RMG export income rises, raw material imports fall in Q1

The country’s garment exports amounted to $12.25 billion in the first quarter of this year, while the raw material imports for that sector during the same period were $3.54 billion, according to Bangladesh Bank data.

Value addition during this period was $8.70 billion or 71%, which was the highest ever in the country’s history.

Fazlee Shamim Ehsan, vice president of the Bangladesh Knitwear Manufacturers and Exporters Association, told TBS, “We had to import raw materials three months earlier for exporting products in the January-March quarter of this year. If you consider import and export during the same time it would appear inconsistent.”

He said, “Many traders are currently not able to open LCs due to various conditions imposed by the central bank on imports and the shortage of dollars in banks. Consequently, the import of garment products has decreased.”

Considering the garment raw material imports in the October-December quarter of 2022 and the export earnings in January-March quarter this year, the value addition in this sector was $8.14 billion or 70%, which was very high.

Regarding that calculation, Fazlee Shamim Ehsan said he was not able to clarify it immediately.

Imports fell by 34.36% in the first ten months of FY23, compared to the same period previous year. Imports in the July-April period of the outgoing fiscal year were $56.36 billion dollars, which were $76.99 billion in the same period of FY22, according to the central bank.

The import of industrial raw materials for garments was $19.21 billion in the first ten months of FY23, which was $28.19 billion or 31.85% higher in the same period of the previous fiscal year. At the same time, capital machinery imports decreased by $16 billion or 56.91% in ten months of this year.

A leader of the Bangladesh Garment Manufacturers and Exporters Association said on condition of anonymity that they reduced importing raw materials due to the dollar crisis, which in turn reduced their production. In this situation there is no reason for an increase in the garment exports.

He said, “Our data and observations do not match with the information provided by the central bank. The picture is not the same in all the export destinations. There is some doubt as to where these products are exported, and how they are registered in the system.”

According to a central bank report, the country’s exports to the UK and France have increased in the last three months (January-March 2023), but, exports to the US and Germany have declined during that period.

The managing director of a number of banks told TBS on condition of anonymity that the export revenue from a number of countries has increased, but Bangladeshi garment makers did not export to those countries that much. They think that some black money from abroad is laundered to the country in the guise of export earnings.

Total export earnings from readymade garments stood at $12.25 billion in January-March FY23 which was 3.67% lower than that of the previous quarter but 6.32% higher than the same quarter of the last year.

Due to the potential threat of a global recession, the buyers and brands of our major export destination countries are facing slow growth of demand which is resulting in our RMG sector to witness a slight downturn in the growth.

BGMEA, Axfoundation seek collaboration on industry’s transition towards circularity

Commerce Minister Tipu Munshi MP held a meeting with Viveka Risberg, programme director of Sustainable Production and Consumption, at Axfoundation in Sweden on 8 June.

The meeting was also attended by BGMEA President Faruque Hassan and Vice President Miran Ali.

During the meeting, they discussed various issues, particularly the areas of cooperation with Bangladesh’s readymade garment sector to facilitate its sustainability initiatives and speed up its transition to circularity.

They stressed on collective efforts to steer the garment industry of Bangladesh towards a circular fashion system.

The transition would be instrumental in ensuring the long-term sustainability of the garment sector of Bangladesh, they said, expressing willingness to extend cooperation in this important area.

