How entrepreneurial daring and sensible government policy enabled Bangladeshi exporters to cash in on geopolitical changes, absorb surging input prices, and beat the raging pandemic

The year 2020 was the worst year for the 40-year-old apparel industry of Bangladesh, the country’s main export earner and the source of livelihood for more than four million people.

That year witnessed discounts, deferred shipments, and about 1,150 apparel makers facing order cancellations or delayed shipments worth $3.18 billion, according to data from the Bangladesh Garment Manufacturers and Exporters Association (BGMEA).

But, leaving difficult times behind them, entrepreneurs saw good times again in 2021.

With the exception of a couple of months, all of 2021 has been a great year for the apparel sector.

Due to an increase in purchase orders in 2021, many entrepreneurs have made new investments to cope with the demand by increasing the capacity of factories.

The industry that many feared was on the brink at the end of 2020 has turned strongly around in 2021.

“2020 was one of the worst years for the global economy, and we were no exception to this,” said Faruque Hassan, president of the BGMEA.

He also said, however, the sector had tried its best to keep the wheels of the economy moving this year, and that the players were able to reap the benefits.

“That is why we can say that 2021 has been a year of turning around,” he added.

Export earnings

The apparel sector is responsible for more than 82% of the total export earnings of the country.

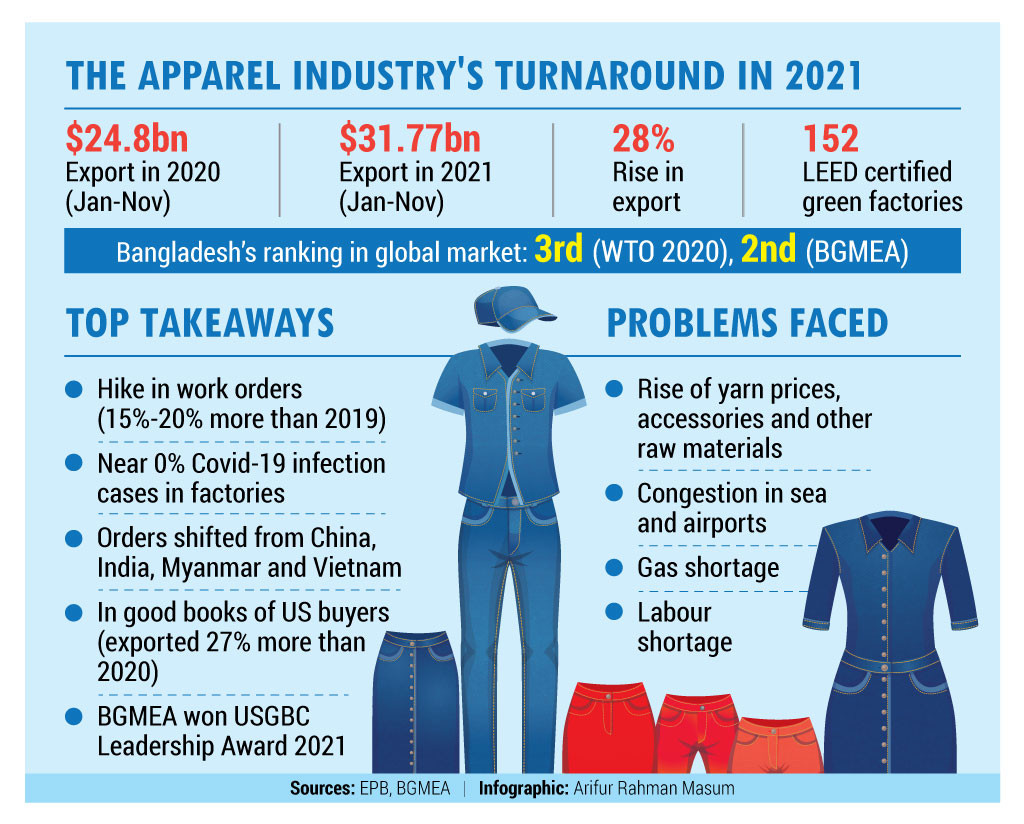

According to the Export Promotion Bureau (EPB), Bangladesh earned $24.8 billion in the first 11 months (January-November) of 2020.

During the same period this year, the apparel sector earned $31.77 billion, fetching a growth of 28%.

Another gain of 2021 was that the apparel items of Bangladesh were in the good books of American buyers as they mostly chose our products over others.

The United States is the top destination for RMG exports from Bangladesh.

Bangladesh outpaced China, Vietnam, and Indonesia in terms of growth in apparel exports to the United States in the first 10 months of this year, according to Otexa.

