Garments sector feeling confident of meeting orders for next season

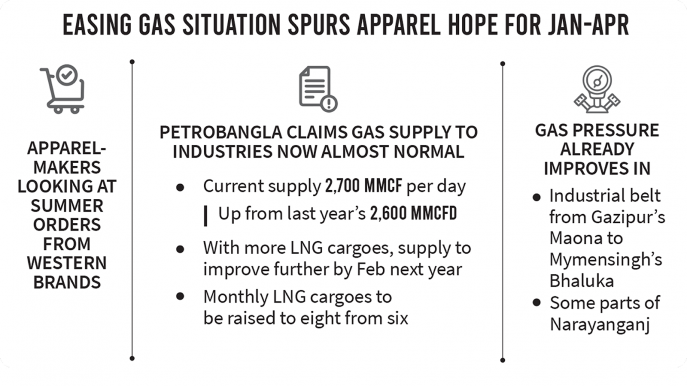

The garment industry expects to come out of the effects of the last few months of a slow period in the coming summer with the greatly improved gas and power supply situation in the industrial belt.

Industry leaders say top foreign buyers are making queries, showing interest to place orders and apparel makers are confident that with the improved energy and power situation they would be able to recover in a few months.

“If the sales continue in the current trend, and we get consistent power and gas supply to the factories, the local apparel industry will be on track again by April next year,” a leading apparel-maker told The Business Standard.

The Business Standard talked to a dozen local apparel exporters last week and most of them said gas supply to their factories has improved than what it was in July or August this year.

Gas supply to industries in Gazipur’s Maona to Mymensingh’s Bhaluka belt has improved, according to Md Fazlul Hoque, managing director of Israq Spinning Mills Limited. Mohammad Hatem, executive president of the Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA), said the supply is now better in some areas of Narayanganj.

Some of the entrepreneurs, however, said the gas supply has not improved much in some areas of Manikganj, Savar, Narayanganj’s Araihazar and Gazipur readymade garment hubs.

But the state-owned Petrobangla claims gas crunch to industries is now largely resolved thanks to a number of belt-tightening measures by the government including power rationing and office hour rescheduling. The steps, coupled with a winter-led low power consumption, took off the pressure from gas, letting Petrobangla to prioritise the industrial customers.

“There might be some industrial consumers at the very end of the supply line facing a bit of poor gas pressure. But an entire industrial area should not have any gas issue now,” Nazmul Ahsan, chairman of Petrobangla, told The Business Standard on Wednesday.

He said the state-owned company, which explores and supplies fuel and gas, is now supplying 2,700 million cubic feet (mmcf) of gas per day to the national grid – up from 2,600 mmcf in the corresponding period last year.

Nazmul Ahsan said the supply will continue getting better until February next year. “Since our demand for gas will start to edge up from March after the winter is over, we are considering additional imports of LNG [liquefied natural gas].”

Local apparel-makers are heavily dependent on imported cotton – the key raw material for readymade garment items. Making yarn from cotton, manufacturing fabrics and dyeing require massive amounts of power. At smaller private power plants, garment manufacturers generate the electricity from gas to keep the production lines running round the clock.

Big hope, but is it immune to recession?

Clothing and textile production is by far the biggest industry in Bangladesh, which profited from surging sales when the pandemic waned and consumers rushed for shopping to meet pent-up demands.

But apparel orders to the world’s largest garment exporter after China had been slowing since July because of Russia’s invasion of Ukraine, western sanctions on Moscow and fallouts stemming from rising inflation globally, said entrepreneurs.

In the home front, apparel factories were plagued by rolling blackouts, an unreliable gas pressure and raw material supply crunch as the government had to tighten its belt to protect the fast-depleting forex reserve.

Local apparel industry is the top export earner for Bangladesh. The country exported apparel worth $42 billion in FY22 – which accounted for around 81% of the country’s export earnings.

The local and global economic situation portrayed a gloomy outlook for the apparel-makers. According to export data, apparel exports registered a negative growth in September 2022 for the first time in recent years. The outlook returned to the positive track again in October and made a big jump in November.

The local apparel industry makes basic clothing items like shirts, t-shirts, denim pants, womenswear and kid items. According to entrepreneurs, the low-end products are kind of immune to the fear of a global recession.

People would still have to wear garments, even during leaner economic times, according to Commerce Minister Tipu Munshi.