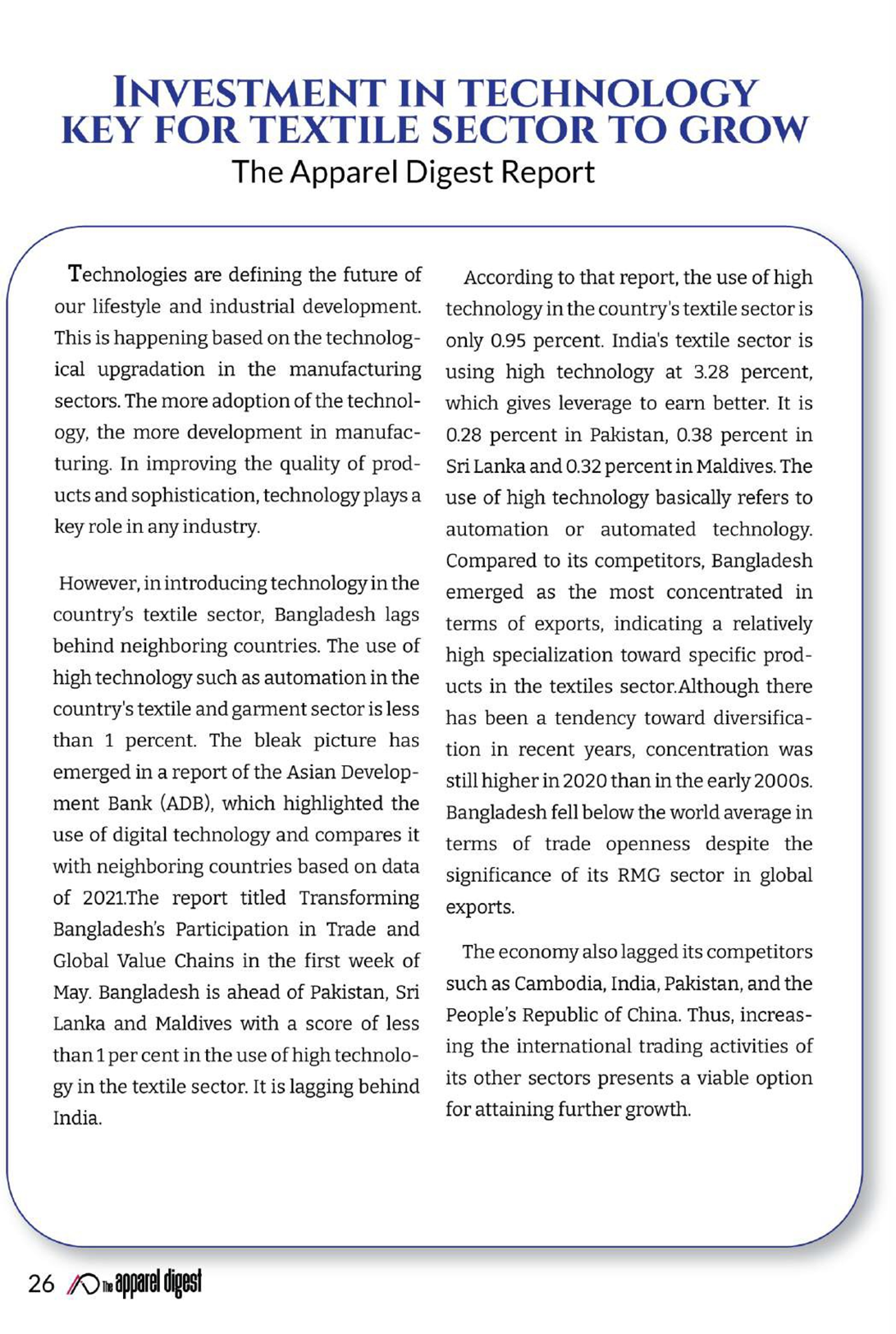

Only a fraction of RMG factories installed fire detection, alarm systems

Safety concerns still plague the RMG factories that were inspected by the Accord, as only a fraction of them have installed fire-detection and alarm systems even after 10 years of the Rana Plaza accident.

Over 80% of the identified safety flaws have been fixed in the last decade, only 27.25% out of 1,700 factories installed fire detection and alarm systems as of April this year, said the monthly progress report of the RMG Sustainability Council (RSC).

Some 22.40% completed installation of the fire suppression system until April 2023.

The Accord, a platform of global unions and over 200 EU-based apparel buyers, was launched immediately after the Rana Plaza collapse in 2013, to inspect fire, electrical and structural integrity of local factories.

