Export earnings from major non-RMG (ready-made garment) sectors like jute, agricultural, frozen and live fish, chemical and engineering products witnessed negative growth in the first half of this fiscal.

Exporters have attributed some internal and external factors, including a decline in global demand mainly due to the Russia-Ukraine war, to this fall in export performance.

Amid this war-hit economic sloth in major destinations, data shows, RMG sustained double-digit growth during the July-January period of fiscal year (FY) 2023.

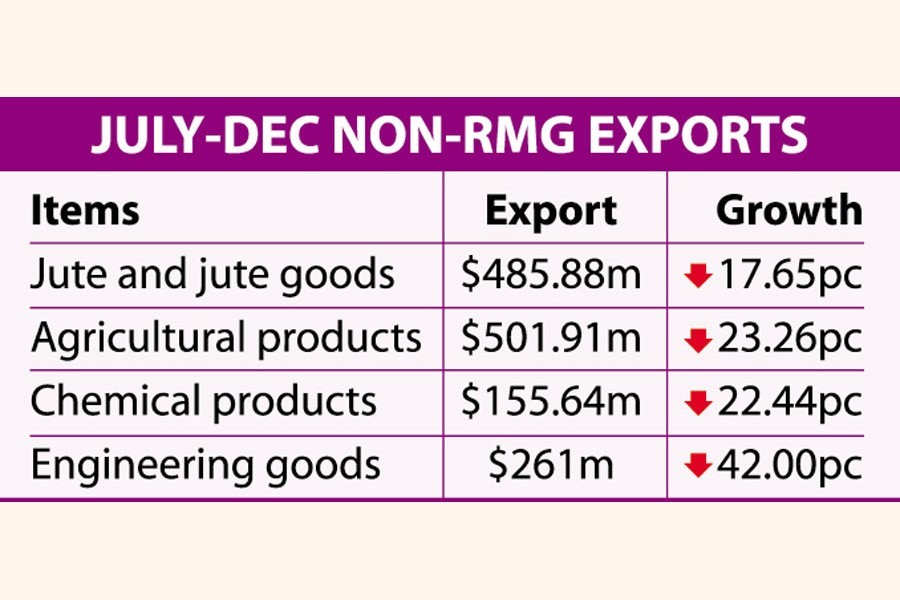

According to the Export Promotion Bureau (EPB), jute and jute goods recorded 17.65-per cent negative growth to $485.88 million in the first half of FY23.

It was $590.05 million in the same period last fiscal.

Bangladesh fetched $1.12 billion from jute and jute goods exports in FY22.

Agricultural products, which fetched $1.16 billion in FY22, earned $501.91 million in FY23 marking 23.26-per cent fall, down from $654.04 million, data showed.

Export of chemical products, including pharmaceuticals, declined by 22.44 per cent to $155.64 million during first half of FY23 than $200.67-million earnings in the corresponding period of FY22.

At the same time, earnings from engineering goods, including engineering equipment and bicycle, witnessed 42-per cent negative growth to $261 million down from $444.32 million, according to EPB data.

When asked, Bangladesh Jute Mills Association secretary general Abdul Barik Khan ascribed multiple factors, including the Indian anti-dumping duty, to this drop in export earnings.

“Besides, both Covid and the war have had a negative impact on our exports as they have eaten up the demands for locally produced jute goods,” he said.

Jute goods are losing competitiveness for high cost fuelled by high bank interest, among others, he noted, adding that quality products need to be exported with a competitive rate.

The sector is also deprived of required policy support as the mandatory jute packaging act is yet to be implemented fully, Mr Khan alleged.

Again, jute as an agricultural product is yet to enjoy the benefits given to other agri-goods, he cited.

Policy Exchange Bangladesh chairman and CEO Dr M Masrur Reaz at a recent event on export diversification identified some key barriers at production, post-harvest, processing and marketing levels to developing export-oriented industrial agriculture.

Total factor productivity challenges result in high cost of processing input while there is unawareness of good agricultural practices, access to low-cost credit as 81-per cent loans farmers borrow from different sources at 19-63 per cent rates, he said.

He also cited import dependence on processing ingredients and absence of national strategy on agribusiness, knowledge of and technology for post-harvest management, high percentage of post-harvest loss and absence of logistic support both in backward and forward linkages as barriers.

Mr Reaz, however, called for some policy priorities for developing an industrial agribusiness sector, saying that agribusiness has huge prospects.

He sought a coordination mechanism and a national agribusiness policy to give the sector a vision, simplify procedures to start and operate a business in the sector and frame a standard export guideline for halal meat to encourage investment and exports.

He suggested incentivising animal feed industry, investment in temperature-controlled logistics and cold chains to decrease post-harvest losses significantly, improving storage and packaging to raise productivity particularly for high-value products, improvement in testing labs and expand export opportunities to foreign markets that require end-to-end cold chains.

Talking to the FE, frozen and live-fish exporters attributed this downswing in demand for fish products upmarket, mainly in the European Union, to the influence of hyperinflation amid the war.

They also attributed this failure to introduce low-cost variety of shrimp like vannamei despite making several attempts over the years.

After a rise in earnings in the two consecutive fiscals, frozen and live-fish earnings fell by 27.33 per cent to $246.38 million during the period under review from $339.02 million in FY22, revealed EPB data.

Bangladesh Frozen Foods Exporters Association president Amin Ullah said export of the item has been on the decline for over a decade for raw material shortages, reduction in farming area and a fall in global demand.

He said both prices and demand for frozen fish declined in the major markets, especially in the EU, as the global market is flooded with vannamei.

When asked, light-engineering insiders identified factors like outdated technology, low productivity and lack of industrial facilities as major challenges hindering export growth of the sector.

They also cited poor quality of products, lack of access to finance, high price and unavailability of quality raw materials, and lack of policy support as challenges facing the industry.

Bangladesh Engineering Industry Owners Association president Abdur Razzaque emphasised timely implementation of the recently adopted time-bound action plan to help the sector flourish, generate employment and increase export earnings.

According to a latest RAPID survey, most conventional machines used by manufacturers are too old as some are found to be used for over 30 years now against their average age of 20 years.

It also finds that the industry falls short of ensuring quality primarily for substandard raw materials, outdated equipment, untrained labour and poor designs.

Meantime, Bangladesh fetched $27.31 billion from merchandise exports during the period in question while RMG (knit and woven items) earned $22.99 billion, marking 15.56-per cent year-on-year growth.

On the other hand, home textile like bed and kitchen toilet linens, and specialised textile like terry towel witnessed 16-per cent and 37.54-per cent negative growth during the same period.

Home textile makers said the pandemic Covid created a huge demand, which gradually declined with the resumption of economic activity.

The ongoing war created uncertainty resulting in higher oil and food prices, forcing consumers to prioritise essentials like food, they noted.