The country also fetched $5.7 billion from the destination, up by around 27% from the same period in 2020, where China’s exports amounted to $16 billion with a 25% growth, followed by Vietnam 14% and Indonesia 10%.

Shahiddullah Azim, vice president of BGMEA said that Bangladeshi clothing has good potential in the US market.

The year began with good news: Covid-19 jabs

Bangladeshi apparel exporters witnessed an increase in interest from global buyers in placing new work orders following the commencement of the Covid-19 vaccination program in several export destinations at the beginning of 2021.

As the situation started to improve and people started getting vaccinated, buyers got ready for the upcoming spring and summer seasons.

Debate on keeping factories operational

In March, the country faced a fresh wave of the Covid-19 cases as the numbers increased significantly and the government imposed restrictions on movement repeatedly to prevent the surge.

However, the members of BGMEA, BKMEA, and BTMA demanded keeping their factories open despite the strict lockdown as they feared if the factories remained closed, work orders would get canceled and the shipments of orders would also be affected.

The government decided to permit apparel factories to remain operational during the lockdown and ordered them to follow all the health and safety protocols very strictly.

“There was a lot of controversy regarding whether to keep the factories open or not, but it is now clear that the decision we made to balance life and livelihood with the help of the government was a wise one,” said the BGMEA president.

He also said that each of the members was keen to follow the health directives and safety protocols.

Although there was a surge of infection cases all over the country, it was almost zero in the apparel sector.

Your journey ceases, mine begins

Apparel manufacturers were enjoying a steady flow of work orders showing that the ball was rolling, similar to the pre-pandemic period.

The prevailing Covid-19 situations in India and Vietnam, as well as the recent political unrest in Myanmar, have both had an impact on shifting orders to Bangladesh.

Orders also shifted from China because of increased tariffs due to the US-China trade war.

Shahidullah Azim said that Bangladesh had plenty of purchase orders from the buyers as their stores were fully operational after mass vaccination programs and in turn, Bangladesh reportedly surpassed Vietnam by November.

The US has shifted orders from China due to the trade war, from Myanmar due to its military rule, and from India due to an unsteady Covid-19 situation, he added.

According to the BGMEA officials, Bangladesh received 15%-20% more orders in comparison to 2019.

Some discomforts

In 2021, many entrepreneurs increased production capacity to grab the additional purchase orders and some of them have also introduced second shifts.

But many entrepreneurs have been disappointed by the problem of not getting enough workers as per the demand.

The sector suffered all year round with the shortage of raw materials even though they were in a favorable position for export.

The price of yarn, in particular, rose abnormally which led the owners of the garment and textile mills to face problems.

Later, they reached a solution to overcome the chaos even though the price was too high but entrepreneurs fear that they might suffer again next year.

Global price hike also pummels the backward linkage of the RMG industry. The steep rise in prices of yarn, kraft paper, polyester, and other accessories in the global market has threatened the local apparel industry.

Moreover, the sector also suffered from global and domestic post congestion, gas shortage, and airport issues.

But the biggest upset for the industry was Vietnam’s overtaking Bangladesh in the global apparel market and making them the second-largest global RMG exporter.

The market value for Bangladesh was $28 billion in the year 2020, where the share of Vietnam was $29 billion.

However, the local manufacturers believe that Bangladesh has already surpassed Vietnam again.

“The WTO report was based on the data of 2020, which was the worst year for the RMG industry. We have already surpassed Vietnam by exporting $2 billion more in 2021. Hopefully, the WTO will release the new data in 2022,” said Faruque Hassan.

Bangladesh has greener pastures for apparel

Bangladesh is a greenfield for the growing apparel sector.

Faruque Hassan said that in 2021, the number of LEED Green garments factories certified by the US Green Building Council (USGBC) has reached 152 and 40 out of the world’s top 100 garment factories are in Bangladesh.

“500 more factories are in the process of getting LEED certification. BGMEA also pledges to the Green Button, which is a global seal of excellence in sustainability by the government of Germany,” he added.

He also said that BGMEA was awarded the “2021: USGBC Leadership Award” for its outstanding contribution to promoting green factories.

“Bangladesh is one of the least polluting countries in the world, emitting only 0.24% of global carbon emissions annually. We are trying to figure out how to reduce it further,” he added.

Omicron

If the Omicron variant does not create any unusual situation, exporters expect that the first six to seven months of the next year will be a good time for them as well.

Manufacturers also believe that the country should have a long-term strategy to sustain the historic export growth of 2021.

To increase productivity, companies need to invest in technology-based skills growth and focus on product diversification to compete in the global market.

Moreover, the development of ease of doing business, business-friendly governmental policies, and the goodwill of the entrepreneurs will keep the industry afloat for years to come.