It inspected some 1,700 factories and monitored initial remediation that was prescribed with a timeframe until handover of all activities to the RSC, which has representations from factory owners, in June 2020.

Data shows completion rates of common fire-related remediation items like design approval of fire suppression systems, and fire detection and alarm systems are 86% and 89.65% respectively.

Meanwhile, 96% factories have removed lockable collapsible gates and 89% have adequate egress lighting in fire exits.

As per media monitoring by the Clean Clothes Campaign, the number of publicly reported workplace accidents has declined to 26 in 2022 compared to 2021’s 33 reported accidents in the industry.

As per the data of Safety and Rights Bangladesh 2022, total workplace deaths in the RMG industry in 2017 and 2018 were 15 and 10 respectively.

In the next two years, in 2019 and 2020, the numbers reduced to only two and one respectively.

However, the number jumped to 13 in 2021.

The comparison of the number of workers killed has shown a somewhat deteriorating trend in the industry’s safety status in recent times.

BB: Bumpy road ahead for RMG industry

The readymade garment (RMG) industry may face challenges ahead due to global trade tensions and economic slowdowns in export destinations, said the Bangladesh Bank.

Exports maintained growth during the outgoing FY23, as per the central bank’s quarterly review of the sector for January-March 2023 released on Tuesday.

Bangladesh earned $12,255.75 million from garment exports in the January-March period of 2023, 0.77% higher than the Commerce Ministry’s target for the quarter and 6.32% higher than that in the corresponding period of the previous year.

However, this was 3.67% lower than that of the previous quarter owing to sluggish growth of the world economy.

Bangladesh’s overall garment export earnings stood at $42,613.15 million in FY22, which was 35.47% higher than that in the previous fiscal year.

In fiscal year 2021-22, the sector contributed 9.25% of the gross domestic product (GDP).

Woven garments and knitwear contributed 40.10% and 44.95% respectively of the total garment export earnings during the quarter under review.

The main destinations of Bangladesh’s garment exports are the US, UK, Netherlands, Germany, Spain, France, Italy, Canada and Belgium.

During the quarter, total export earnings from these nine countries stood at $9,123.67 million.

Of this amount, 92.20%, or $8,412.46 million, was earned from garment exports (woven 45.45% and knitwear 46.75%).

However, the earnings were a decrease of 6.74% and 0.11% compared to that of the previous quarter and that of the corresponding quarter of the preceding fiscal year respectively.

The garment sector of Bangladesh was making a fairly good turnaround in the post Covid-19 period.

However, the start of the Russian-Ukraine war in late February of last year and its resultant supply chain disruptions, high global inflation and tight monetary policy of the Federal Reserve have created some challenges in recent months.

“However, to face different corresponding challenges and to accelerate the export growth of RMG, we should focus on inter-apparel diversification, increase productivity, efficiency and product innovation,” the review said.

At the same time, Bangladesh should prioritize exploring new global markets.

Moreover, emphasis should be given on skills development of the garment workers for facing potential challenges and harnessing available benefits of this sector, it said.

The government and Bangladesh Bank have taken a number of measures, especially for facilitating production and export of the garment sector.

For instance, the central bank has formed a refinance fund worth Tk5,000 crore, from which entrepreneurs can take loans through banks at 6% interest rate, said the review.

Bangladesh Bank has expanded the tenure of loan facilities for entrepreneurs from 1 year to 3 years under this refinance scheme, it added.

PwC: RMG industry must keep up with global sourcing trends

The readymade garment (RMG) manufacturing companies need to align their product basket with the global sourcing trends and may like to move towards more value-add products to increase profitability and competitiveness, said a recent report by PricewaterhouseCoopers (PwC) Bangladesh.

In the report titled “What’s next for the RMG sector in Bangladesh?”, PwC also said that customized strategies must be followed for each product–market combination for deeper penetration of existing markets, entry into relevant new markets and product diversification.

