Bangladesh’s earnings from merchandise shipment crossed the $5-billion mark for the first time in November, a major boost for the country reeling from the foreign exchange crisis, official figures showed yesterday.

It came despite a gloomy global economic scenario stemming from the Russia-Ukraine war and the dragging impacts of Covid-19 and amid warnings from the manufacturers that exports could slide amid the persisting higher inflation in the developed markets.

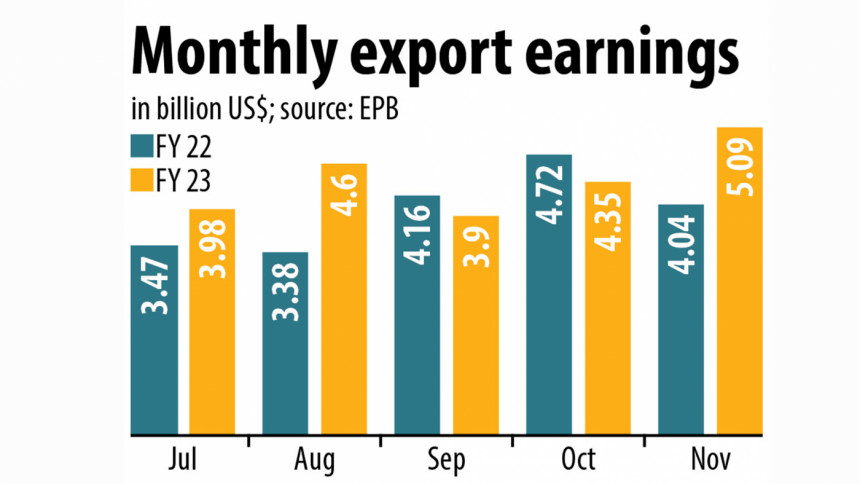

Last month, exporters brought in $5.09 billion, the highest in a single month, according to provisional data from the Export Promotion Bureau (EPB), which is yet to publish the full export data for November. It was up 26.01 per cent from November last year.

The previous monthly high was recorded in June when the merchandise shipment surged to $4.908 billion.

The record exports would extend some breathing space to Bangladesh since the country’s foreign currency reserves are on the decline owing to the higher import payments.

Exports grew 10.89 per cent year-on-year to $21.94 billion in July-November, EPB data showed.

“This is an extraordinary export performance,” said Senior Commerce Secretary Tapan Kanti Ghosh.

“The demand for locally made garment items is still very high despite the higher inflation in Europe.”

Bangladesh is a dominant supplier in basic garment items and the demand for apparel products has remained strong among the consumers amid the runaway cost of living.

“Still, we did not expect such a big jump in export growth in a time of crisis,” Ghosh said.

He said the good thing is that inflation the US, the single largest export market for Bangladesh, has started falling.

“This has inspired the consumers to spend more.”

In the US, consumer prices rose 7.7 per cent in October, less than the 7.9 per cent that analysts had expected and down from 8.2 per cent in the year through September.

A forecast by the National Retail Federation in October said holiday sales in the US during November and December are expected to rise up to 8 per cent to as much as $960 billion.

Inflation, however, has remained at an elevated level in Europe, which accounts for more than 60 per cent of Bangladesh’s shipment, because of the war-induced energy crisis. The eurozone inflation hit 10.7 per cent last month.

Local garment exporters say international retailers and brands are coming back with a handful of work orders as their stock of unsold products is waning rapidly. Apparel shipment represents about 85 per cent of the national export earnings.

This is because, for the first time in three years, which witnessed the outbreak of the coronavirus pandemic and the war, western retailers and brands are recoding a massive sale ahead of Christmas.

Faruque Hassan, president of the Bangladesh Garment Manufacturers and Exporters Association, said recently international retailers and brands have started paying a bit higher prices to local suppliers to help them absorb the higher cost of production driven by the escalated prices of raw materials in the global markets.

Moreover, Bangladesh has also started exporting more high-end value-added garment items, which have driven up earnings, he said.

SM Khaled, managing director of Snowtex, expects the export of garment items to continue to grow from January.

The country is looking to exports and remittance, which grew 4.5 per cent to $1.59 billion last month, to replenish its forex reserves and avert any major economic crisis.

The reserves fell to $33.86 billion on Wednesday, down more than 26 per cent from $45.95 billion in February, the month when the war broke out.

Abdur Razzaque, chairman of the Research and Policy Integration for Development, a think-tank, described the export growth as unusual.

“And it is difficult to explain because of the reaction of exporters in the recent weeks after they started facing massive load-shedding and the gas crisis and the slowing order from buyers abroad.”

“It will, however, give some relief to the economy if the data is accurate,” said Razzaque.

Yet, the biggest concern that the major economies would fall into recession is still there, he warned.

One possible explanation for the higher exports could be, he said, the relocation of orders from China because of the supply disruption amid Covid-19-related restrictions in the world’s second-largest economy.

“Eventually how much of the orders would materialise would depend on the actual export proceeds coming through the banking channel.”

Zahid Hussain, a former lead economist of the World Bank Bangladesh, said some large exporters expressed surprise after the release of export data in October.

“So, there is a question about the authenticity of data.”

The divergence between export shipment and receipt data has widened in the recent period. If there is any growth in export earnings, that should come from the US as consumer confidence is largely positive in the world’s biggest economy, he said.

The third quarter data for the current calendar year showed that the US economy grew 2.9 per cent. It was unexpected and many assumed that the US economy was falling into recession.

Hussain also said orders are diverting from China and this may bring some unexpected growth to export earnings.

“It is a very good development. The question is whether it will sustain as the recession fears in the US economy have not been over yet. Questions have also remained whether orders diverted from China will sustain as the country is moving away from its zero-Covid position.”

Another positive side, according to Hussain, is the peak of the appreciation of the US dollar globally seems to be over.

“Our products will be attractive in the export markets if the American greenback depreciates,” he said.