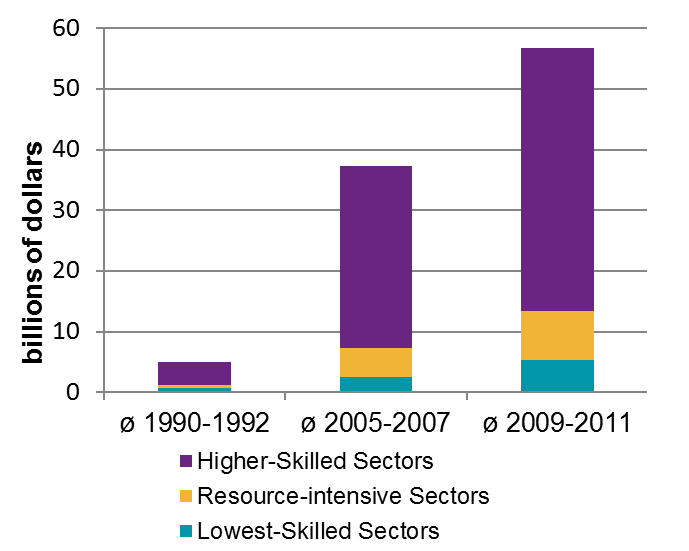

Foreign direct investment (FDI) in developing countries has a bad reputation. In some discussions, it is presented as tantamount to postcolonial exploitation of raw materials and cheap labour. However, recent data shows that FDI in developing countries increasingly flows to medium and high-skilled manufacturing sectors, involving elevated income levels (Figure 1). What’s more, many emerging economies have built their growth on FDI flows.

Quality FDI

The trick is to attract “quality FDI” that links foreign investors into the local host country economy.

Quality FDI is characterised as:

- contributing to the creation of decent and value-adding jobs;

- enhancing the skill base of host economies;

- facilitating the transfer of technology, knowledge and know-how;

- boosting competitiveness of domestic firms and enabling their access to markets; and

- operating in a socially and environmentally responsible manner.

To achieve this, host countries cannot just wait and see what international market forces may bring to them. Rather, they need tailored policies to overcome domestic imperfections that hinder the smooth integration of indigenous and foreign firms into world-wide supply-chain networks.

Recent research offers evidence for strategies in developing countries that successfully turned FDI into quality FDI. The idea underlying the following suggestions is to learn the lessons from experience (Moran et al., 2016).

Figure 1: Manufacturing FDI flows to developing countries

Source: UNCTAD 2014

Strategies for attracting quality FDI

- Open markets and allow for FDI inflows. Reduce restrictions on FDI. Provide open, transparent and dependable conditions for all kinds of firms, whether foreign or domestic, including: ease of doing business, access to imports, relatively flexible labour markets and protection of intellectual property rights.

- Set up an Investment Promotion Agency (IPA). A successful IPA could target suitable foreign investors and could then become the link between them and the domestic economy. On the one side, it should act as a one-stop shop for the requirements investors demand from the host country. On the other side, it should act as a catalyst in the host’s domestic economy, prompting it to provide top notch infrastructure and ready access to skilled workers, technicians, engineers and managers that may be required to attract such investors (Moran, 2014; Barnes et al., 2015; Harding and Javorcig, 2012).Moreover, it should engage in after-investment care, acknowledging the demonstration effects from satisfied investors, the potential for reinvestments, and the potential for cluster-development because of follow-up investments.

- Think carefully about sectors/activities to be targeted. Investment and location decisions of suppliers may be dependent on those of prime multinational investors in the host economy (McKinsey, 2001; Javorcik et al., 2006).

- Put up the infrastructure required for a quality investor: such as sufficient close-by transport facilities (airport, ports), adequate and reliable supply of energy, provision of an adequately skilled workforce, facilities for the vocational training of specialised workers, ideally designed in cooperation with the investor (Ibid.).

- Strengthen backward linkages from FDI into the indigenous economy. Allow for the competitive pressure of foreign entrants on their local suppliers to raise competitiveness of the latter (Rhee et al., 1990), and allow for multiple forms of direct assistance from foreign to domestic firms, in the form of training, help with setting up production lines, management coaching regarding strategy and financial planning, financing, assistance with quality control and introduction to export markets (Javorcik and Spatareanu, 2005; Blalock and Gertler, 2008; Godart and Görg, 2013; Görg and Seric, 2016).

