We need to explore our potential in the areas where global market is trending- Faruque Hassan, President, BGMEA

The World Trade Organization (WTO) has published the annual global apparel trade data for the year 2022. As per the data, the world apparel trade has increased by 7.26 % in 2022 year-over-year and reached US$ 576 billion from US$ 537 billion in 2021.

As per the data, Bangladesh retains its position as the world’s second-largest clothing-exporting country after China. Bangladesh’s share in the world apparel market has climbed to 7.87% in the mentioned year from 6.37% in 2021. It is to mention that since 2016 Bangladesh has been maintaining over 6% share in the world apparel market and for the first time the share crossed the 7% mark last year. This is certainly encouraging for us in this depressing time. It reflects the indomitable spirit of the entrepreneurs and hard work and dedication of the workers, and the confidence of the global brands and retailers in us. It does not only prove our competitiveness but also the increased preference for Bangladesh as a sustainable sourcing destination. Most importantly, the policy supports from the Government of Bangladesh (for instance, we have seen how proactive and dynamic role the government has played to protect and recover from the damage caused by COVID), the political stability we have seen in the past decade which is expected to continue in coming years, and most importantly the visionary leadership of our Honorable Prime Minister Sheikh Hasina in laying the foundation of a prosperous nation, have been the crucial driving forces behind this steady performance.

During 2022, Bangladesh’s apparel export to the world increased by 32.60% year-over-year to US$ 45.35 billion from US$ 34.20 billion. At the same time, China’s apparel export to the world grew by 3.60% year-over-year, i.e. to 182.42 billion in 2022 from US$ 176.08 billion. However, the share of China fell to 31.67% in 2022 from 32.79% in 2021.

Vietnam ranked as the third largest exporter of the global apparel market with a 6.12% share followed by Turkey with a 3.46% share. In 2022, Vietnam’s apparel export to the world grew by 13.05%. i.e. to US$ 35.27 billion in 2022 from US$ 31.20 billion in 2021. At the same time, Turkey’s clothing export to the world also reached US$ 19.91 billion in 2022 from US$ 18.73 billion in 2021; 6.27% growth. In 2022, the difference in the market share occupied by Bangladesh and Vietnam has widened.

Export from other top countries like India, Indonesia and Cambodia also grew by 9.67%, 8.14%, and 12.14% respectively. Besides the share of these countries in the world apparel market also increased to 3.07%, 1.75%, and 1.58% respectively. However, the growth in trade is attributed to the inflation worldwide including the abnormal rise in shipping costs in 2022.

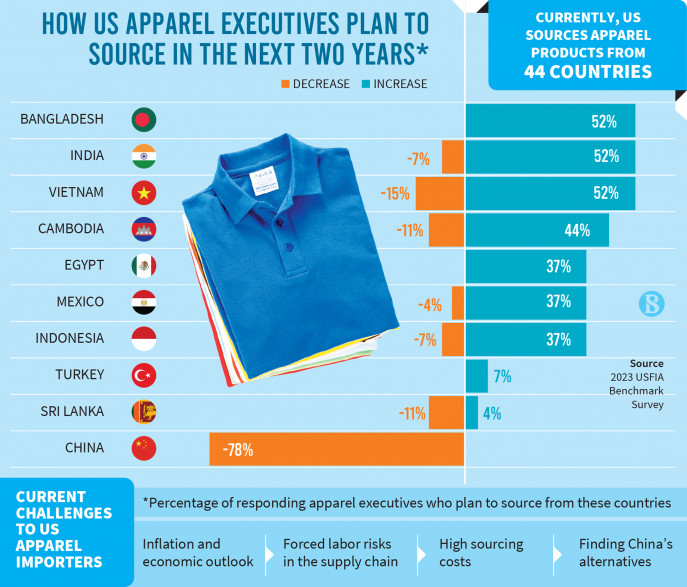

Now if we look at 2023 and its performance, we can see that the sourcing of major markets has drastically gone down. Particularly, the RMG import of USA and EU from the world has declined by 22.92% and 8.84% respectively during January-May 2023. Bangladesh is also witnessing a slowdown in apparel export in the past few months. The global economic growth, and retail and trade outlook show a depressive picture, meaning that the slowdown in demand and order may continue rest of the year. And the price of raw materials and shipping costs is getting back to the normal state from unusually higher levels in 2022. Therefore, the year 2023 will not be a good year in terms of apparel trade measured in dollar values. And my projection is that the global trade of apparel will drastically fall in 2023 which we will see in the next year’s report by WTO.

However, we can certainly see a dynamic shift in sourcing patterns as China is slowly but gradually losing its global share, which is being gained by a few countries including Bangladesh. Now, if we can prepare ourselves with the right investments in products, technologies, skills and of course in safety and sustainability, we will certainly be on the top as a sourcing country. Plus, we need to explore our potential in the areas where the global market is trending, like circular fashion and digital marketplace. We need to continue our efforts in enhancing efficiency, product development capability and invest in reducing carbon emissions. The impressive part is that our factories are making all these efforts and very innovatively, and more investments are coming in non-traditional items and in backward linkage industries. So, the vision we have set to reach 12% of the global apparel market share by 2030 is not over-optimistic. We have already surpassed China’s share in European Union in volume and hopefully by the end of this year we can take them over by dollar value. As we have reached 7.87% share of the world market last year despite all the odds, given all the positive transformation that has happened in the industry and in the country’s infrastructure, we are certainly able to reach 12% by 2030.