Bangladesh aims to double garment exports to Australia in 5 years

Bangladesh has set eyes on doubling its garment exports to Australia, which is one of the largest and potential markets for Bangladeshi apparel, within the next five years.

Entrepreneurs in the sector are optimistic that Bangladesh can capitalise the expected reduction in China’s garment exports to Australia, much like it has successfully done in Europe and the United States.

Despite the upcoming graduation from least developed country (LDC) status in 2026, which could impact duty-free access to the Australian market, Bangladeshi entrepreneurs remain hopeful that the preferential trade benefits for apparel will remain intact.

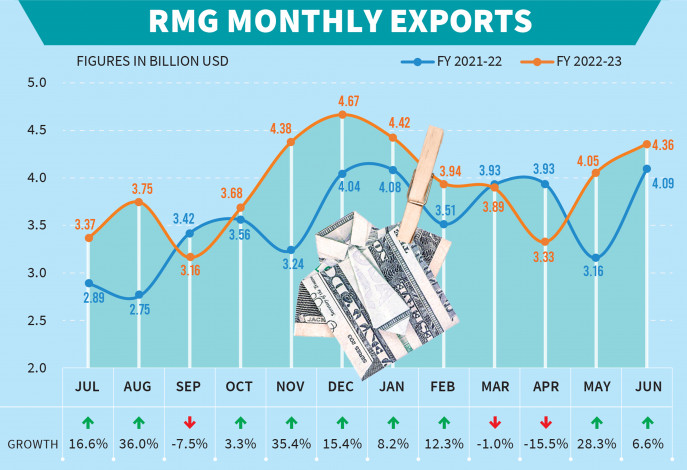

In fiscal 2022-23, Bangladesh’s readymade garment (RMG) exports to Australia reached $1.2 billion, marking an impressive 42% growth despite a global slowdown, as reported by the Bangladesh Garment Manufacturers and Exporters Association (BGMEA).

According to Fibre2Fashion, in 2021, Australia’s total apparel imports amounted to $7.382 billion, with China holding around 63% of the share. Bangladesh ranks as the second-highest apparel exporter to Australia, followed by Vietnam, India, and Indonesia.

To pursue the ambitious goal of doubling RMG exports to Australia within five years, a delegation led by Faruque Hassan, president of the BGMEA, is currently on a visit to the country.

During the visit, the first-ever Bangladesh Apparel Summit took place on 18 July, where the delegation engaged in meetings with representatives from the Australian government, non-governmental organisations, and various brands.

Shahidullah Azim, vice president of BGMEA and a member of the visiting delegation, expressed his confidence in Australia as a highly promising market. He shared, “We anticipate a decline in Chinese garment exports to Australia, and we hope that Bangladesh can fill that void.”

“We have held productive meetings with brands such as Kmart Australia, Cotton On, Target Australia, and others, and received an overwhelmingly positive response,” he added.

Asif Ashraf, director of the BGMEA and a member of the visiting representative team, expressed their hopes for doubling RMG exports to Australia, given the tremendous response received from buyers.

Bangladesh primarily exports its RMG to traditional markets such as the USA, EU, and UK. However, the country is now eyeing non-traditional markets like Australia, Japan, Brazil, India, and China as part of its market diversification strategy.

Continuation of duty-free access to Australian market

During the visit, the clothing lobby group met with fashion brands, members of parliament, Oxfam Australia – a renowned independent and community-based aid and development organisation, and other think-tanks.

According to BGMEA leaders, they reiterated the logic of obtaining duty-free market access to Australia after Bangladesh’s LDC graduation. The BGMEA representatives expressed hope that Australia would consider this proposal very positively.

Last month, the United Kingdom introduced an initiative called the Development Country’s Trading Scheme (DCTS), which would allow Bangladesh to export almost 98% of its products to the UK duty-free.

Shahidullah Azim told TBS, “Canada also is considering duty-free access for Bangladesh’s export products, similar to the UK. We hope Australia will offer us this facility as well.”

However, during the discussions, the Australian side raised concerns about Bangladesh’s labour rights and the recent murder of a workers leader in Gazipur, as well as the issue of the new wage board.

“We explained our position and the current situation regarding these issues, and they were convinced,” he added.

Infographic: TBS

Infographic: TBS