The textile firm expects its profitability to increase significantly and its revenue to jump to around Tk2,000 crore in the future

Alif Group, a textile conglomerate with a dozen firms, is planning to merge its three publicly listed companies into a single entity with the hope of expanding business and reducing management and administration costs.

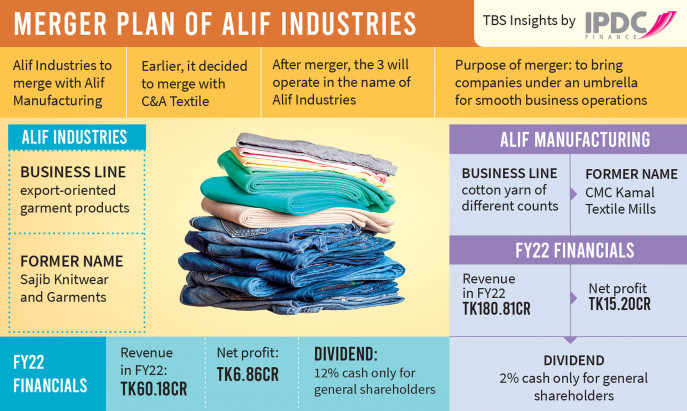

According to the plan, Alif Industries, Alif Manufacturing Company, and C&A Textile will run under a single management.

The textile firm expects its profitability to increase significantly and its revenue to jump to around Tk2,000 crore in the future.

Thus, shareholders will benefit from higher dividends.

In the fiscal 2021-22, Alif Industries’ annual revenue was less than Tk100 crore, while Alif Manufacturing’s was over Tk150 crore.

The merger of Alif Industries and Alif Manufacturing Company has been announced recently, while Alif Industries and C&A Textile announced their merger two months ago. The merger of Alif Industries and C&A Textile is already under way.

“After completing the mergers, we also have plans to merge our other textile firms with Alif Industries,” said Azimul Islam, managing director of Alif Group.

“After merging the three listed firms, Alif Industries will be the mother company, which will help it to be one of the largest listed textile firms in the stock market,” he added.

In separate stock exchange disclosures, Alif Industries and Alif Manufacturing announced that their boards had unanimously approved the merger. However, the merger is subject to approval from banks, creditors, shareholders, stakeholders, and the High Court.

Once the amalgamation plan is approved, the shareholders of Alif Manufacturing will get a share of Alif Industries at a proportionate rate.

Why Alif Industries merging other business entities

Alif Industries and Alif Manufacturing Company are both sister concerns of Alif Group, running under a common management.

Alif Industries produces export-oriented garment products, and Alif Manufacturing produces yarn of different counts.

So, the management thought that if both merged, management and administration costs would significantly reduce, which would help the company make a higher profit than earlier.

Both companies got listed in the nineties. After staying in the over-the-counter market for a long time since 2009, Alif Industries and Alif Manufacturing returned to the mainboard of stock exchanges in 2017.

The Alif Group acquired C&A Textile to revive the losing concern in the stock market as its former owner fled away for loan complexity.

Then, the Alif Group acquired the sponsor-director shares and is now operating the company.

Azimul Islam said that combining three companies into one entity will reduce administrative and management costs as these three companies have several similar departments, functional areas, and boards of directors. Merging three companies into a single entity will help reduce costs.

He said, Alif Manufacturing makes yarn from cotton. Alif Industries is a producer of garments and fabric, and C&A has both garmenting and dyeing as well as knitting.

“So, when we combine all these products, we get the end product of garments. So, after completion of the said amalgamation, Alif Industries would just need to import cotton and ship garments (end product); the value addition would be almost 90%, and just 10% of materials like accessories and others would need to be procured from outside.”

Replying to a question on how shareholders will benefit from such a merger, he said, a true vertical integrated company will be able to capture more market share.

“Moreover, cost savings and business efficiency will lead to higher economic value addition. Net margins will drastically increase due to this, and we expect to pay our shareholders a much higher rate of dividend and create shareholder value,” he added.