Textile industries can be set up in leased jute mills

From now on, entrepreneurs can set up textile industries by leasing state-owned jute mills. Bangladesh Jute Mill Corporation (BJMC) has brought necessary changes in various conditions and references in this regard.

BJMC has relaxed the policy due to lack of interested entrepreneurs. According to the revised policy, private sector entrepreneurs will now be able to lease state-owned jute mills to produce jute, jute products or textile products. They can work in forward and backward linkages both in jute and textile. At the same time, the lease term has been increased by 10 years to 30 years.

Recently, an international tender prepared for the lease of nine jute mills under the supervision of BJMC to the private sector has said these things after revising the previous policy.

Earlier BJMC had allowed only jute or jute products to be produced in state owned jute mills. In this case, the lease term was 20 years.

According to a BJMC source, entrepreneurs are not only willing to invest in jute and jute products. For this reason, it has been decided to allow the establishment of textile industry which is a promising sector of export potential.

Nasimul Islam, General Manager (Administration and Social Services) of BJMC said, despite repeated attempts to hand over the jute mills to the private sector, we did not get much response from the entrepreneurs. Because of that opportunity is being given to textile. Ten new mill leases have been tendered.

Although the process of re-leasing the closed jute mills to the private sector was initially strong, the pace of leasing slowed down due to economic uncertainty and the subsequent dollar crisis. At the beginning of the preparation of international tenders in 2021, major companies of the country, including Pran, Bay and Akiz Group, expressed their desire to take the lease of state-owned jute mills. Besides, some entrepreneurs from India and UK were also interested in getting lease of jute mills.

However, due to various conditions of the government and the duration of the medium-term lease, the interest of many organizations later declined.

A. Barik, Secretary General, Bangladesh Jute Mill Association said that the reason for private entrepreneurs’ disinterest in state-owned jute mills is the poor condition of the mills and the government’s various conditions.

He said that all the mills of BJMC are very old. The production capacity of these is a quarter of the new machine. Labor costs are several times higher. Apart from this, no development initiative has ever been taken.

Now the entire jute sector is being pushed towards destruction by converting jute into textiles. Textile millers will bring cotton from abroad to make yarn. And the jute farmers of our country will stop jute production without getting the fare price. By reopening these mills, the dream of development of jute will end completely, he added.

Current jute mill leasing status

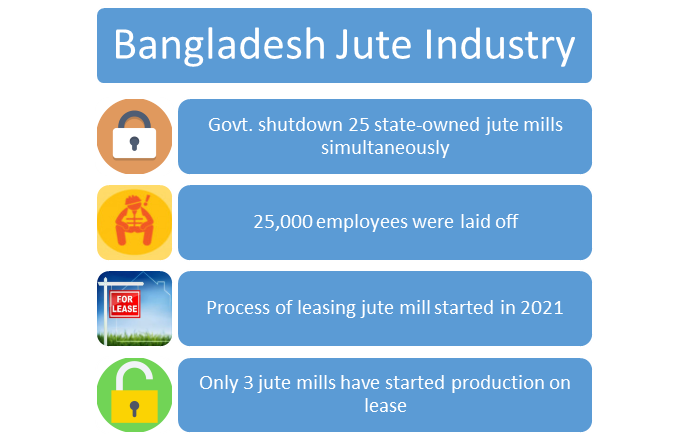

Although started two years ago, so far only three jute mills have gone into production. About 400 crore taka have been invested in it. KFD Jute Mills of Chittagong Region under Unitex Group; Bangladesh Jute Mills of Narsingdi under Bay Group and National Jute Mills under Rashid Group are in operation.

KFD Jute Mills and Bangladesh Jute Mills are currently exporting jute products. Besides, the Rashid Group is using the manufactured products (especially sacks) themselves. They are one of the largest suppliers of rice across the country.

According to BJMC sources, there will be a joint inspection to resume production of the six jute mills soon. They will be handed over after joint inspection of BJMC and selected entrepreneurs.

Besides, three private sector entrepreneurs have been selected for three jute mills in Khulna and Chittagong zones. Four H Apparel is selected for leasing out Mills Furnishing Limited, a non-jute mill in the Chattagram zone; Uni World for Doulatpur Jute Mills, and Akij Jute Mills for Jashore Jute Mills.

Corporation has selected the companies a few days ago. The mills will be handed over to BJMC after paying 24 months’ rent.

On July 1, 2020, the government shutdown 25 state-owned jute mills simultaneously due to losses and excessive production costs. Even though the private jute mills were profiting, the jute mills of BJMC were making losses year after year. Around 25,000 employees were laid off at that time.

Later, the government decided to open the closed jute mills in the private sector. The first international tender was invited in January 2021 to lease 17 of the 25 state-owned jute mills. It was stipulated in the tender that a lessee could only use these jute mills to produce jute, jute products and jute-varieties. The third tender is currently underway, but nine jute mills are yet to be leased.

Jute, known as golden fibers, was once the main cash crop of Bangladesh. Bangladesh ranks second in the world in jute production and first in the world in exporting jute and jute products. At present, Bangladesh manufactures 285 types of products from jute and exports them abroad. Currently, jute products worth $1.2 billion are being exported annually.