- Encourage spillovers from FDI into the indigenous economy. Local firms set up by managers who had started in multinational firms are more successful and more productive than others (Görg and Strobl, 2005). Managers of local firms gain knowledge of new technologies and marketing techniques by studying and imitating their multinational competitors (Javorcic and Spatareanu, 2005; Boly et al., 2015). Similarly, worker movements from multinational to local firms spread knowledge and skills.

- Encourage first-time foreign direct investors. Foreign firms that are not already part of an extensive network of subsidiaries are readier to accept linkages to domestic suppliers (Amendolagine et al., 2015).

- Encourage foreign direct investors from diaspora members. These are also more likely to generate linkages to domestic firms and contribute to the internationalisation of the host country (Boly et al., 2014).

- Provide access to credit by reforming domestic financial markets. Setting-up a business-friendly financial system helps indigenous firms to respond to challenges and impulses from foreign entrants, to self-select into supplier status, and to thereby grow and prosper (Alfaro et al., 2009).

- Set up a vendor development programme to support the match making process between foreign customer and local supplier. To strengthen the capacity of the domestic economy, it may offer financing opportunities to indigenous suppliers for required investment on the basis of purchase contracts from foreign buyers (see the Local Industry Upgrading Program (LIUP) of Singapore), or reimburse the salary of a manager in a foreign plant acting as a talent scout among domestic suppliers (see the example of the Singapore’s Economic Development Board).

- Shape Export Processing Zones (EPZs) in a way that they spearhead into the domestic economy. Avoid EPZ regulations discriminating against the creation of local supplier relationships. Set up a secondary industrial zone for local suppliers, be it as a geographical site adjacent to formal export processing zones, or be it as a legal status allowing for easy foreign-domestic linkages with, for example, databanks and “marriage counselors”, to assist in supplier selection (Moran et al., 2016).

- Refocus the “Who Is Us?” perspective and address related concerns adequately. “Us” should be understood as the firms that are most beneficial to the domestic economy irrespective of the nationality of their owners. Therefore, the firms that create the highest-skilled and highest-paying jobs, the least-expensive products, and the most competitive exports are considered “Us” (Reich, 1990).

- Be patient and rely on the gradual structural transformation of the domestic economy. Investors may come in waves. For example, first, investors in thermionic tubes, valves and transistors, then, in television and broadcasting systems, and finally, in computers, computer peripherals, and data processing systems. Along such avenues, FDI may contribute to diversifying and upgrading domestic production (Amendolagine et al., 2013; Moran, 2014; Barnes et al., 2015).

Notes of caution

- Do not insist that all inward FDI be at the most sophisticated technical level. International firms with middle-level technology can provide benefits and connect up with local suppliers whose capabilities match the foreign firms more closely (Boly et al., 2015; Pérez-Villar and Seric, 2015).

- Do not confound supply-chain creation with support for SMEs. Medium-sized and larger indigenous companies are often more apt to link with foreign investors in win-win scenarios than their smaller counterparts (UNCTAD, 2011).

- Do not subsidise specific companies. Public support should take the more general form of creating reliable infrastructure and offering specific vocational training.

The role of external donors and developed countries

- There is still a vital role for external donors such as developed countries and multilateral financial institutions in supporting developing countries. The explosion of international private sector investment flows has not eliminated the need to support growth-and-development programmes in developing countries, even beyond emergency aid and pure poverty reduction programmes.

- Developed countries should improve the functioning of financial markets worldwide, to enable developing countries to harness their FDI. For instance, better financial market institutions, even in FDI source countries, help overcoming deficient financial markets in host countries, thus increasing FDI flows to developing countries (Görg and Kersting; forthcoming, Donaubauer et al.; 2016).

- Developed countries should intensify support for effective FDI promotion of developing countries. Targeting large investors pro-actively in particular sectors requires specific and expensive expertise on the side of the IPAs, with a professional staff to be paid at internationally competitive salaries, the costs of which could be borne by external donors. Moreover, developing countries need help in learning how to use IPAs effectively for marketing their countries to multinational investors.

Conclusion

The essence of the suggestions is to advocate a light form of industrial policy: a policy that seeks to hitch FDI to development goals and to generate backward linkages as deep as possible into the host economy. The evidence cited here shows that progress in developing countries can be achieved without either substantial levels of protection or large amounts of direct support, through focusing on Quality FDI.

References

Alfaro, L., Kalemli-Ozcan, S. and Sayek, S. (2009), FDI, productivity and financial development, World Economy, 32(1), 111-136.

