It needs to adopt technology and invest in skill development and innovation for high valued product manufacturing

Bangladesh has widened the gap with its close competitor Vietnam in the global apparel export market to retain the second position as supplier of clothing items after China.

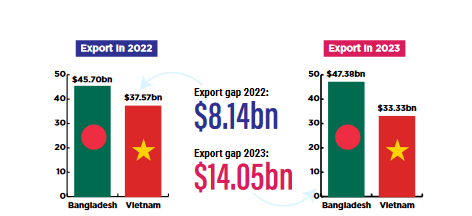

According to Export Promotion Bureau (EPB) and General Statistics Office of Vietnam data, in 2023 Bangladesh earned $47.38 billion, which is $14 billion higher than Vietnam’s $33.33 billion in the same period.

In 2022 the gap was $8.14 billion as Bangladesh earned $45.70 billion against Vietnam’s $37.57 billion.

Though the widening gap gives exporters confidence, but experts as well as the sector people warned not to be complacent as Vietnam is competing with Bangladesh with almost half of the workforce. It is a threatening factor for Bangladesh to retain second position in the global market.

Bangladesh’s apparel industry employs over 4 million people, while Vietnam’s labor force in the sector is over 2.5 million.

Bangladesh lost its second position to Vietnam in 2021, when it earned $27.47 billion against the latter’s $29.8 billion.

“If we consider Bangladesh’s gap with China, it is very large. But in the last two years, we have done better than Vietnam. However, it does not guarantee that we will remain second as Vietnam’s apparel export performance was better in the last couple of years,” said Professor Mustafizur Rahman, distinguished fellow at Centre for Policy Dialogue (CPD).

To sustain the growth and remain the second largest exporter title, we have to identify our shortcomings and ways to grow further, said the economist.

Rahman also urged to be prepared to face the post LDC challenges as it may lessen our competitiveness in the export markets due to tax benefits erosion.

Problems and ways forward

In terms of comparative benefits, Vietnam is in a strategic location with the European Union and the US, while it has competitive labor costs. The country has focused on technology and innovation as well as invested more in skill development.

“We have a good number of factories but the lion share of RMG export earnings are contributed by a few large groups,” said SM Khaled, Managing Director of Snowtex Group.

Our capacity is larger than Vitamin but we produce mostly basic items except a few. In contrast, Vietnam makes high valued goods and earns better prices, said Khaled.

On the other hand, despite having a big workforce, we are manufacturing less quantity and basic items as their skill and productivity is comparatively lower than Vietnam, he said.

“They have a closer supply source of raw materials from China and a strong backward linkage industry.”

To cash the opportunity of capacity and large volume workers, we have to invest in skill development and move towards product diversification of most non-cotton and high valued goods, said Khaled.

“Bangladesh manufacturers are weak in product marketing. As a result, they take basic orders. For example, from a buyer an exporter can grab 50,000 basic work orders but similarly he/she has to negotiate at least five brands or buyers to grab 50,000 orders, said Abrar Hossain Sayem, a director of Bangladesh Garment Manufacturers and Exporters Association (BGMEA).

Bangladesh has to set a strategy on how to take a $2-$3 order to $5-$6 one. Buyers pay $15 for a woolen sweater, while an acrylic sweater pays $5-$6 on an average, said Sayem.

“We have to address this challenge to reap the most benefits of our capacity.”

For high valued products manufacturing, supply of raw materials is crucial and no alternative to establish a strong backward linkage. We have to develop fabrics for high end products to compete with Vietnam, said the CEO of Merchant Bay Limited.

Low workers’ wages were an advantage for Bangladesh but in recent years it has been over as the cost of production increased due to the hiked prices of utility services, explained sector people.

In addition, the minimum workers’ wage rose to Tk12,500 for entry level workers, which reduces competitiveness, they said.

On top of that, workers productivity is less than Vietnam and the use of technology is much better than Bangladesh.

Foreign investments matter

In moving towards the high-end products manufacturing, foreign direct investment plays a key role. But Foreign Direct Investment (FDI) in the textile and garment sector here in Bangladesh is relatively low.

This is because of a lack of well-developed infrastructure and good governance. In addition, doing business is harder than in Vietnam in case of getting license and utility services.

Higher corporate tax and complexity in the tax system are other barriers in attracting overseas investment.

Bangladesh is not even receiving enough Chinese investment, which is shifting to South Asian nations. Chinese investors are choosing Vietnam for investment in the RMG sector.

Technology adoption crucial

The Vietnam apparel and textile sector is undergoing a digital transformation, optimizing processes and boosting efficiency. They have embraced the latest technology such as WFX PLM, ERP and MES. Manufacturers are using robotics and automation solutions as well as supply chain management.

“If we look at the present situation of the industry in terms of technology use, sustainability practice and safety, it is far better than any time. We have upgraded technology, established an innovation centre and developed a training programme for skill development,” said immediate past BGMEA president Faruque Hassan.

Exporters are now exporting high valued items such as denim, jackets, suits, which contributed to widening the gap with Vietnam. Through research we have identified challenges and opportunities of non-cotton exports, said the business leader.

Contribution of non-cotton products to garment exports increased to 29% from 25% over the last three years and Bangladesh’s export earnings from non-cotton items rose to rise $42bn by 2032 with proper investment, said Hassan.

So, Bangladesh will continue to grab market share and decrease the gap with number one exporter China as well as widen the gap with Vietnam, said Hassan.