coast.

Competitive workforce

Of 16 million people in Cambodia, over 60% are under 35 years old. With a labor force participation rate of 80%, Cambodia has a readily available young & active workforce. Cambodia’s literacy rate is quickly rising, reaching almost 90% in 2019. Since 2008, there have been 1.6x growth of employment in secondary and tertiary industries. A full range of talent awaits you and your business.

However, Cambodia’s minimum wage for the apparel sector is $200 in 2023 which is much higher than Bangladesh (around $71), Pakistan ($104), Sri Lanka ($105), India ($145) and Myanmar ($157) but lower than China ($217), Indonesia ($243) and Turkey ($245).

Road map to overhaul the textile and apparel industry

Cambodia launched a new road map to revamp its textile and clothing industry, a key economic pillar that accounts for more than a third of the country’s gross domestic product. The Industrial Transformation Map for the Textile and Apparel Industry 2023-2027 aims to further transform and transfer the country’s skill-based technology resources to build a globally competitive and sustainable industry.

The Road Map will attract more investment to help implement the Cambodia Garment, Footwear and Travel Goods (GFT) Sector Development Strategy 2022-2027, which aims to make the sector environmentally sustainable, resilient and high value for Cambodia’s economic diversification and competitiveness.

These road maps are to upgrade Cambodia’s garment production models, diversify raw material sources, expand exports to other markets, and develop skills and increase productivity.

The transition from simple cut, make, trim designs to more complex products in line with consumer trends will require investment in modern technology, technology transfer and skill training. Over time, Cambodia’s textile and clothing industry is expected to grow further and gradually move towards becoming one of the sourcing hubs for apparel, footwear and travel goods.