Amendolagine, V., Boly, A., Coniglio, N. D., Prota, F. and Seric, A. (2013), FDI and Local Linkages in Developing Countries: Evidence from Sub-Saharan Africa, World Development, 50, 41-56.

Barnes, J. and Morris, M. (2008), “Staying alive in the global automotive industry: What can developing economies learn from South Africa about linking into global value chains?”, The European Journal of Development Research, 20(1), 31-55.

Barnes, J., Black, A. and Techakanont, K. (2015), “Industrial Policy, Multinational Strategy and Domestic Capability: A Comparative Analysis of the Development of South Africa’s and Thailand’s Automotive Industries”. The European Journal of Development Research.

Blalock, G. and Gertler, P. J. (2008), “Welfare gains from foreign direct investment through technology transfer to local suppliers”, Journal of International Economics, 74(2), 402-421.

Boly, A., Coniglio, N. D. and Prota, F. A. (2015), Which Domestic Firms Benefit from FDI? Evidence from Selected African Countries. Development Policy Review, 33(5), 615–636.

Boly, A., Coniglio, N. D., Prota, F. and Seric, A. (2014), Diaspora Investments and Firm Export Performance in Selected Sub-Saharan African Countries. World Development, 59, 422-433.

Donaubauer, J., Neumayer, E. and Nunnenkamp, P. (2016), Financial Market Development in Host and Source Countries and Its Effects on Bilateral FDI, Kiel Working Paper 2029. Kiel: Institut für Weltwirtschaft.

Godart, O. and Görg, H. (2013), “Suppliers of Multinationals and the Forced Linkage Effect: Evidence from Firm Level Data”, Journal of Economic Behavior and Organization, 94(C), 393-404.

Görg, H. and Seric, A. (2016), “Linkages with Multinationals and Domestic Firm Performance: The Role of Assistance for Local Firms”, European Journal of Development Research, 28(4), 605-624.

Görg, H. and Strobl, E. (2005), “Spillovers from Foreign Firms through Worker Mobility: An Empirical Investigation”, Scandinavian Journal of Economics, 107(4), 693-709.

Görg, H. and Kersting, E. (Forthcoming), “Vertical Integration and Supplier Finance”, Canadian Journal of Economics.

Harding, T. and Javorcik, B. S. (2011), “Roll Out the Red Carpet and They Will Come: Investment Promotion and FDI Inflows”, Economic Journal, 121(557), 1445-1476.

Harding, T. and Javorcik, B. S. (2012), “Foreign Direct Investment and Export Upgrading”, The Review of Economics and Statistics, 94(4), 964-980.

Javorcik, B. S. and Spatareanu, M. (2005), Disentangling FDI Spillover Effects: What Do Firm Perceptions Tell Us?, in Moran, T. H., Graham, E. M. and Blomström, M. (Eds.), Does Foreign Direct Investment Promote Development?, Washington, DC: Institute for International Economics, Centre for Global Economics.

Javorcik, B. S., Keller, W. and Tybout, J. R. (2006), “Openness and Industrial Responses in a Wal-Mart World: A Case Study of Mexican Soaps, Detergents and Surfactant Producers”, The National Bureau of Economic Research Working Paper (12457).

Lewis, B. et al. (2001), “India: The growth imperative”. McKinsey Global Institute.

Moran, T. H. (2009), “Three threats: an analytical framework for the CFIUS process”. Washington, DC: Peterson Institute for International Economics.

Moran, T. H. (2014), “Foreign Investment and Supply Chains from Emerging Markets: Recurring Problems and Demonstrated Solutions”. Working Paper Series Peter G, Peterson Institute for International Economics (IIE)(14-12).

Moran, T. H., Görg, H. and Seric, A. (2016), Quality FDI and Supply-Chains in Manufacturing. Overcoming Obstacles and Supporting Development. UNIDO and Kiel Institute for the World Economy, Vienna Investment Conference 2016, Discussion Paper.

Pérez-Villar, L. and Seric, A. (2015), “Multinationals in Sub-Saharan Africa: Domestic Linkages and Institutional Distance”, International Economics, 142, 94-117.

Reich, R. (1990), “Who Is Us?”. Harvard Business Review, 68(1), 53-64.

Rhee, Y. W., Katterback, K. and White, J. (1990), Free Trade Zones in Export Strategies. Washington, DC: The World Bank Industry Development Division.

UNCTAD (2011), How to Create and Benefit from FDI-SME Linkages: Lessons from Malaysia and Singapore. Geneva: United Nations Conference on Trade and Development.