Moreover, industrial infrastructure and logistics need to support the efficient functioning of businesses by reducing cost of operations, making operations environment-friendly and safe, and decreasing the response time and overall business risks, the report stated, adding that quality utilities need to be sufficiently available at competitive prices.

The global textile and RMG industries have been experiencing a series of disruptions in the last five years.

The geopolitical tensions between major markets and manufacturing countries, cotton price fluctuations, global geopolitical conflicts and the Covid-19 pandemic have changed the overall trade dynamics.

Other significant developments include a sharp increase in wages and power cost in Bangladesh, the EU–Vietnam Free Trade Agreement and sustainability-related commitments made by the industry at the COP 26 summit.

To enable the survival and profitable growth of textile and RMG manufacturing businesses, transformation is required at both the company and country levels, the report said.

As the textile and RMG industry are labour-intensive industries, continuous skilling, re-skilling and up-skilling of human resources is required for adopting new technologies, developing new products, improving process efficiencies and enabling innovation, said the PwC report.

Moreover, continuous technology upgradation is necessary for improving productivity, product diversification, quality improvement and improving cost competitiveness.

The report also suggested adopting new technologies to improve competitiveness, technologies including business intelligence tools, 3D design, automation, barcodes, RFID, blockchain, laser technology, nano-bubble technology and many more.

“Faster adoption of technologies is required to reduce cost of manufacturing and business risks. This will help to improve sustainability, enable data-driven decision-making processes, ensure transparency and traceability, and enhance quality, service and responsiveness,” the report stated.

The report said that the growth of Bangladesh’s garment manufacturing industry has considerably improved the socioeconomic development of the country.

In the last decade, garment export has more than doubled to touch $42.6 billion in FY22.

Moreover, the country has now set an ambitious target of exporting RMG worth $50 billion by 2025, and touching $100 billion by 2030.

However, the industry is facing many headwinds which may impact its growth in the coming decade.

Therefore, it might be useful for the Bangladesh textile and garment manufacturing industry to maintain the mentioned recommended levers in achieving its targets.

The report also recommended that a culture of innovation needs to be introduced for creating differentiating factors around products and processes.

Moreover, the industry needs to focus on circular economy, sustainable product designing, green chemistry, net zero commitments, measurement and control of emissions and baselining the of scope emissions, living wages, and clearly defined career progression paths for the workforce.

The industry also must ensure continuous supply of good quality power at competitive prices, improved efficiency in port, road transport and custom clearance processes, with lesser human interventions.

It should ensure improved occupancy of industrial zones and strengthening of textile manufacturing capacity, especially that of finished woven fabric.

An inclusive, motivated and sufficiently skilled workforce will bring in the required changes.

Monitoring and evaluation of the implementation of governance mechanisms is also necessary, stated the report, adding that the policies need to be objectively defined, and relevant stakeholders need to be sufficiently sensitized to accommodate frequent changes.

Clear RMG salary, bonus before Eid holidays

State Minister for Labour and Employment Begum Monnujan Sufian today urged the factory owners, including garment factory owners, to clear workers’ salaries and festival bonuses before the beginning of the Eid-ul-Azha holidays.

The factory owners have to clear 15 days’ salary of June to the workers before the beginning of the Eid holiday, she said at a statement after a meeting of tripartite consultative committee (TCC) held at the Shromo Bhavan in Dhaka today.

If any factory owner wants to pay the salary of the full month of June, he or she can do it, but it is not mandatory.

The TCC is a body consisting of government representatives, factory owners and worker leaders formed for the sake of the garment sector.

The Eid-ul-Azha is scheduled to be held on June 29.

Export bounces back in May

Bangladesh’s exports bounced back in May after a consecutive decline for the last two months riding on increased shipment of main export earner garments, according to data released by the Export Promotion Bureau (EPB) today.

Exporters shipped $4.84 billion worth of goods in May this year, up 26.6 per cent year-on-year from the same month previous year’s $3.83 billion.

Overall export soared 7.1 per cent year-on-year to $50.5 billion in July-May during 2022-23 fiscal year, according to EPB data.