There are a few peak fashion-making and export times – basically centring the winter and summer. Ahead of the summer, Bangladeshi manufacturers usually remain busy in January-April every year.

Even if there is a recession next year, local manufacturers said basic item orders would not tumble much. Besides, they expect to seize some of the work orders shifting from China owing to Washington-Beijing political tensions and Covid rules.

Strong business commitments now pay off

Even during the tight economic situation, local manufacturers showed firm commitment to the delivery deadlines by compromising the profit margin.

In addition to increasing the use of diesel to deal with power situations, some entrepreneurs adopted modern technology at an additional cost. Some continued the production lines by alternative means like burning garment waste and paddy husk to run the boilers.

In the face of the gas and power crunch, local apparel-makers had been accumulating more fashion wastes at spinning and weaving stages. The energy supply allowed only 12-hour production a day. But the entrepreneurs did not give up, Kutubuddin Ahmed, founder of Envoy Textiles, told The Business Standard.

He said this concrete trade confidence will pay off in the upcoming months.

“We are expecting a good order flow in January. We need to fix the energy issues before that,” Fazlee Shamim Ehsan, managing director of Fatullah Apparels, told The Business Standard.

What about after April?

From Qatar and Oman under the long-term contracts, Petrobangla currently imports six cargoes of LNG on an average per month. The import, according to energy sources, could be extended to eight from March next year to meet the peak summertime demand.

With the additional LNG and local production, the total gas supply will be around 2900 mmcf in March, said a source at the Energy and Mineral Resource Division.

Apart from long-term LNG imports, the government is also trying to increase LNG supply to the national grid by taking Brunei and Saudi Arabia on board.

Recently, a team from the Energy and Mineral Resources Division toured Brunei to discuss the scopes of importing LNG from the country. Besides, Saudi Arabia is another option for Bangladesh to increase its gas supply.

Local apparel industry is the top export earner for Bangladesh. The country exported apparel worth $42 billion in FY22 – which accounted for around 81% of the country’s export earnings.

The local and global economic situation portrayed a gloomy outlook for the apparel-makers. According to export data, apparel exports registered a negative growth in September 2022 for the first time in recent years. The outlook returned to the positive track again in October and made a big jump in November.

The local apparel industry makes basic clothing items like shirts, t-shirts, denim pants, womenswear and kid items. According to entrepreneurs, the low-end products are kind of immune to the fear of a global recession.

People would still have to wear garments, even during leaner economic times, according to Commerce Minister Tipu Munshi.

There are a few peak fashion-making and export times – basically centring the winter and summer. Ahead of the summer, Bangladeshi manufacturers usually remain busy in January-April every year.

Even if there is a recession next year, local manufacturers said basic item orders would not tumble much. Besides, they expect to seize some of the work orders shifting from China owing to Washington-Beijing political tensions and Covid rules.

Strong business commitments now pay off

Even during the tight economic situation, local manufacturers showed firm commitment to the delivery deadlines by compromising the profit margin.

In addition to increasing the use of diesel to deal with power situations, some entrepreneurs adopted modern technology at an additional cost. Some continued the production lines by alternative means like burning garment waste and paddy husk to run the boilers.

In the face of the gas and power crunch, local apparel-makers had been accumulating more fashion wastes at spinning and weaving stages. The energy supply allowed only 12-hour production a day. But the entrepreneurs did not give up, Kutubuddin Ahmed, founder of Envoy Textiles, told The Business Standard.

He said this concrete trade confidence will pay off in the upcoming months.

“We are expecting a good order flow in January. We need to fix the energy issues before that,” Fazlee Shamim Ehsan, managing director of Fatullah Apparels, told The Business Standard.

What about after April?

From Qatar and Oman under the long-term contracts, Petrobangla currently imports six cargoes of LNG on an average per month. The import, according to energy sources, could be extended to eight from March next year to meet the peak summertime demand.

With the additional LNG and local production, the total gas supply will be around 2900 mmcf in March, said a source at the Energy and Mineral Resource Division.

Apart from long-term LNG imports, the government is also trying to increase LNG supply to the national grid by taking Brunei and Saudi Arabia on board.

Recently, a team from the Energy and Mineral Resources Division toured Brunei to discuss the scopes of importing LNG from the country. Besides, Saudi Arabia is another option for Bangladesh to increase its gas supply.